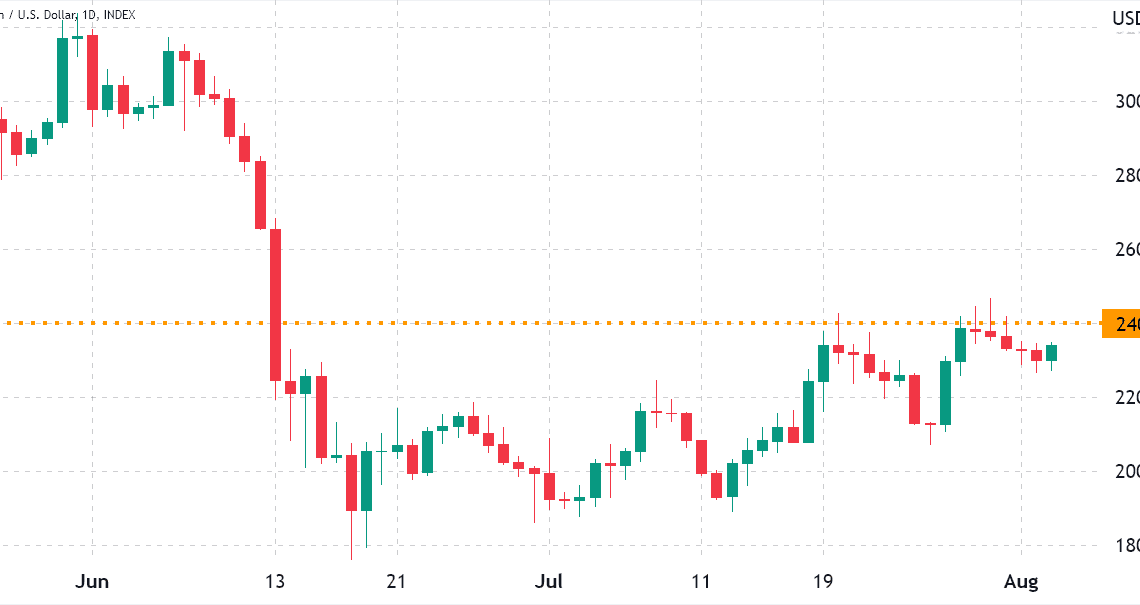

Fifty-one days have passed since Bitcoin (BTC) last closed above $24,000, causing even the most bullish trader to question whether a sustainable recovery is feasible. However, despite the lackluster price action, bulls have the upper hand on Friday’s $510 million BTC options expiry.

Investors have been reducing their risk exposure as the Federal Reserve raises interest rates and unwinds its record $8.9 trillion balance sheet. As a result, the Bloomberg Commodity Index (BCOM), which measures price changes in crude oil, natural gas, gold, corn, and lean hogs, has traded down 9% in the same period.

Traders continue to seek protection via U.S. Treasuries and cash positions as San Francisco Fed President Mary Daly said on Aug. 2 that the central bank’s fight against inflation is “far from done.” With that being said, the tighter monetary impact on inflation, employment levels, and the global economy are yet to be seen.

Bearish bets are mostly below $22,000

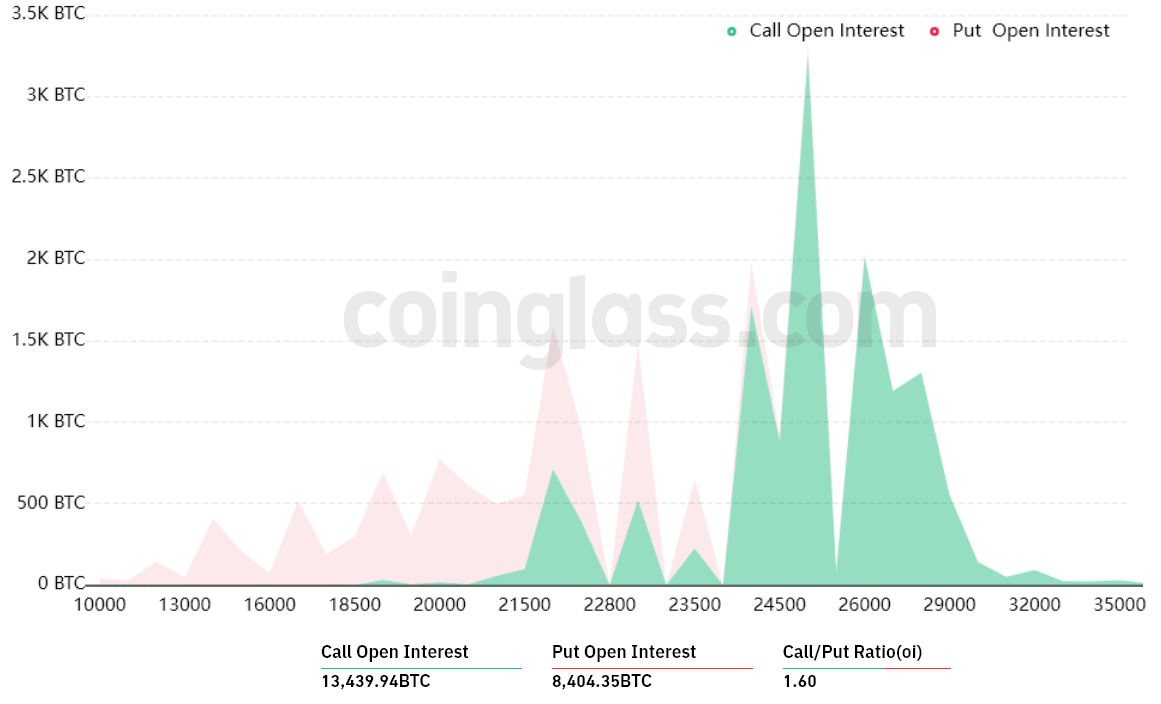

Bitcoin’s recovery above $22,000 on July 27 took bears by surprise because only 28% of the put (sell) options for Aug. 5 have been placed above such a price level. Meanwhile, Bitcoin bulls may have been fooled by the $24,500 pump on July 30, as 59% of their bets lay above $25,000.

A broader view using the 1.60 call-to-put ratio shows more bullish bets because the call (buy) open interest stands at $315 million against the $195 million put (sell) options. Nevertheless, as Bitcoin currently sits above $23,000, most bearish bets will likely become worthless.

For instance, if Bitcoin’s price remains above $23,000 at 8:00 am UTC on Aug. 5, only $19 million worth of these put (sell) options will be available. This difference happens because there is no use in a right to sell Bitcoin at $22,000 or $20,000 if it trades above that level on expiry.

Bulls might pocket a $200 million profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available on Aug. 5 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $20,000 and $22,000: 100 calls vs. 3,700 puts. The net result favors bears by $75 million.

- Between $22,000 and $24,000: 1,400 calls vs. 1,600 puts. The net result is balanced between call (buy) and put (sell) instruments.

- Between $24,000 and…

Click Here to Read the Full Original Article at Cointelegraph.com News…