In a blazing start to March, the feverish activity of Bitcoin has set it up for its largest monthly increase in almost three years early Thursday. Money pouring into listed bitcoin funds is fueling a huge gain, and bitcoin is now just a stone’s throw away from a record high.

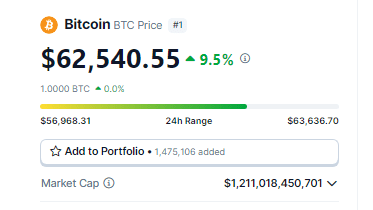

Source: Coingecko

Investor Frenzy As Bitcoin Set To Reclaim $64K

The primary cryptocurrency rose as much as 14% late Wednesday to momentarily reach $64,000 — its first move above $60,000 since November 2021 — before reversing part of the gains.

BTC was trading at $62,540 as of this writing, according to data from Coingecko.

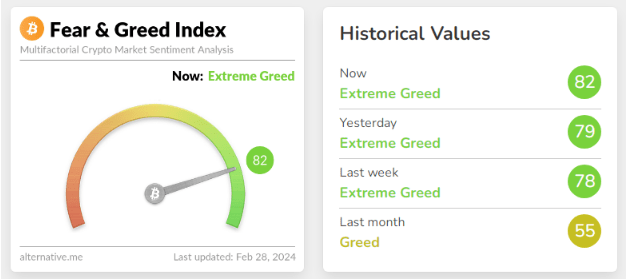

Due to “fear of losing out” on potential price increases, investors are rushing to buy cryptocurrencies, which brings back memories of the crypto bull market that drove the main cryptocurrency asset to a record high of around $69,000 in November 2021.

Since the beginning of the year, the value of bitcoin has more than tripled, recovering from a 64% decline in 2022. That is an incredible recovery from a slew of scandals and bankruptcy that had cast doubt on the sustainability of digital assets.

Meanwhile, the sudden changes in price have been whipsawing both bulls and bears. According to CoinGlass, centralized exchanges had short liquidations of $176 million and long liquidations of $86.1 million over the previous day.

Bitcoin market cap currently at $1.22 trillion. Chart: TradingView.com

Crypto Rising

After prices crashed during the “crypto winter” of 2022, investors lost interest in spot bitcoin exchange-traded funds. However, this year’s approval and introduction of these funds to the US market has rekindled interest in cryptocurrencies.

According to LSEG statistics, the top 10 spot bitcoin ETFs saw inflows of $420 million on Wednesday alone, the highest amount in nearly two weeks. Voltages increased when the three most well-known, operated by Grayscale, Fidelity, and BlackRock (IBIT.O), ignited a whole new interest.

Ahead of April’s halving event, which occurs every four years and reduces the rate at which tokens are generated by half as well as the prizes paid to miners, more traders have now been flocking to bitcoin.

Source: Alernative.me

What The Experts Are Saying

“Bitcoin optimism is fueled by factors like spot BTC ETF inflows, the imminent halving reducing new issuance, and renewed confidence in the crypto asset class, according to Jonathon Miller, managing director at Kraken Australia.”

“When…

Click Here to Read the Full Original Article at NewsBTC…