Bitcoin (BTC) bulls regained some control on Nov. 30 and they were successful in keeping BTC price above $16,800 for the past 5 days. While the level is lower than traders’ desired $19,000 to $20,000 target, the 8.6% gain since the Nov. 21, $15,500 low provides enough cushioning for eventual negative price surprises.

One of these instances is the United States stock market trading down 1.5% on Dec. 5 after a stronger-than-expected reading of November ISM Services fueled concerns that the U.S. Federal Reserve (FED) will continue hiking interest rates. At the September meeting, FED Chairman Jerome Powell indicated that the point of keeping interest rates flat “will need to be somewhat higher.”

Currently, the macroeconomic headwinds remain unfavorable and this is likely to remain the case until investors have a clearer picture of the employment market and foreign currency strength of the U.S. dollar (DXY) index.

Excessively high levels lower the income of exporters and companies that rely on revenues outside the U.S. A weak dollar also indicates a lack of confidence in the U.S. Treasury’s capacity to manage its $31.4 trillion debt.

The impact of the 2022 bear market continues to make waves as Bybit exchange decided to roll out a second round of layoffs on Dec. 4. Ben Zhou, co-founder and CEO of Bybit, announced a steep 30% reduction in the company’s workforce. The company had previously grown to over 2,000 employees in two years.

Let’s look at derivatives metrics to better understand how professional traders are positioned in the current market conditions.

Asia-based stablecoin demand drops after a 4% peak

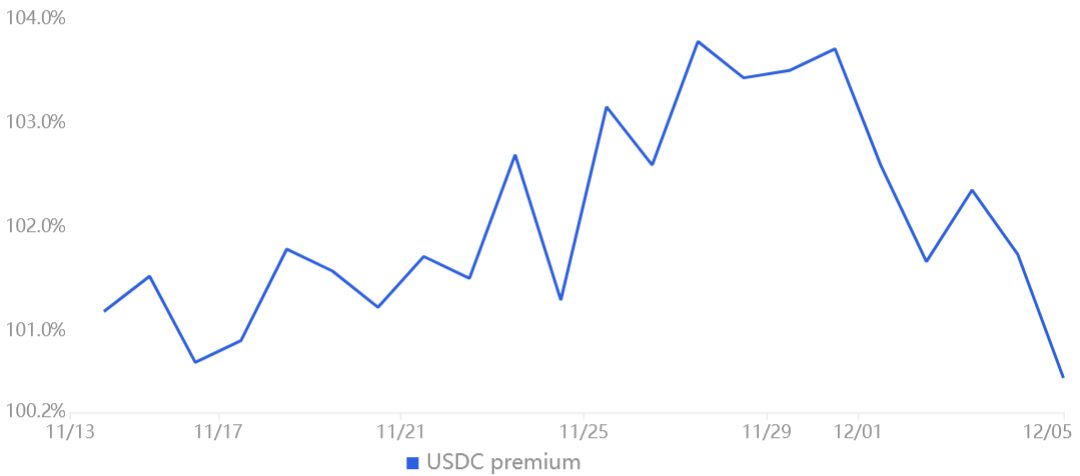

The USD Coin (USDC) premium is a good gauge of China-based crypto retail trader demand. It measures the difference between China-based peer-to-peer trades and the United States dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100%, and during bearish markets, the stablecoin’s market offer is flooded, causing a 4% or higher discount.

Currently, the USDC premium stands at 100.5%, down from 103.5% on Nov. 28, so despite the failed attempts to break above the $17,500 resistance, there was no panic selling from Asian retail investors.

However, this data should not be considered bullish because the recent USDC buying pressure up to a 4% premium indicates that traders took shelter in stablecoins.

Leverage buyers ignored the recent pump to $17,400

The long-to-short metric excludes…

Click Here to Read the Full Original Article at Cointelegraph.com News…