Bitcoin’s (BTC) 16% price gain between Feb. 13 and Feb. 16 practically extinguished the bears’ expectation for a monthly options expiry below $21,500. As a result of the abrupt rally, these bearish bets are unlikely to pay off, especially since the expiry occurs on Feb. 24. However, bulls were not counting on the strong price rejection at $25,200 on Feb. 21 and this reduces their odds of securing a $480 million profit in this month’s BTC options expiry.

Bitcoin investors’ primary concern is a stricter monetary policy as the U.S. Federal Reserve (FED) increases interest rates and reduces its $8 trillion balance sheet. Feb. 22 minutes from the latest Federal Open Market Committee’s (FOMC) meeting showed that members were in consensus on the most recent 25 bps rate hike and that the FED is willing to continue raising rates as long as deemed necessary.

St. Louis FED President James Bullard told CNBC on Feb. 22 that a more aggressive interest rate hike would give them a better chance to contain inflation. Bullard said,

“Let’s be sharp now, let’s get inflation under control in 2023.”

If confirmed, the increased interest rate pace would be negative for risk assets, including Bitcoin, as it draws more profitability for fixed-income investments.

Even if the newsflow remains negative, bulls still can profit up to $480 million in Friday’s monthly options expiry. However, bears can still significantly improve their situation by pushing the BTC price below $23,000.

Bears were not expecting Bitcoin to hold $22,000

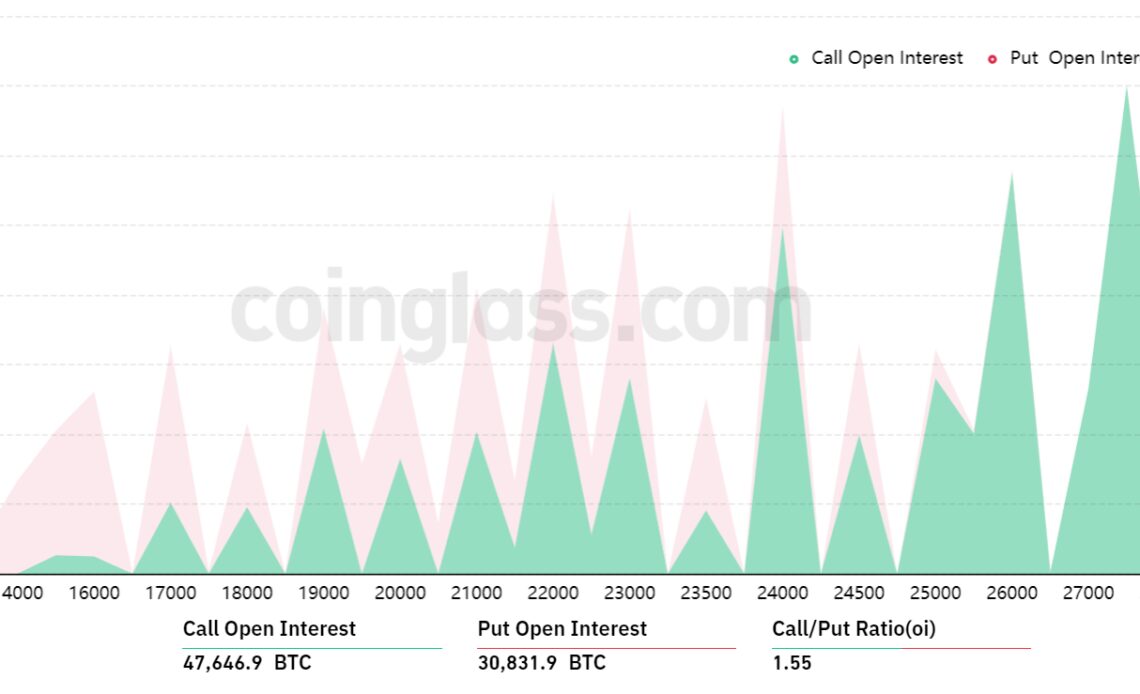

The open interest for the Feb. 24 monthly options expiry is $1.91 billion, but the actual figure will be lower since bears expected prices below $23,000. Nevertheless, these traders were surprised as Bitcoin gained 13.5% between Feb. 15 and Feb. 16.

The 1.55 call-to-put ratio reflects the imbalance between the $1.16 billion call (buy) open interest and the $750 million put (sell) options. If Bitcoin’s price remains near $24,000 at 8:00 am UTC on Feb. 24, only $125 million worth of these put (sell) options will be available. This difference happens because the right to sell Bitcoin at $22,000 or $23,000 is useless if BTC trades above that level on expiry.

Bulls aim for $23,000 to secure a $155 million profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available on Feb. 17 for call (bull) and put (bear) instruments varies,…

Click Here to Read the Full Original Article at Cointelegraph.com News…