Bitcoin (BTC) may see more pain in the near future, but the bulk of the bear market is already “likely” behind it.

That is one of many conclusions from Philip Swift, the popular on-chain analyst whose data resource, LookIntoBitcoin, tracks many of the best-known Bitcoin market indicators.

Swift, who together with analyst Filbfilb is also a co-founder of trading suite Decentrader, believes that despite current price pressure, there is not long to go until Bitcoin exits its latest macro downtrend.

In a fresh interview with Cointelegraph, Swift revealed insights into what the data is telling analysts — and what traders should pay attention to as a result.

How long will the average hodler need to wait until the tide turns and Bitcoin comes storming back from two-year lows?

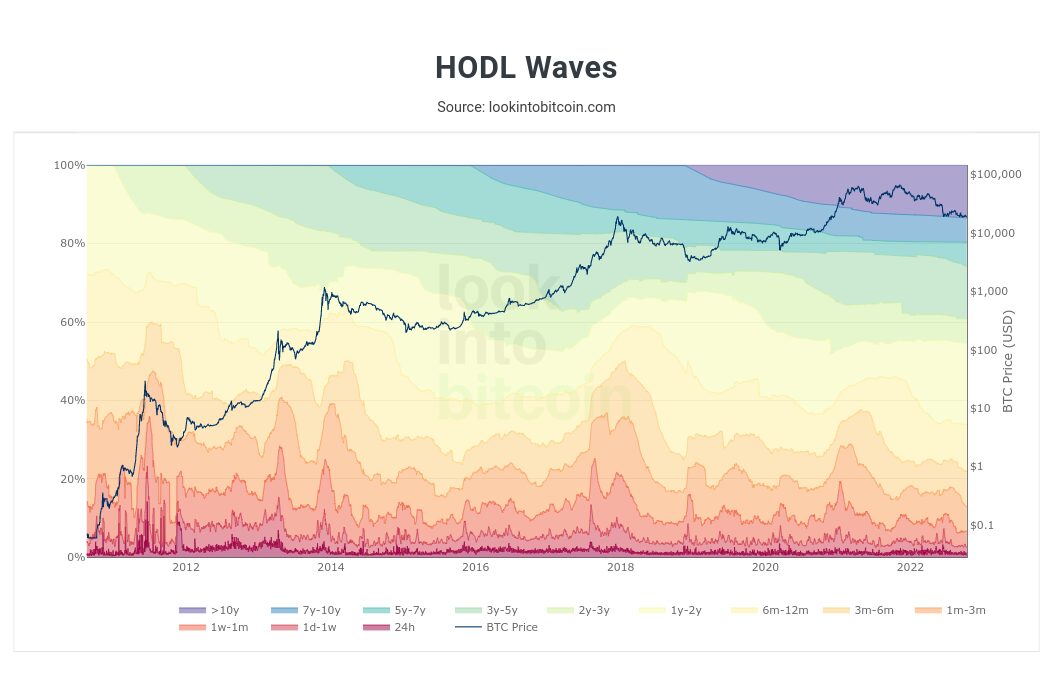

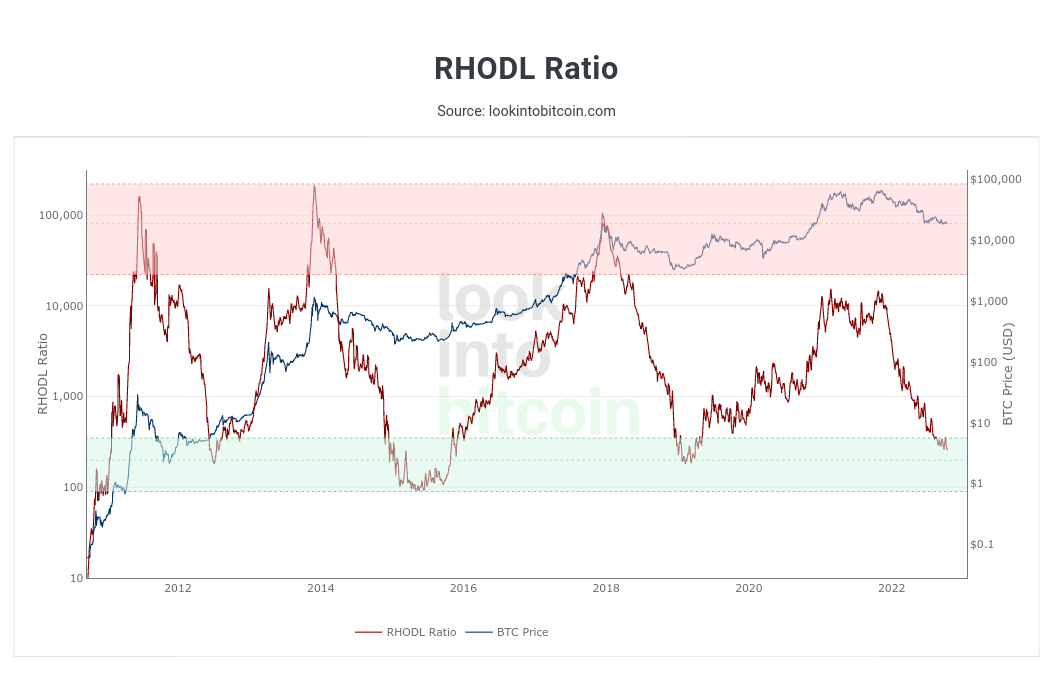

Cointelegraph (CT): You’ve pointed out that some on-chain metrics such as HODL Waves and RHODL Ratio are hinting at a BTC bottom. Could you expand on this? Are you confident that history will repeat this cycle?

Philip Swift (PS): I believe we are now at the point of maximum opportunity for Bitcoin. There are numerous key metrics on LookIntoBitcoin that indicate we are at major cycle lows.

We are seeing the percentage of long-term holders peak (1yr HODL Wave), which typically happens in the depths of bear market as these long-term holders don’t want to take profit until price moves higher.

This has the effect of restricting available supply in the market, which can cause price to increase when demand does eventually kick back in.

We are also seeing metrics like RHODL Ratio dip into their accumulation zones, which shows the extent to which euphoria has now been drained from the market. This removal of positive sentiment is necessary for a bottom range to form for BTC.

RHODL Ratio is highlighting that the cost basis of recent Bitcoin purchases is significantly lower than prices paid 1–2 years ago when the market was clearly euphoric and expecting +$100k for Bitcoin. So it is able to tell us when the market has reset in preparation for the next cycle to start.

CT: How is this bear market different from previous BTC cycles? Is there any silver lining?

PS: I was around for the 2018/19 bear market and it actually feels pretty similar. All the tourists have left and you just have the committed passionate crypto people remaining in the space. These people will benefit the most in the next bull run…

Click Here to Read the Full Original Article at Cointelegraph.com News…