In the lead-up to the Federal Open Market Committee (FOMC) meeting scheduled for Wednesday, March 20, the Bitcoin and crypto market is experiencing a severe downtrend. BTC price has plunged roughly -10% in the past two days, and Ethereum (ETH) is down -12% in the same period.

The anticipation surrounding the Fed’s stance on interest rates has heightened in the wake of recent economic indicators, including unexpected spikes in the US Consumer Price Index (CPI) and Producer Price Index (PPI), stirring volatility across markets, including digital assets.

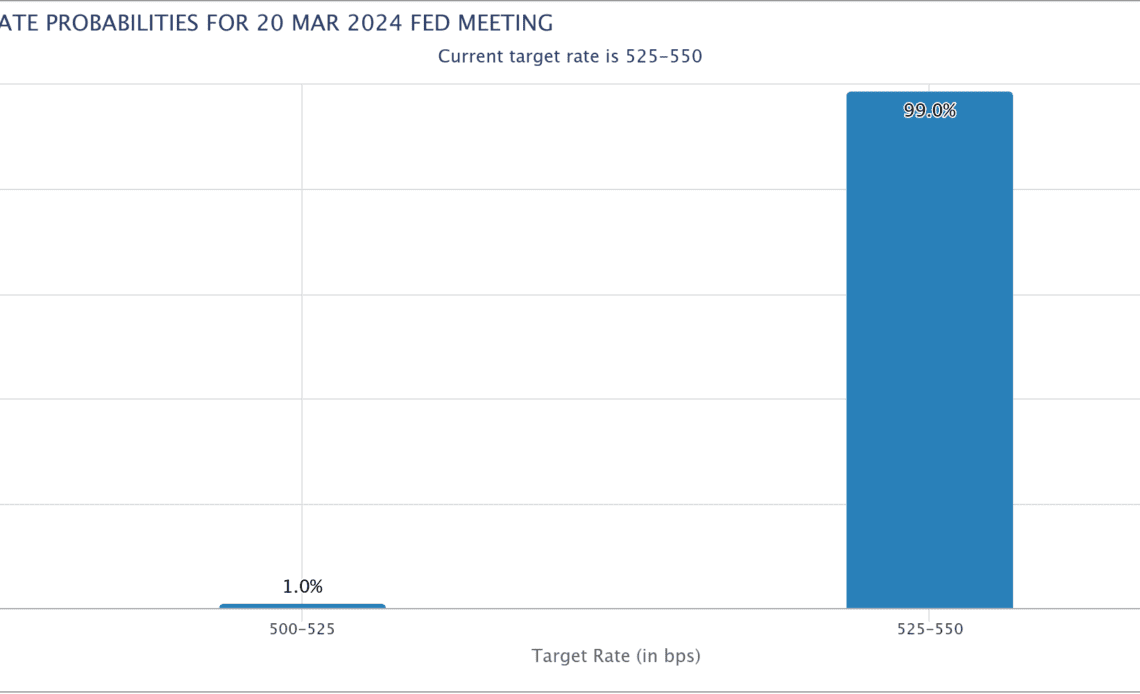

The consensus, with a 99% probability according to the CME FedWatch tool, suggests interest rates will hold steady. Nonetheless, the spotlight turns to the Fed’s dot plot, a graphical representation of the individual members’ expectations for future interest rates, which could provide crucial insights into the monetary policy outlook for the coming months and years.

Anna Wong, Chief US Economist for Bloomberg, remarked via X (formerly Twitter), “Another reason why FOMC [is] not ready to cut: members not yet of broad agreement of that need. Here’s visualizing the dispersion of FOMC views with the help of our new weekly NLP Fed spectrometer. “

Another reason why FOMC not ready to cut: members not yet of broad agreement of that need. Here’s visualizing the dispersion of FOMC views with the help of our new weekly NLP Fed spectrometer. (Interactive version at @TheTerminal BECO models —> Fedspeak —> spectrometer) pic.twitter.com/Kney89BERM

— Anna Wong (@AnnaEconomist) March 19, 2024

How Will Bitcoin And Crypto React?

Macro analyst Ted, expressing his perspective on X, underscores the nuanced relationship between macroeconomic trends and the crypto market at the moment. Ted elucidated that spot Bitcoin ETF flows have taken the backseat while macro factors came to the foreground.

He stated via X, “If BTC is to be considered digital gold, it’s expected to mirror gold’s market movements, albeit with a higher degree of volatility. In the current climate, with the market bracing for the Fed’s upcoming meeting, macroeconomic factors momentarily take precedence, driven by recent developments in PPI and CPI figures.”

He further speculates that “Despite the eventual remarks from [Fed Chair] Powell, the market has already adopted a hawkish stance in anticipation of a ‘higher for longer’ interest rate…

Click Here to Read the Full Original Article at NewsBTC…