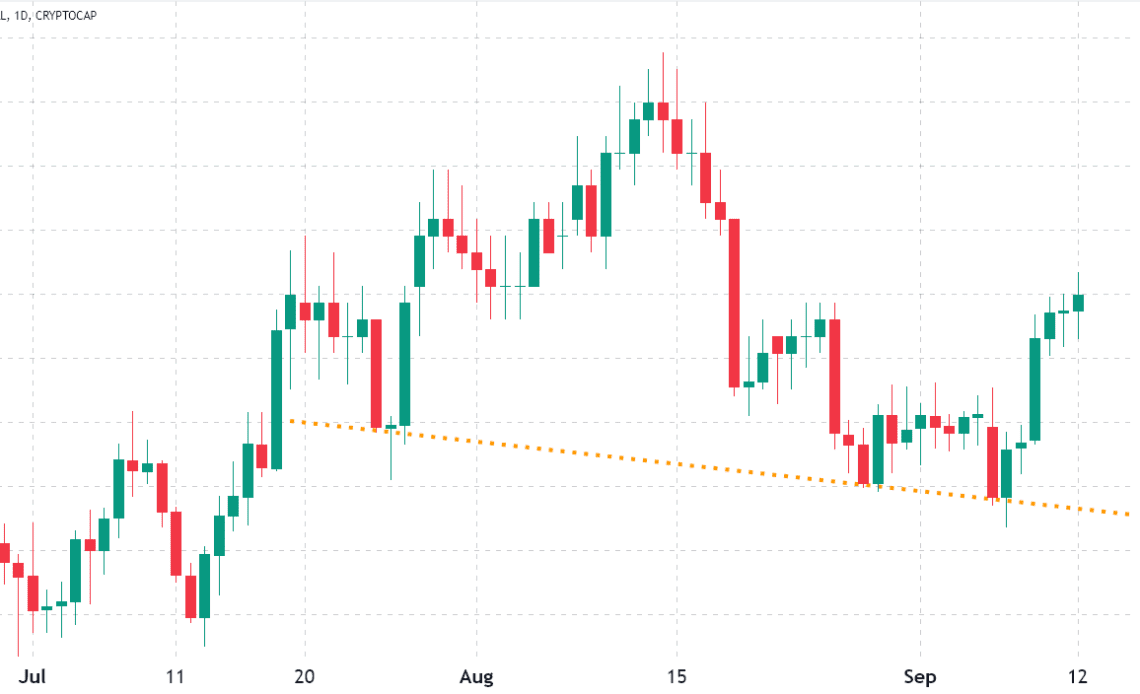

The 13% gains in the six days leading to Sept. 12 brought the total crypto market capitalization closer to $1.1 trillion, but this was not enough to break the descending trend. As a result, the overall trend for the past 55 days has been bearish, with the latest support test on Sept. 7 at a $950 billion total market cap.

An improvement in traditional markets has accompanied the recent 13% crypto market rally. The tech-heavy Nasdaq Composite Index gained 6.2% since Sept. 6 and WTI oil prices rallied 7.8% since Sept. 7. This data reinforces the high correlation versus traditional assets and places the spotlight on the importance of closely monitoring macroeconomic conditions.

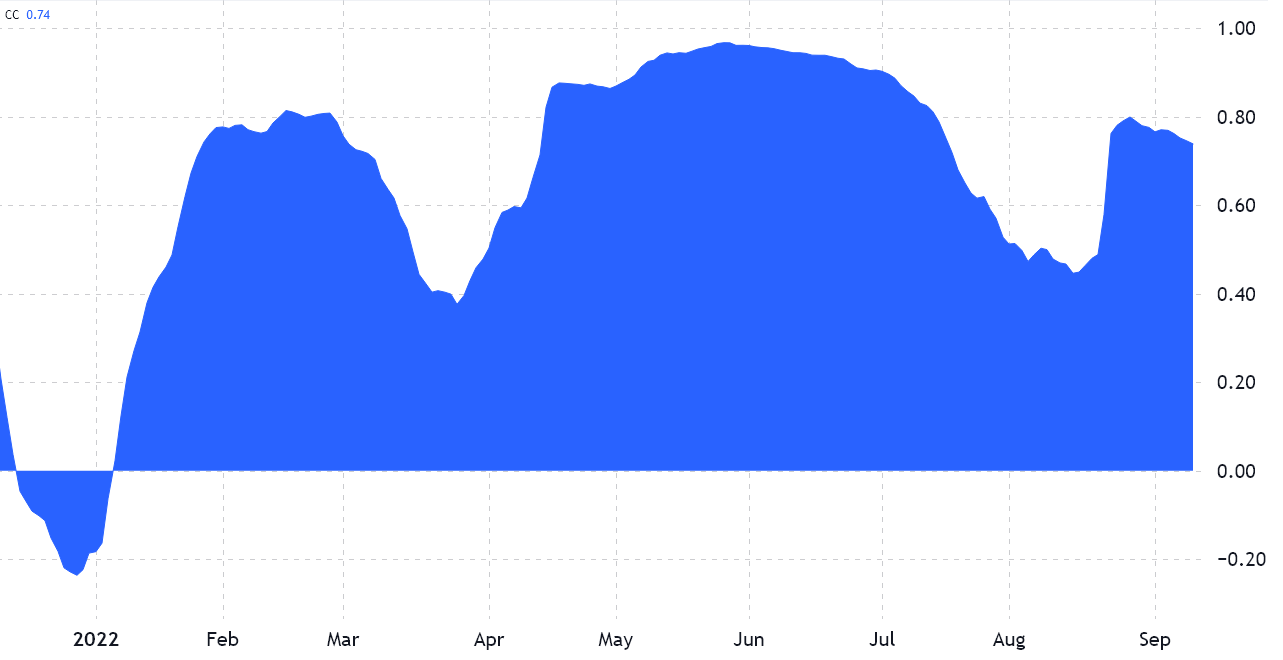

The correlation metric ranges from a negative 1, meaning select markets move in opposite directions, to a positive 1, which reflects a perfectly symmetrical movement. A disparity or a lack of relationship between the two assets would be represented by 0.

As displayed above, the Nasdaq composite index and Bitcoin 50-day correlation currently stand at 0.74, which has been the norm throughout 2022.

The FED’s Sept. 21 decision will set the mood

Stock market investors are anxiously awaiting the Sept. 21 U.S. Federal Reserve meeting, where the central bank is expected to raise interest rates again. While the market consensus is a third consecutive 0.75 percentage point rate hike, investors are looking for signs that the economic tightening is fading away.

A report on the U.S. consumer price index, a relevant inflation metric, is expected on Sept. 13 and on Sept. 15, investor attention will be glued to the U.S. Retail sales and industrial production data.

Currently, the regulatory sentiment remains largely unfavorable, especially after the enforcement director for the United States Securities and Exchange Commission (SEC), Gurbir Grewal, said the financial regulator would continue to investigate and bring enforcement actions against crypto firms.

Altcoins rallied, but pro traders were resilient to leverage longs

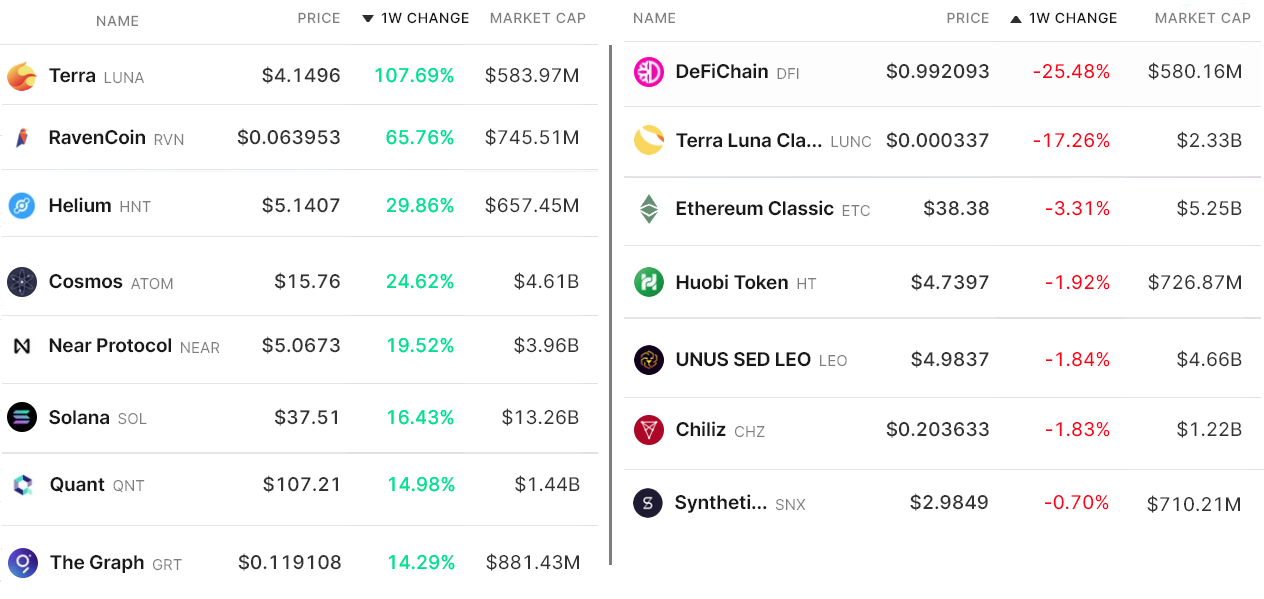

Below are the winners and losers of last week’s total crypto market capitalization 8.3% gain 8.3% to $1.08 trillion. Bitcoin (BTC) stood out with a 12.5% gain, which led its dominance rate to hit 41.3%, the highest since Aug. 9.

Terra (LUNA) jumped 107.7% after Terra approved a proposal on Sept. 9 for an…

Click Here to Read the Full Original Article at Cointelegraph.com News…