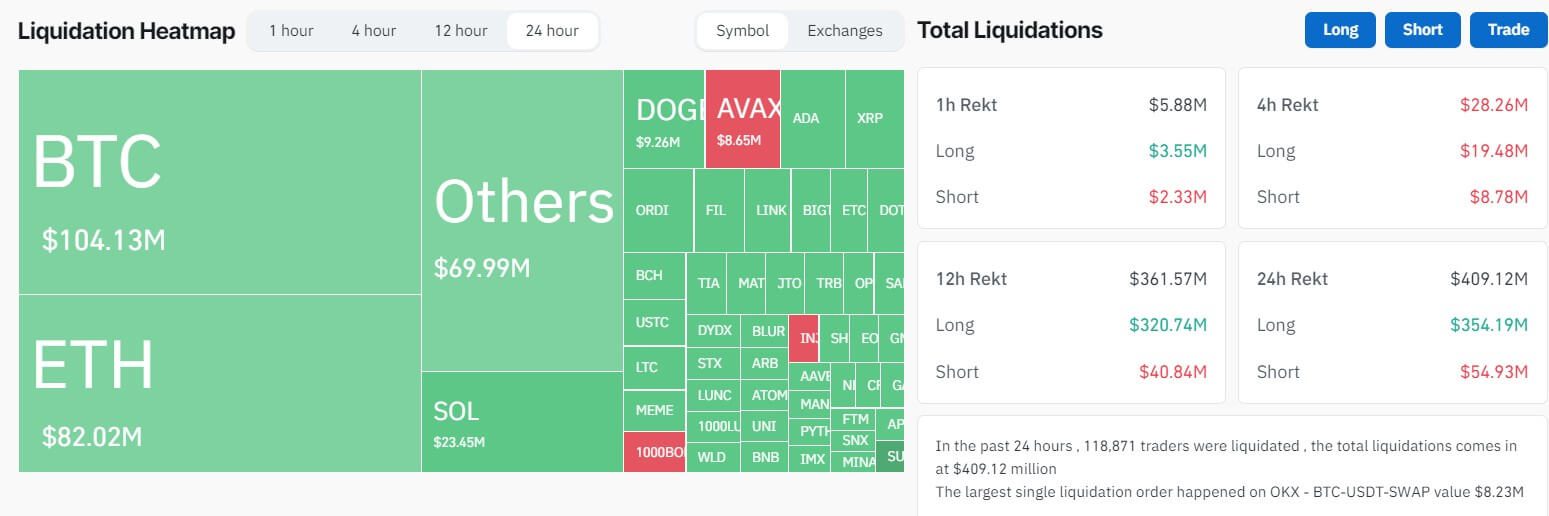

Nearly 120,000 crypto traders lost more than $400 million in the past 24 hours as digital asset prices plummeted during the opening of Asia trading hours on Dec. 11.

Coinglass data indicates that approximately $356 million of these liquidations were attributed to long positions, marking the most extensive single-day loss driven by long speculation in the last four months. Additionally, short traders faced losses totaling $54.79 million.

Bitcoin traders bore the brunt of these losses, accounting for approximately $104 million in total liquidations. Long positions in BTC contributed $90.9 million to this figure, while shorts accounted for $12.12 million.

Ethereum investors also faced considerable losses, with around $74.62 million liquidated in long positions alongside $6.52 million from short positions.

Other cryptocurrencies such as Solana, XRP, Dogecoin, Avalanche, Cardano, and Litecoin saw notable losses for traders holding long positions during this period.

Among exchanges, OKX and Binance witnessed the most significant losses, tallying liquidations exceeding $171 million and $128 million, respectively. Notably, the most substantial individual loss recorded was an $8.2 million long bet on Bitcoin’s price on the OKX exchange.

Crypto market takes a breather.

Bitcoin, the largest cryptocurrency by market capitalization, tumbled around 5% to a low of $41,649 before recovering to its current value of $42,155 as of press time, according to CryptoSlate’s data.

BTC’s fall ignited the price declines in other major cryptocurrencies like Ethereum, which slid by almost 5%, followed by other large-cap cryptocurrencies such as Solana, XRP, Binance-backed BNB, and Cardano, enduring some of their most considerable losses in recent weeks.

The global crypto market capitalization fell by around 4% to $1.57 trillion.

The recent drop comes after a three-month surge fueled by optimism about the potential approval of a Bitcoin Exchange-Traded Fund (ETF) in the United States.

Although the approval hasn’t materialized yet, experts point to ongoing communications between the U.S. Securities and Exchange Commission (SEC) and the applicants as a positive sign, hinting that the regulator might finally give the green light to these investment products.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…