The SEC’s lawsuits against Binance and Coinbase created a discernable shift in the market, leading to significant changes in the exchanges’ asset balances.

The lawsuits, filed on June 5 and June 6, accuse Binance and Coinbase of a variety of securities law violations. These legal encounters have created a domino effect in the legal sphere and caused changes in the exchanges’ market performance, including fluctuations in Coinbase’s stock price and a drop in Binance’s market share.

Bitcoin’s price experienced a sharp drop on June 6, mirroring the reaction of the broader crypto industry. Despite this abrupt downturn, BTC managed to recover, demonstrating the resilience inherent within the sector.

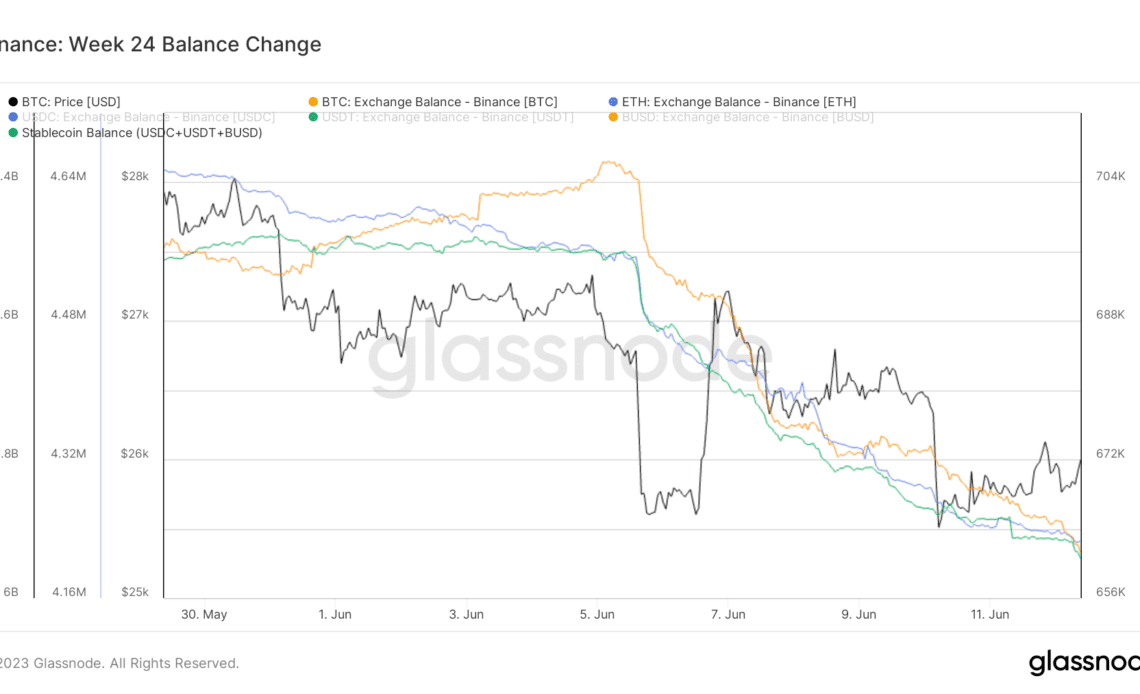

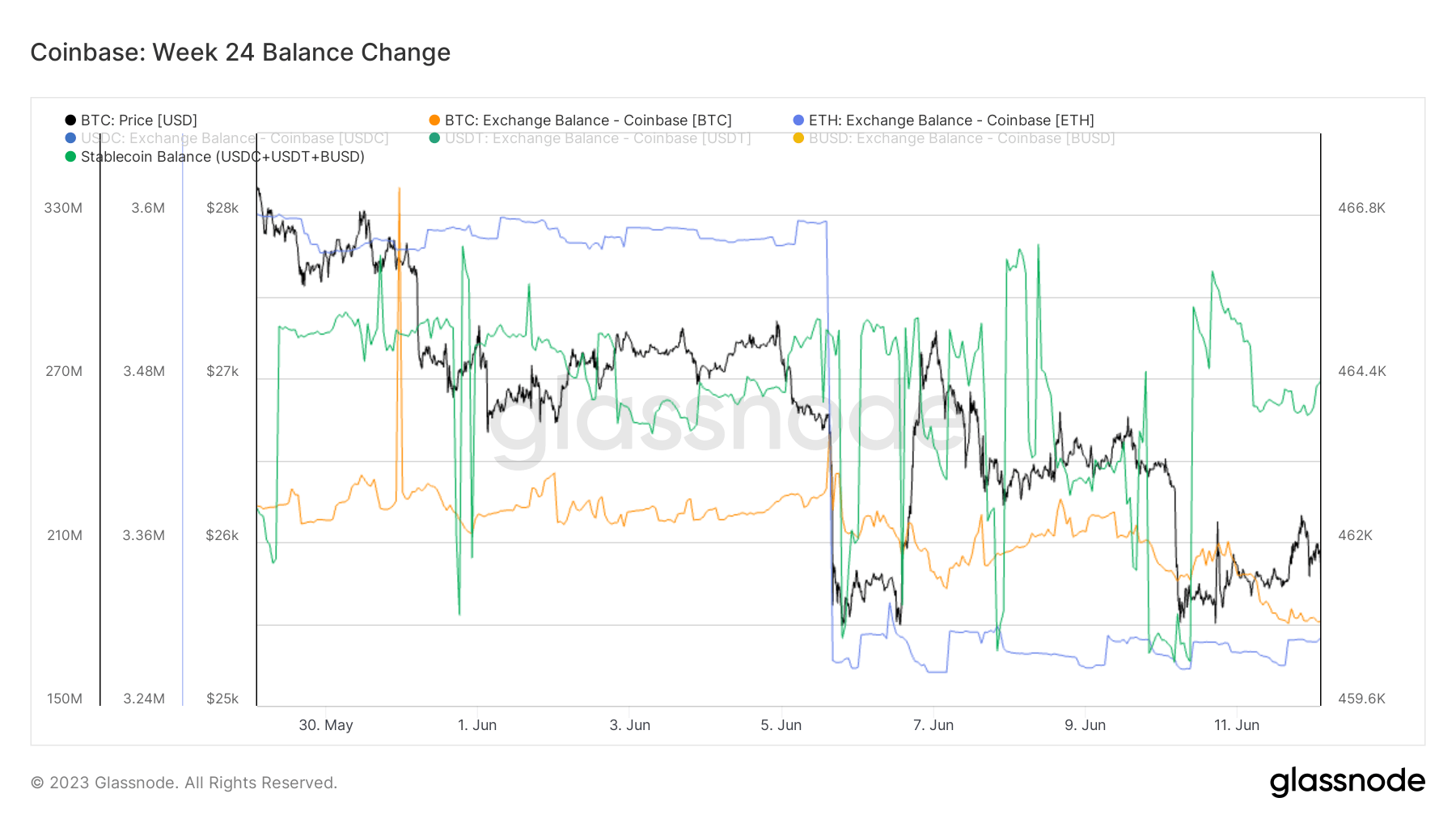

Another effect of the lawsuits can be seen in the changes in the exchanges’ asset balances. Evaluating withdrawals of the major assets — Bitcoin, Ethereum, and stablecoins — can help gauge the overall market impact of these lawsuits.

Data from Glassnode reveals a significant outflow of assets from Binance following the SEC lawsuit. Approximately 20.9% of Binance’s total USDT, USDC, and BUSD balance, around $1.6 billion, has been withdrawn by users. Similarly, Binance’s reserves of Bitcoin and Ethereum have shrunk by 5.7% and 7.1%, respectively.

Meanwhile, stablecoin balances on Coinbase remained relatively steady between June 5 and June 12, with Bitcoin balances seeing a minor decrease of 0.5%.

However, Ethereum was hit harder with a significant withdrawal of 291,000 ETH, accounting for roughly 8% of the total balance of ETH on Coinbase.

This discrepancy in withdrawals between the exchanges can be attributed to several factors. The more significant outflow of Ethereum from Coinbase likely stems from regulatory uncertainties around its Earn product,…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…