The biggest news in the cryptoverse for Nov. 9 includes Binance’s decision to not move forward with the potential acquisition of FTX, Bitcoin’s retrace to $ 15,000 levels, and multiple stablecoins dropping below $1.

CryptoSlate Top Stories

Binance walks away from FTX deal, citing ‘mishandled customer funds,’ regulatory scrutiny

Binance revealed its intent to purchase FTX on Nov.8, while noting it needed to run due diligence before doing so. On Nov. 9, Binance announced that it decided not to continue with the acquisition.

The exchange said that a U.S. agency opened an investigation on FTX, which was what changed Binance’s mind.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

Large short positions push Bitcoin toward $17k amid $861M in crypto liquidations

The market saw $861 million in crypto liquidations over the past 24 hours. Of this, $259 million was made up of Bitcoin (BTC) shorts, which assisted in sending Bitcoin to $17.000.

Bitcoin options traders swing bearish as FTX fallout takes hold

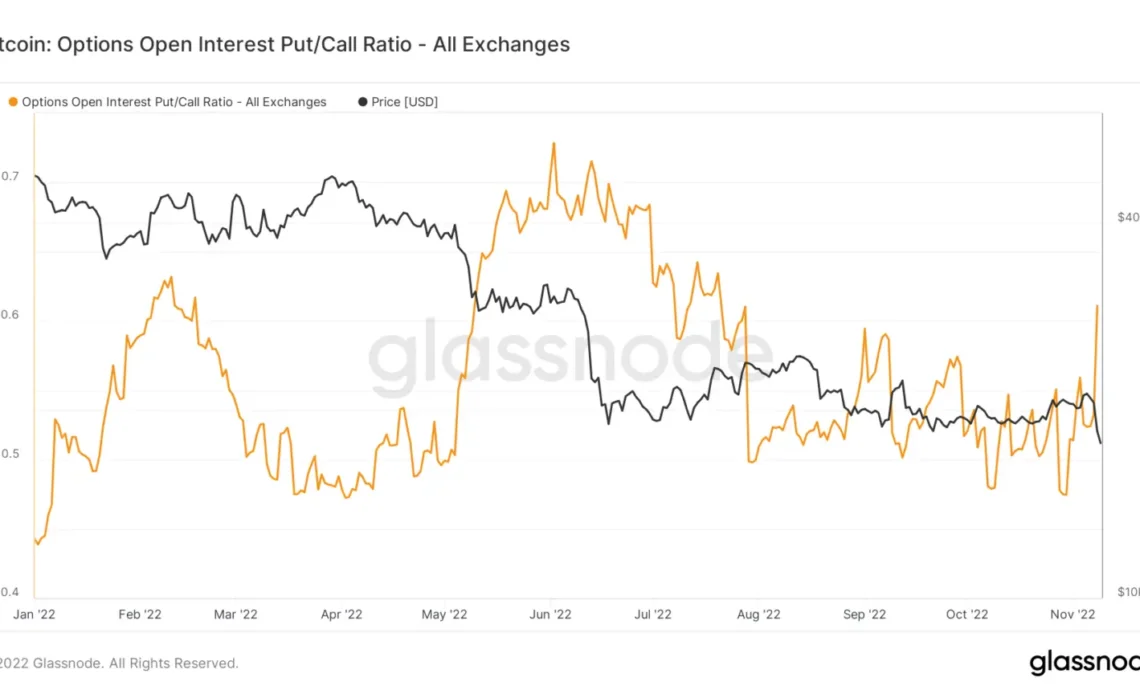

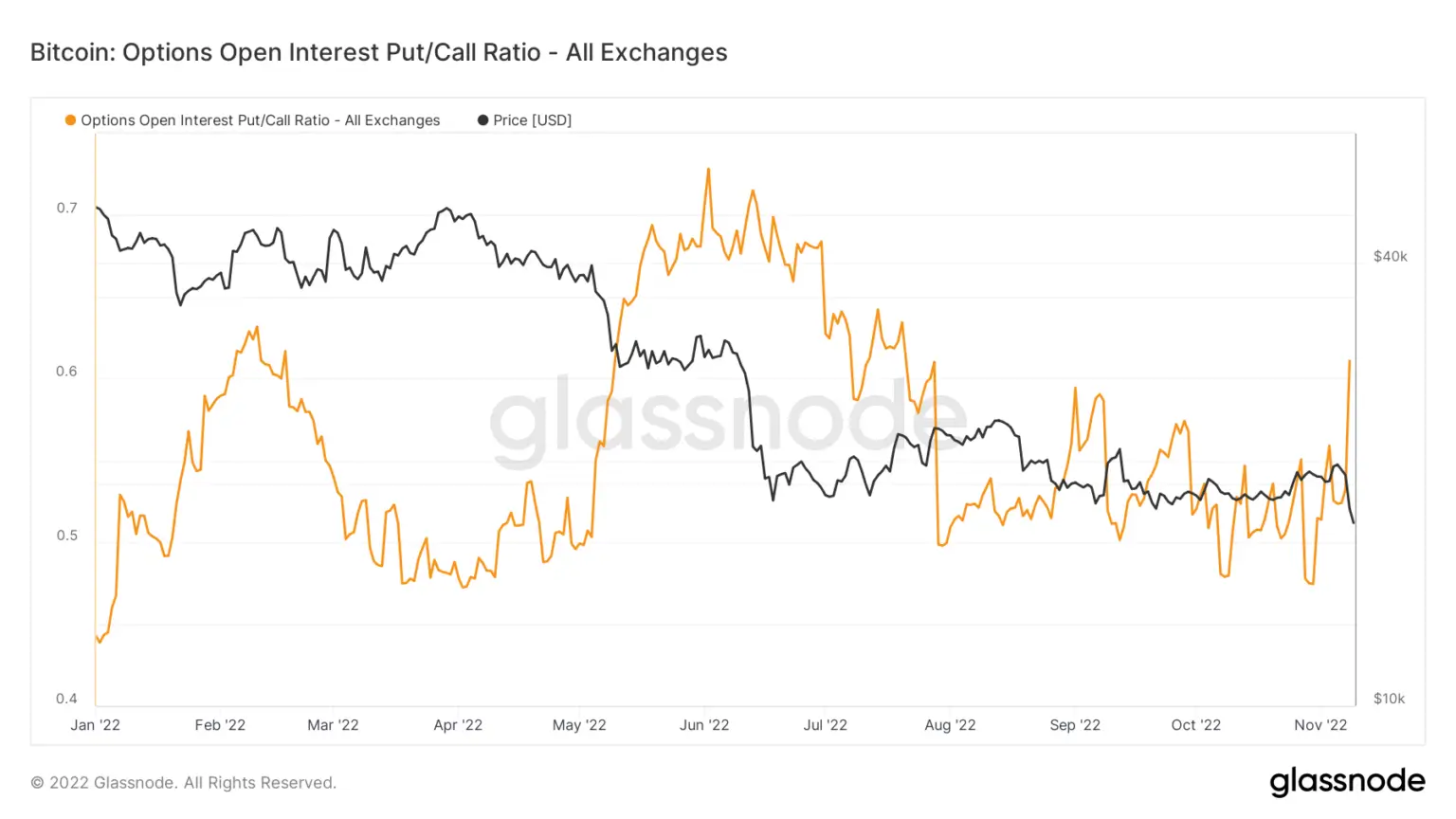

The Options Open Interest Put/Call Ratio (OIPCR), investors are leaning toward buying, which suggests a bearish market sentiment.

The OIPCR is calculated by dividing the total number of puts open interest by the total number of calls open interest on a given day. It has been spiking high since the FTX crisis started to unveil, while it didn’t see its extremes yet, as it did during the Luna collapse.

Crypto exchanges to publish ‘proof-of-reserves’ following FTX’s implosion

After the market implosion due to the FTX crisis, Binance’s CEO Changpeng Zhao said that exchanges should share a Merkle-tree proof-of-reserves to prove that they’re not insolvent.

All crypto exchanges should do merkle-tree proof-of-reserves.

Banks run on fractional reserves.

Crypto exchanges should not.@Binance will start to do proof-of-reserves soon. Full transparency.— CZ 🔶 Binance (@cz_binance) November 8, 2022

Following Zhao’s lead, several leading exchanges including OKX, Huobi, and KuCoin stated that they intended to publish their fund reserves to address the current contagion fears in the market.

Gate.io became the first exchange that published its Merkle-tree proof-of-reserves.

Double dip expected as flood of unlocked Solana to hit the…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…