It is no secret that Binance benefits from FTX’s insolvency. After the second largest exchange in the world went belly up, other exchanges had to divide FTX’s market share among themselves.

And that Binance is one of the biggest winners now seems to be confirmed by recent data. The Block claims that Binance now has a 75% market share on the spot market, 8.5 times more than the second Coinbase.

🚨Binance now represents 75% of all exchange volume, and almost 8.5x that of the second (Coinbase)

Good or bad for the ecosystem? pic.twitter.com/ykPisGn3W2

— Mario Nawfal (@MarioNawfal) November 30, 2022

Other Data Providers Do Not Agree

The chart is based on CryptoCompare data and shows that total volume for the month was $642.7 billion. Binance’s share of the yet-to-be-completed month of November reportedly equates to $481.7 billion.

However, there are discrepancies with other data providers. Their data doesn’t find a massive dominance by Binance.

Coinmarketcap, which was acquired by Binance in April 2020, shows that the exchange currently has $12.5 billion in daily trading volume. It is followed by Coinbase Exchange with $1.5 billion dollars, Kraken with $626 million and KuCoin with $495 million.

With a total volume of $44.985 billion over the past 24 hours, this only calculates to a much healthier 27.8% market share for Binance.

CoinGecko, on the other hand, tracks 544 crypto exchanges with a total 24-hour trading volume of $59.5 billion. Binance’s market share is actually only 21.7% based on this figure. However, both data providers only provide daily volumes and thus not a complete picture.

Binance Is In The Crosshair Due To Other Reasons

Regardless of the discussion about Binance’s market supremacy, the exchange is in the crosshair of critics due to other reasons. One of the harshest critics is Bitcoin analyst Dylan LeClair.

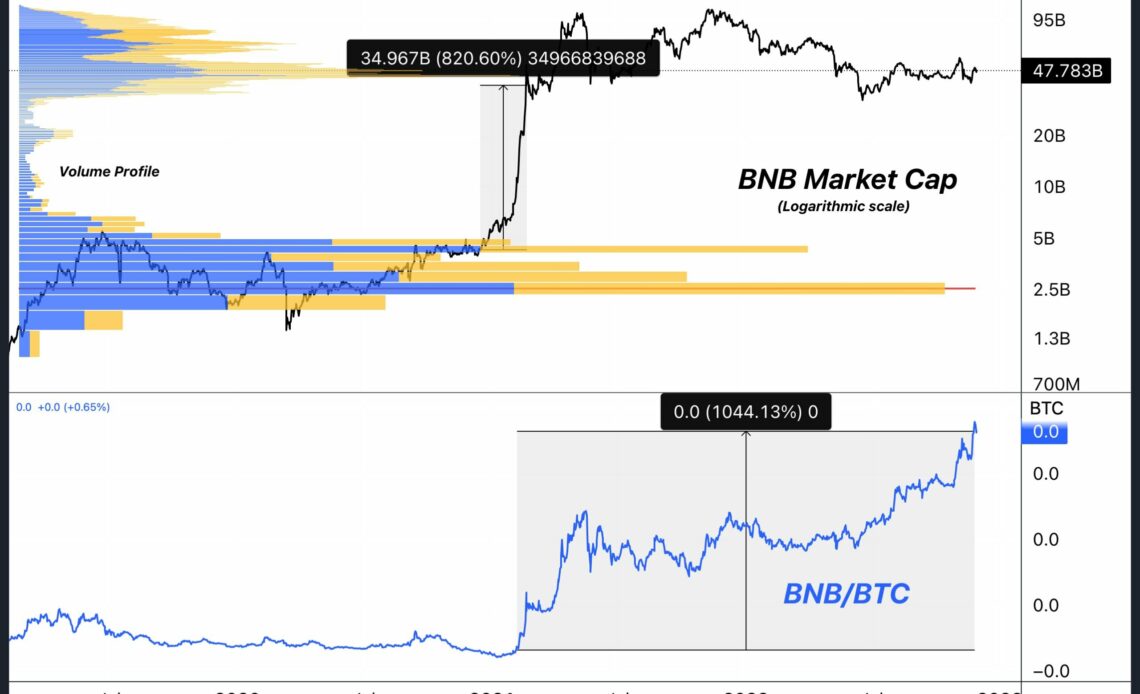

As he notes, BNB has made 9x in two months during the bull run with barely a retrace, 10x versus BTC since 2021. “Must be a new paradigm,” LeClair wrote and shared the following chart.

The analyst drew comparisons to FTX and commented ironically; “I’m sure it was retail that sent BNB 10x in two months. Same with FTT, right?”, and shared a chart of FTT and BNB with a similar price trend.

“It definitely wasn’t the exchange operator with an incentive to drive up the price of their own token to create a feedback loop of attention, hype, and more users…. Definitely not,” LeClair further…

Click Here to Read the Full Original Article at NewsBTC…