Events of the last 24 hours involving crypto exchange Binance and several U.S. federal agencies, including the Commodity Futures Trading Commission (CFTC) and the Department of Justice, wiped over $200 million from crypto traders who held positions on the market.

CryptoSlate’s data showed that the total market cap of digital assets declined by 2.04% to $1.38 trillion amid these developments.

Over $200M in the last 24 hours

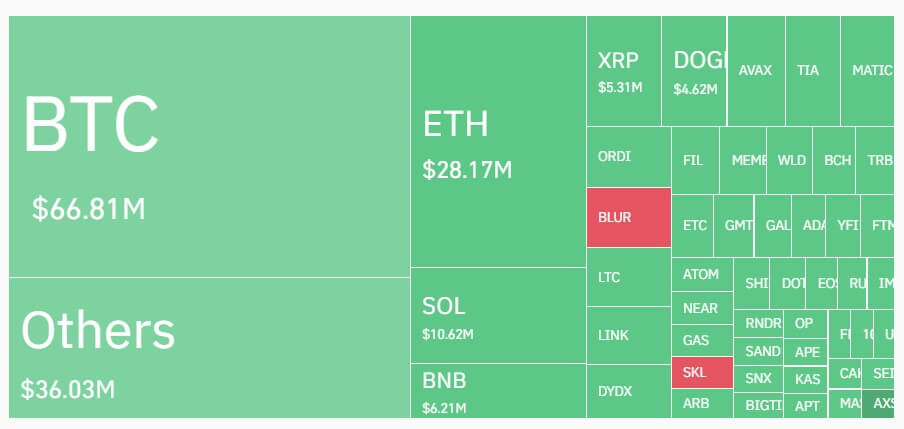

The crypto market saw $226.88 million liquidated in the past 24 hours, with nearly 93,000 traders affected.

Data from Coinglass showed that long traders lost $175.55 million, with Bitcoin and Ethereum accounting for $69.02 million of these losses.

Short traders experienced $51.31 million in liquidations. The top two digital assets accounted for over 50% of these losses.

Additionally, traders who held positions in Solana lost more than $10 million, while those in BNB lost over $6 million. Other assets such as Dogecoin, Chainlink, XRP, and Litecoin experienced less than $3 million in liquidations, respectively.

Across exchanges, most of the liquidations occurred on Binance, OKX, and ByBit. These three exchanges accounted for nearly 90% of the overall liquidations, with 78% being long positions. Other exchanges like Huobi, Deribit, and Bitmex also recorded a sizeable amount of the total liquidations.

The most significant liquidation occurred on Bybit– BTCUSD valued at $2.35 million.

Binance issues rekt market

Crypto analysts have attributed the market drawdown to Binance’s more than $4 billion settlement with the U.S. authorities and the subsequent resignation of its founder Changpeng ‘CZ’ Zhao as CEO after pleading guilty to money laundering charges.

On Nov. 21, several U.S. federal agencies, including the DOJ and CFTC, detailed how Binance violated multiple finance-related laws. These violations stemmed from the platform’s failure to prevent transactions involving sanctioned users and individuals in restricted regions.

In response, Binance pled guilty to the charges and issued a statement acknowledging its shortcomings. The firm agreed to pay over $4 billion in fines, retain an appointed monitor for three years, and commit to enhancing compliance measures.

Additionally, it appointed Richard Teng, its former Global Head of Regional Markets, as the new CEO.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…