Billionaire venture capitalist Chamath Palihapitiya thinks the Federal Reserve will keep interest rates higher for longer as the world witnesses the start of a new war.

Palihapitiya tells his 1.6 million followers on the social media platform X that inflation could soar once again on the back of rising oil prices amid the escalating war between Israel and Hamas.

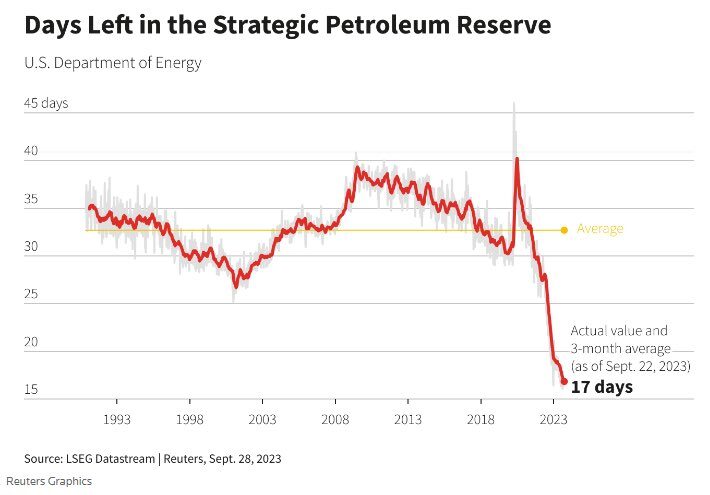

Citing data from The Kobeissi Letter, the billionaire highlights that the country’s Strategic Petroleum Reserve (SPR) is at a dangerously low level, indicating that the US government can do very little to flood the oil markets with supply to slow down surging prices.

“Biden drained the SPR to help push down US CPI (consumer price index) when oil looked like it was going to $100. How does oil not spike again now on the back of two hot wars (Israel-Hamas and Russia-Ukraine) and a 1.5 million barrel production cut by OPEC (Organization of the Petroleum Exporting Countries) with an SPR that is at the same level it was in the mid-1980s?”

Data from The Kobeissi Letter shows that the SPR is at its lowest level in history with 17 days of supply remaining.

According to Palihapitiya, the situation in the oil market will likely keep the Fed from cutting its benchmark interest rate anytime soon.

“If inflation then spikes back up, what does the Fed do? The Fed is already in a game of chicken with the bond market and is under a lot of pressure to do no harm and ideally start the cutting cycle soon. This would make that path much less likely…

It’s dizzying how so many things are so loosely coupled now and have implications for everything else.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image:…

Click Here to Read the Full Original Article at The Daily Hodl…