Billionaire venture capitalist Chamath Palihapitiya says economic conditions will force Fed Chair Jerome Powell to cut rates more than once.

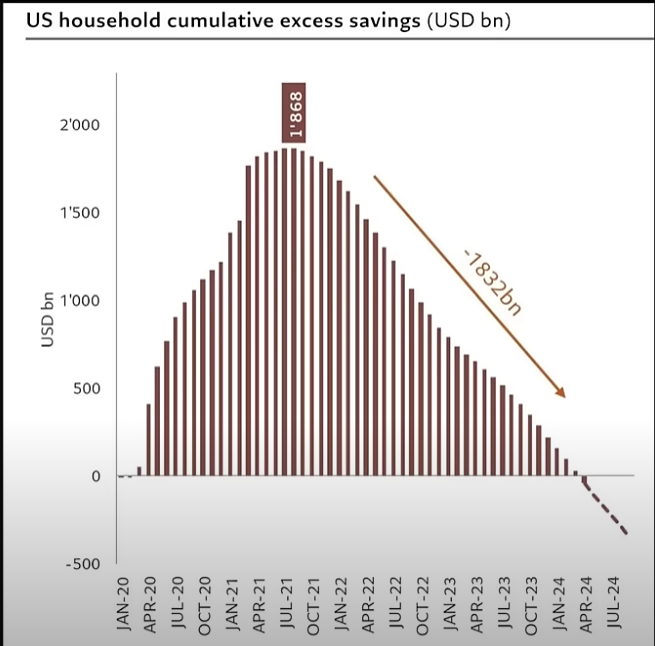

In a new episode of the All-In Podcast, Palihapitiya says he expects the economy to shrink based on data that Americans have spent all their savings.

According to the Social Capital CEO, people relying on their savings are now driven to find jobs, but most will struggle to land one as companies steer clear from expansion due to the Fed’s higher-for-longer policy.

“If I had to simplify the United States economy, GDP is 70% spending by individual people. People can spend two things. Savings that they have or credit that they have.

What’s interesting is that we have finally burned through all of the money that folks had in their bank accounts. And so what does that force people to do? It actually forces people to re-enter the workforce so that they can start to make money. But the problem is that companies have been shrinking and have been on a defensive posture. As a result, which you started to see this past unemployment report, unemployment is now ticking up because when these people re-enter the workforce, there are no jobs for them to have.”

Palihapitiya goes on to explain that an uptick in unemployment will lead to an economic slowdown and force the hand of Powell to cut rates multiple times.

“I think what we’re starting to see is that for the large portion of the economy, we’ve run out of cash to spend. As a result, I do think we are going to see an economic slowing and I think that that will create not just enormous empirical justification for Jerome Powell, it will be exacerbated by the political pressure that he’s going to be under to cut.

Will it cause him to cut more aggressively that he would have otherwise? On the margins, I actually think yes but my perspective is that I think we’ve run out of money, individual people. So I think unemployment’s going back up. I think GDP is going to shrink and I tend to be in this camp that we’re going to see more than one rate cut.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any…

Click Here to Read the Full Original Article at The Daily Hodl…