The White House released its first comprehensive framework this month for the Responsible Development of Digital Assets following President Joe Biden’s March 9 executive order. The order called for regulators to assess the industry and develop recommendations to safeguard investors while simultaneously promoting innovation. While more work is needed, the framework is a step in the right direction as it shows the willingness of regulators to provide the industry with the much-needed regulatory clarity it seeks.

The framework’s recommendations addressed six key areas to protect market participants, offer access to financial services, and promote innovation. While Biden’s administration has focused more on just the protection of consumers in the industry in the past, it is encouraging to see the framework focus on all three groups in the industry — consumers, investors and businesses. The framework cited a 2018 Wall Street Journal study that showed nearly a quarter of coin offerings had red flags such as plagiarized documents and promises for return on investment. To encourage protection, the framework encouraged regulators to “aggressively pursue” unlawful practices in the industry, redouble enforcement efforts, and increase public-awareness efforts to promote education in this area.

Related: Biden’s anemic crypto framework offered nothing new

Additionally, the framework provided steps for both the Biden administration and Congress to fight against illicit finance, such as amending the Bank Secrecy Act, monitoring transactions, and exposing and disrupting illicit actors.

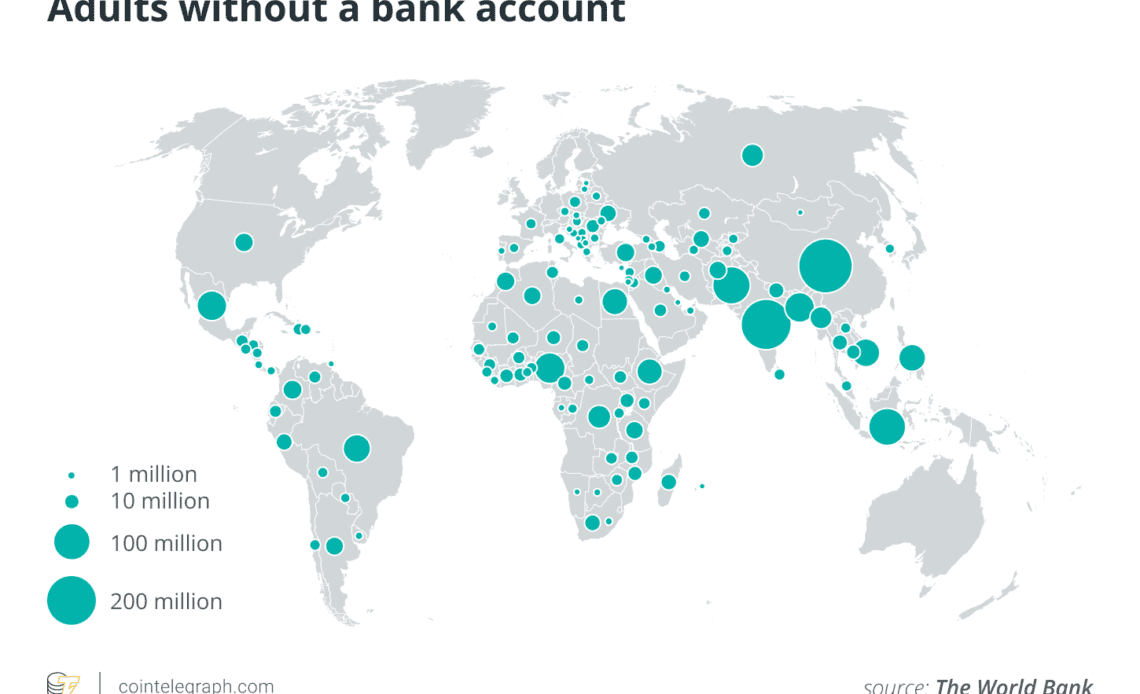

The framework also discussed promoting access to safe and affordable financial services. This is one of the key positives for the cryptocurrency industry, as it has provided access to financial services to millions around the world. It mentioned the fact that nearly 7 million Americans have no bank account, and another 24 million rely on nonbanking services, which can be costly. By encouraging payment providers to have increased instant access to payment systems, prioritizing the efficiency of cross-border payments, and supporting research in technological and socio-technological disciplines, the framework can help provide much-needed financial services to those in need.

Biden will also consider creating a federal framework to regulate nonbank payment providers, some of which now offer cryptocurrency services. The framework will also provide financial stability by having the…

Click Here to Read the Full Original Article at Cointelegraph.com News…