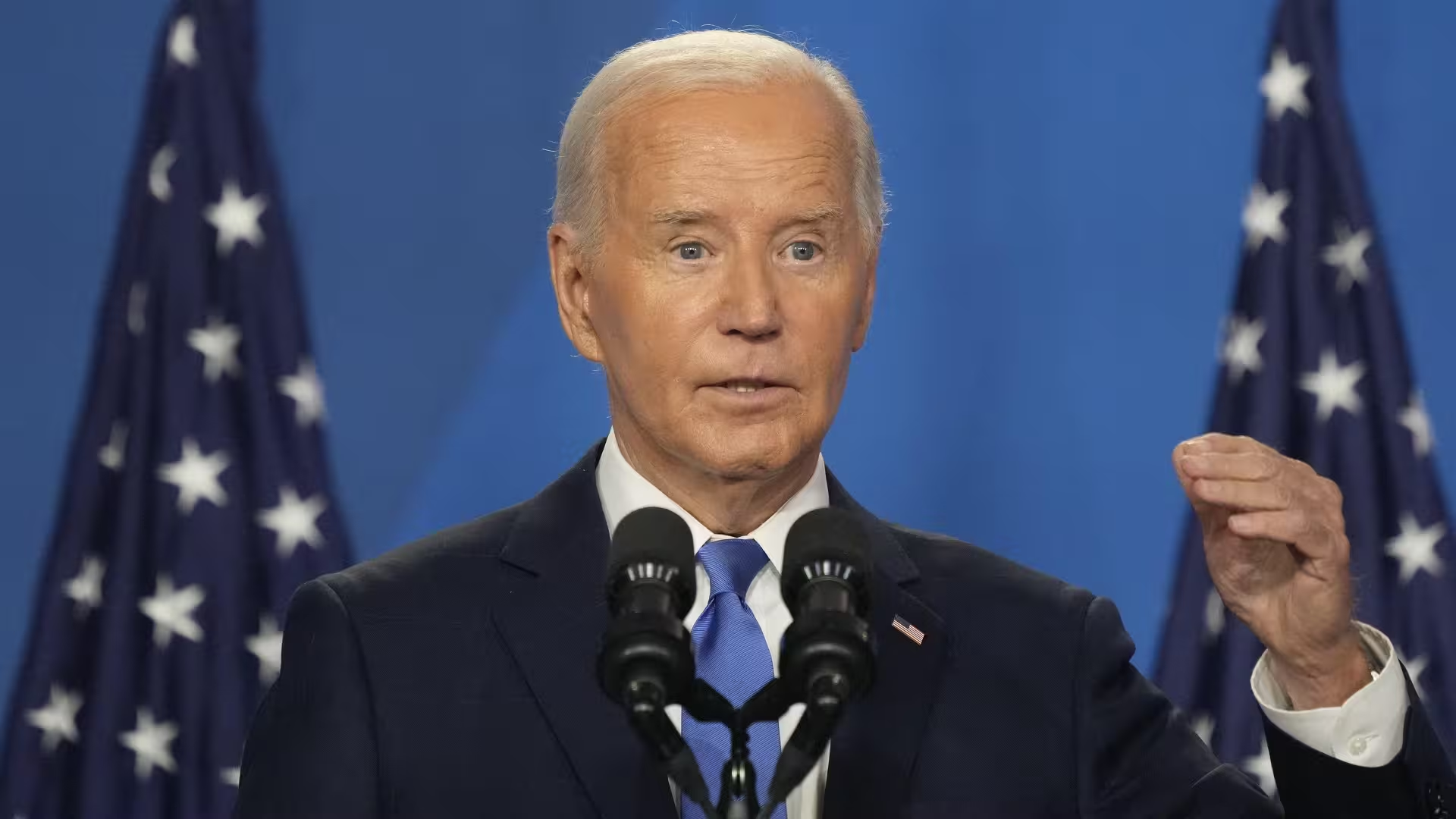

Increased pressure from the Democratic party for President Joe Biden to pull out of the presidential race has led to an inevitable conclusion: Biden has withdrawn from the race today.

While Biden has endorsed Vice President Kamala Harris as the new nominee, Democrats still have the power to propose a different nominee.

How will this impact the economy, and more specifically, the stock market? Here’s a look at what experts had to say about it.

Also consider investing your money in these sectors if Trump wins.

Check Out: How I Went From Middle Class to Upper Middle Class

Learn More: 5 Subtly Genius Things All Wealthy People Do With Their Money

Immediate Reaction: Increased Volatility

Several experts argued that Biden’s exit will increase market volatility.

CEO of Impact Health USA Josh Thompson said, “Investors generally prefer stability and predictability and such a significant political shift would disrupt both.”

According to him, the initial response could be a sharp decline in stock prices as investors seek to hedge against potential risks.

Michael Collins, CFA, founder and CEO of WinCap Financial, echoed the sentiment, saying that there could be increased uncertainty and volatility in the market due to a change in leadership, as he feels a Biden withdrawal would almost guarantee a win for Trump.

“Investors may also react differently depending on who becomes the new frontrunner for the Democratic party and their perceived policies towards businesses and the economy,” he said.

“Could Be Supportive of U.S. Equities”

Now, in terms of specific sectors, some experts argued that an exit could help U.S. equities.

Timothy Holland, CFA and chief investment officer at Orion, said Biden’s “most likely replacement,” Harris, could be perceived to be a weaker candidate against Trump. However, he said, “It could prove supportive of U.S. equities as Wall Street [begins] to contemplate and price in a fiscal policy backdrop that [features] both the extension of the Trump Tax Cuts and incremental government spending, particularly on the military.”

Holland also said such a combination could prove stimulating to the U.S. economy and corporate profits in the short to intermediate term, helping push stock prices higher.

“That said, accelerating economic growth could also push…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…