While most of the market focuses on Bitcoin’s price volatility, a much bigger problem seems to go unnoticed.

The centralization of Ethereum has been one of the hottest topics in the crypto industry since the network’s switch to Proof-of-Stake, with many critics warning about the dangers of such a high market cap cryptocurrency relying on only a handful of centralized validators.

Since the coveted mining ban in China, the centralization of the Bitcoin network mostly disappeared from mainstream discussions and became the focus of a niche group in the mining sphere.

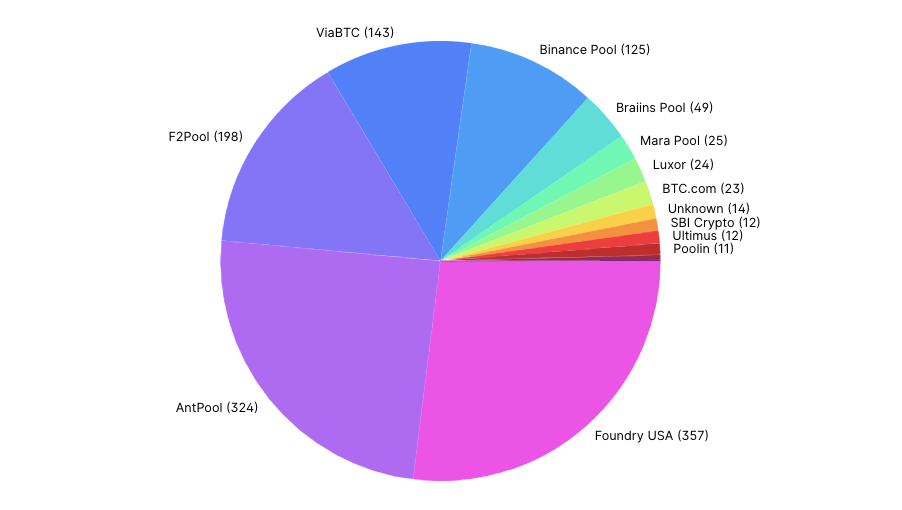

However, Bitcoin’s centralization is a problem that concerns the entire market, especially now when only two mining pools produce the majority of its blocks.

CryptoSlate looked at Bitcoin’s global hash rate distribution and found that more than half of it came from Foundry USA and Antpool.

The two pools mined over a quarter of Bitcoin blocks in the past ten days each. Since mid-December, Foundry USA mined 357 blocks, while Antpool mined 325. Foundry’s block production accounted for 26.98% of the network, while Antpool was responsible for just under 24.5% of the total block production.

Antpool has been at the forefront of Bitcoin mining for years and produced almost 14% of the blocks mined in the past three years. On the other hand, Foundry is a relatively new name in the mining space. However, it quickly rose to become one of the top ten pools by hash rate, accounting for 3.2% of the blocks mined in the past year.

A deeper look at Antpool and Foundry USA shows an alarming level of centralization — and a web of interconnected companies that effectively own half of the network.

Foundry — DCG’s mining behemoth

It took less than two years for Foundry USA to become a force to be reckoned with in the Bitcoin mining space. The mining pool is owned and operated by the eponymous Foundry, a company Digital Currency Group (DCG) created in 2019.

By late summer 2020, Foundry was already among the largest Bitcoin miners in North America. Aside from mining, the company offered equipment financing and procurement. By the end of 2020, Foundry helped procure half of all the Bitcoin mining hardware delivered to North America.

Foundry’s massive success as an equipment procurer and miner directly results from DCG’s influence in the crypto industry.

The venture capital firm is one of the…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…