Digital currency markets, precious metals, and stocks dropped another leg down on Monday following the drop markets saw last Tuesday. Last week’s fall was one of the worst weeks in more than three months as market strategists believe a sizable Fed rate hike is coming this week. Bank of America’s analysts led by Savita Subramanian believes the U.S. Federal Reserve “has more work to do,” and an aggressive central bank may be “anathema for stocks that have benefited from low rates and disinflation.”

Crypto, Precious Metals, Equities Show Volatility Ahead of Fed Rate Hike — Pseudonymous Analyst Plan B Says Bitcoin and the S&P 500 Are Correlated but Are ‘Completely Different Worlds’

A hawkish Fed may be like repellent or kryptonite to assets that profited from easier monetary policy and stimulus, Bank of America’s market strategists led by Savita Subramanian said in a note this past weekend. Global assets are having a rough start on Monday as all four major stock indexes on Wall Street started the day (9:30 a.m.) lower following a gruesome week of trading activity last week. By 3:00 p.m. (ET), benchmark stocks saw a slight rebound showcasing extreme market volatility and uncertainty.

Subramanian and his team predict the S&P 500 will lose another 8% this year, and he further stressed that the “summer rally is over.” On Monday, digital currency markets slid 1.61% in the last 24 hours, and the crypto economy is now just above the $900 billion mark at $933.17 billion. Bitcoin (BTC) has lost 1.67% and ethereum (ETH) shed 1.79% against the U.S. dollar during the past 24 hours.

Precious metals like gold and silver saw losses as well on Monday, as gold shed 0.12% and silver dipped by 0.74% against the greenback. Bitcoin markets have been extremely correlated with U.S. equities, but some BTC market analysts believe bitcoin is a very different animal.

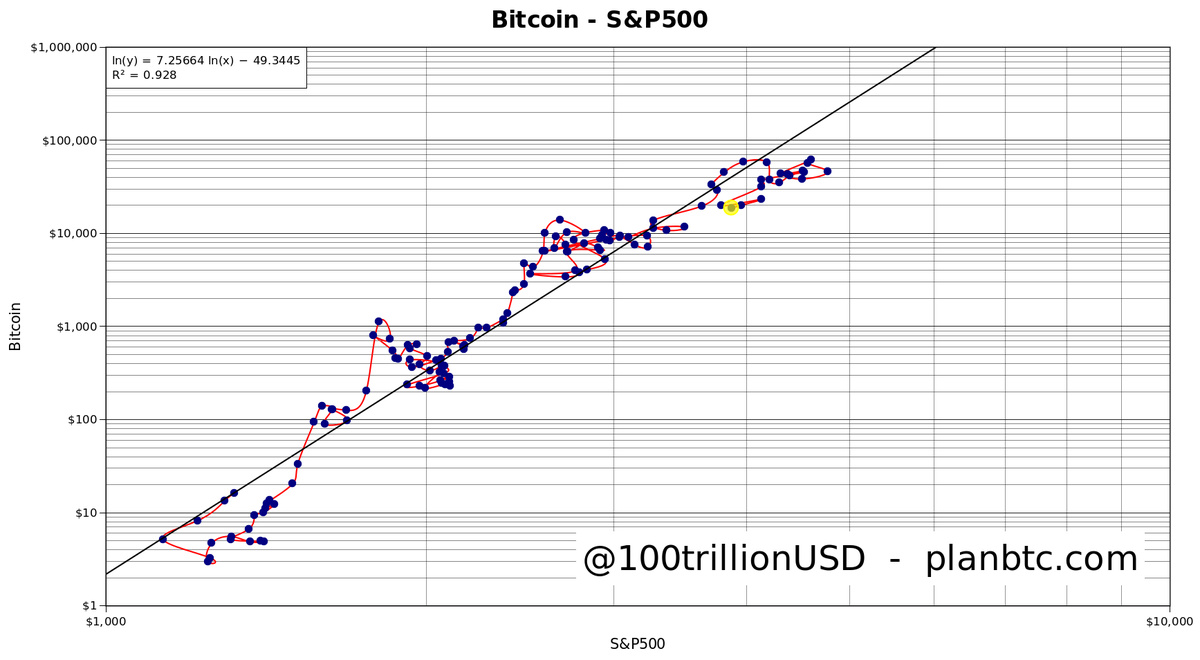

“[Bitcoin] and S&P 500 are correlated,” the pseudonymous analyst Plan B tweeted on Monday. “However, in the same period that S&P increased from ~$1K to ~$4K, [bitcoin] jumped from ~$10 to ~$20K. 4x versus 2000x … completely different worlds. Short-term moves are noise, long term trends are the signal.”

Bank of America Market strategists: ‘The Fed Has More Work to Do’ — Greenback Jumps Higher, 10-Year Treasury Notes Tap an 11-Year High

In the meantime, economists and analysts suspect the U.S. Federal Reserve will raise the target…

Click Here to Read the Full Original Article at Bitcoin News…