BitConnect’s national promoter in Australia, John Bigatton, pled guilty to his role in promoting the scam after three and a half years of his indictment. He promoted the fraudulent cryptocurrency scheme on social media, hosted seminars across the country, and had face-to-face meetings with victims, persuading them to invest in the scheme.

Bigatton pled guilty to a criminal charge of offering unlicensed financial services before the Sydney District Court on 16 May and will receive his sentence on 5 July. He is facing a monetary penalty as well as jail time of up to two years.

A $2.4 Billion Crypto Scam

BitConnect was one of the largest cryptocurrency scams, duping investors of about US$2.4 billion globally. The scheme lured victims with absurdly high fixed interest rates.

As the Australian Securities and Investment Commission (ASIC) detailed, the fraudulent scheme even offered a lending platform which was promoted as an investment opportunity. Investors needed to acquire the platform’s native BitConnect coin to participate in the investment scheme. Investors could invest or loan these tokens for promised fixed returns.

However, the platform did not allow the investors to withdraw any of their loan amounts until the expiry of the lending period.

BitConnect promoted its scheme heavily in 2016 and 2017 globally. The scheme incentivised invites and referrals to grow its network of investors or, rather, victims. The crypto scheme suddenly evaporated in 2018, with the disappearance of its websites and social media handles, leading to investigations by agencies in several countries.

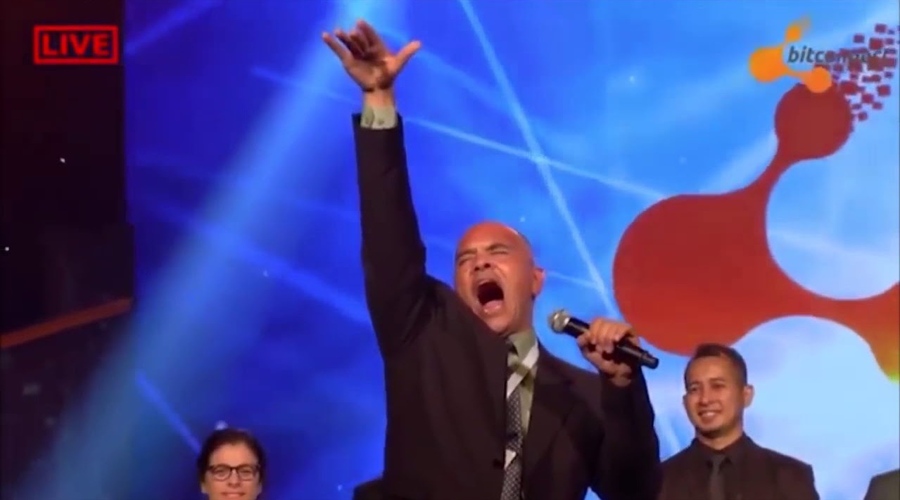

Promoting BitConnect in Australia

Bigatton, the Australian promoter of the scheme, promoted BitConnect locally in the country. According to ASIC, he promoted the scheme, its lending platform, and tokens. He conducted four seminars across the country and promoted the scheme with two social media posts.

Although it is unclear if Bigatton was aware of the scheme’s fraudulent nature, ASIC indicted him for offering financial services products without holding a licence. ASIC’s first action against the Aussie BitConnect promoter was to ban him from providing financial services for seven years. He was later arrested for his role in promoting the scheme.

“A related charge of operating an unregistered managed investment scheme was withdrawn following Mr Bigatton pleading guilty to the charge for which he is to be sentenced,” the regulator noted.

Meanwhile, the US securities market regulator