As a market crash takes place, assets become oversold and typically there’s an “oversold bounce,” “return to mean,” “mean reversion,” or some price snapback to the bottom of the pre-crash range.

Afterward, the asset under study either consolidates, continues the downtrend, or returns to the bullish uptrend if the downside catalyst was not significant enough to break the market structure. That’s all kind of basic trading 101.

This week Cosmos (ATOM) price appears to be following this path and the altcoin is showing a bit of strength with a 35% gain since Aug. 22, but why?

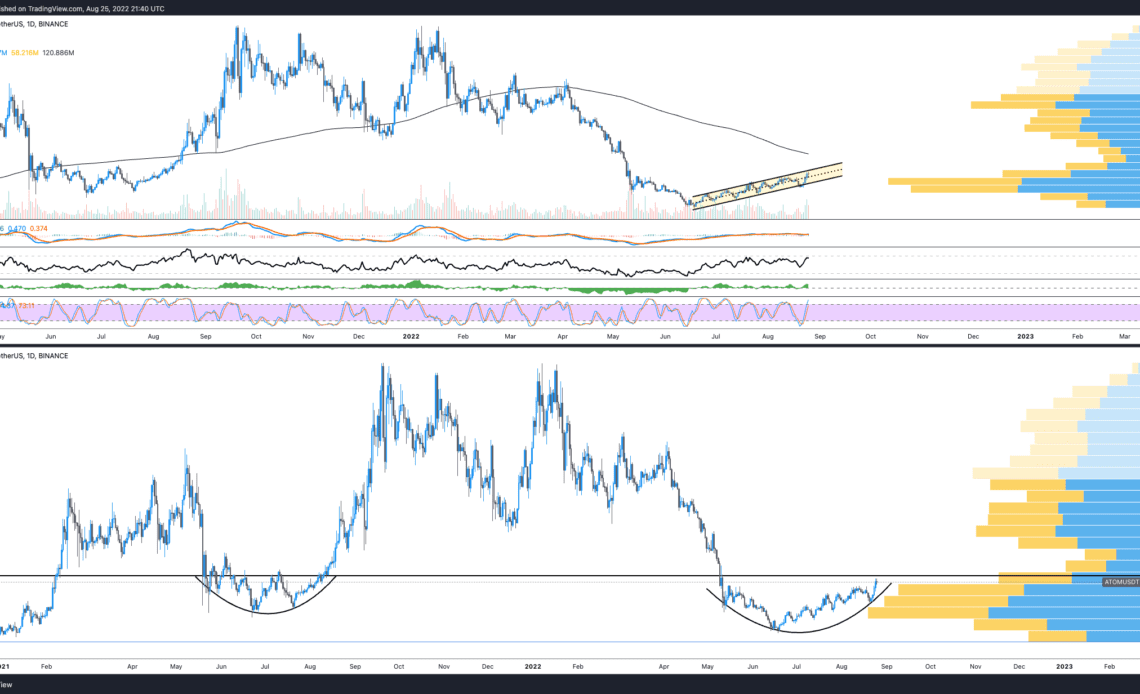

Depending on how you look at it, and technical analysis is by all means a subjective process, ATOM price is either in an ascending channel or one could say a rounding bottom pattern is present with price close to breaking above the neckline.

Resistance above $13 (the horizontal black line in the bottom chart) is currently close to being tested and with sufficient volume and “stability” from the wider crypto-market, the price could be en-route to the 200-day moving average at $17.20.

Of course, if Bitcoin goes belly up at the daily close, or hawkish talk starts to leak out of Jackson Hole, the whole bullish structure for ATOM is likely kaput. So if one is trading, prepare and size accordingly.

If price manages to reach the $17 zone, without skipping a beat, your favorite technical analysts will then say something along the lines of:

“If ATOM price manages to flip the 200-MA to support, continuation to the $27 level could occur.”

Surely you’ve seen that on crypto Twitter lately, but let me find an example.

I bought this $ATOM retest as it’s been leading the market

Looking for a move towards $14.4 as long as the lows hold here. pic.twitter.com/FjP8mzdFHK

— CryptoGodJohn (@CryptoGodJohn) August 25, 2022

So, it’s only up, sir?

What traders need to find out is whether ATOM’s upside momentum is simply the result of a “stable” market and Bitcoin and Ether trading in a relatively predictable range, or is there some Cosmos-related set of fundamentals which validate the current move and warrant opening a swing long?

Apparently, the analysts at VanEck, a multi-billion dollar asset management fund, think ATOM price will do a 160x move by 2030.

Hard to believe isn’t it and perhaps a little bit far fetched, but see for yourself. Here’s what they said:

“Based on our discounted cash flow analysis of potential Cosmos ecosystem…

Click Here to Read the Full Original Article at Cointelegraph.com News…