Crypto and TradFi asset management are converging.

From the record breaking launch of the U.S. spotbitcoin exchangetraded funds (ETFs) to BlackRock CEO Larry Fink’s latest claims that the next step is the “tokenization of every financial asset,” the direction of travel is becoming clearer. As assets migrate on-chain, more managers will be confronted with unique challenges in deploying institutional capital on public blockchains.

Ainsley To is the head of asset management at Avantgarde Finance.

Beneath the hype and speculation around future directions in price, an entire internet native ecosystem has been building atop crypto rails.

Decentralized autonomous organizations (DAOs), digital entities which transcend geographical borders and are governed by code in place of legal contracts, are uniquely familiar with many of this challenges, given the large pools of assets they have amassed in their treasuries, which are typically managed on-chain.

Volatility and lack of a ‘risk-free’ asset

Price volatility is rampant across the crypto ecosystem and many DAOs must confront this head on. The majority of DAOs have a native token which is even more volatile than bitcoin {{BTC}} or ether {{ETH}}. An additional challenge for managing assets on-chain is that unlike traditional markets, crypto lacks a true risk-free asset to fall back to as a haven of certainty.

See also: Explaining Ethereum’s ‘Risk Free’ Rate of Return

While dollar-pegged stablecoins are often used as a proxy for a risk-free asset, the absence of volatility is not absence of risk — as was made clear during the collapse of Silicon Valley Bank in 2023 when USDC suffered a drawdown over 7% due to Circle’s underlying exposure to the bank.

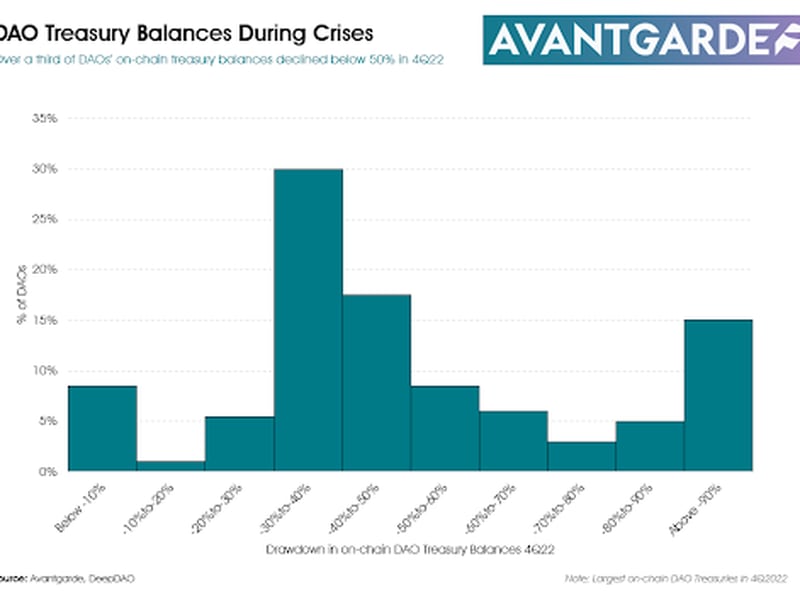

There is a certain resilience built into DAO communities through the weathering of extreme volatility. Of the 200 DAOs with the largest on-chain treasuries in the fourth quarter of 2022, over a third of them saw their portfolios decline by more than 50% the the wake of the FTX collapse, and 30 saw a drawdown of over 90%, according to DeepDAO data.

One solution DAOs have been turning to is real world assets (RWAs), in particular tokenized Treasury bills. This trend is providing a natural crypto native source of on-chain demand for RWAs and paving the way for broader tokenization and convergence…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…