In his latest essay, Arthur Hayes, the co-founder of BitMEX, has laid out his investment playbook in the current global economic landscape, focusing on the potential of Bitcoin, cryptocurrencies, big tech, and traditional financial markets.

Dumb Trades

Hayes begins with a blunt critique of traditional investment strategies, particularly the purchase of long-term bonds in the current economic climate. He explicitly states, “The dumbest thing one can do is purchase long-term bonds with a buy-and-hold mentality.”

Hayes explains this viewpoint by highlighting the risks associated with these bonds, especially when liquidity conditions shift, saying, “You will experience a market-to-market gain today, but…the market will start to discount the impact of further Reverse Repo [RRP] balance decreases and long-end bond yields will creep higher, which means prices fall.”

Moving on to smarter investment approaches, Hayes acknowledges leveraging short-term debt, as exemplified by Stan Druckenmiller. Hayes notes that Stan Druckenmiller went mega-long 2-year treasuries. He remarked, “Great trade, brah! Not everyone has the stomach for the best expressions of this trade (hint: it’s crypto). Therefore, if all you can trade are manipulated TradFi assets like government bonds and stocks, then this isn’t a bad option.”

Hayes also argues that a trade “that’s a bit better than the medium-smart trade (but still not the smartest) is to go long on big tech.” Hayes focuses on AI-related companies. He identifies AI as a pivotal future technology, arguing, “Everyone knows that everyone knows that AI is the future. This means anything AI-related will pump, because everyone is buying it too. Tech stocks are long-duration assets and will benefit from cash being trash once more.”

Smart Trades: Bitcoin And Crypto

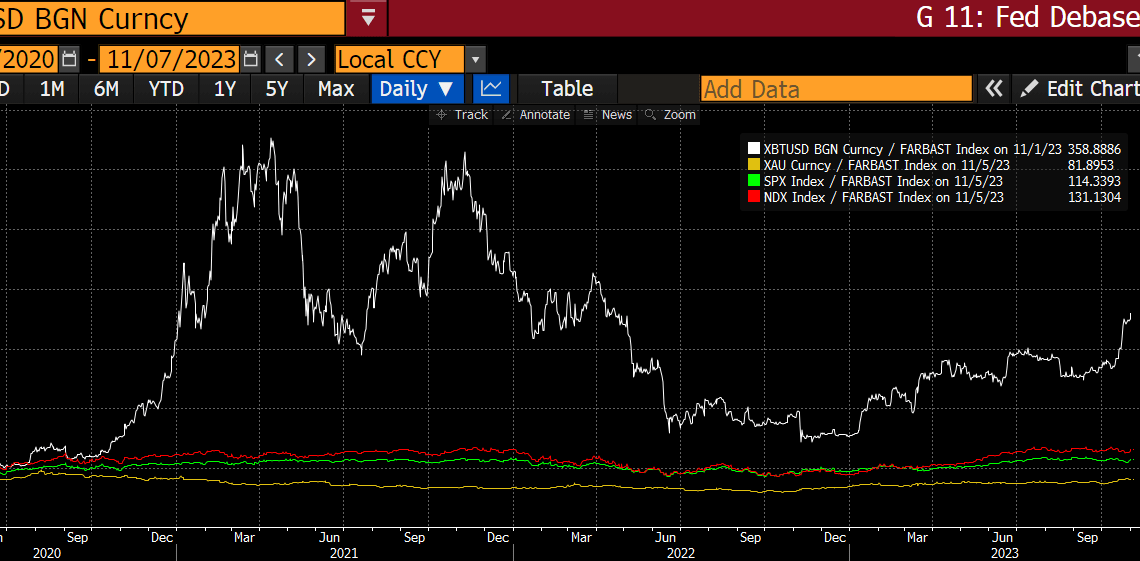

However, the smartest trade is to go long crypto, which has significantly outperformed other assets relative to the increase in central bank balance sheets. Hayes presented the chart below, comparing the performance of Bitcoin, Nasdaq 100, S&P 500, and Gold against the Fed’s balance sheet since March 2020, highlighting Bitcoin’s exceptional growth.

Hayes identifies Bitcoin as the primary investment target, describing it as “money and only money.” Following Bitcoin, he…

Click Here to Read the Full Original Article at NewsBTC…