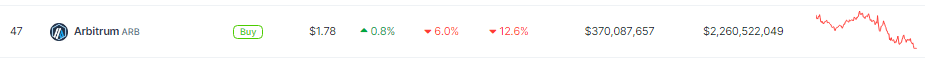

Arbitrum (ARB), the Ethereum Layer 2 scaling solution, has experienced a recent price drop, falling below the $2 mark after a brief attempt to establish a new price floor. This decline, attributed to several factors including increased selling pressure and bearish technical indicators, raises questions about the token’s short-term trajectory while highlighting long-term potential.

ARB price losing its grip on the $2 handle. Source: Coingecko

Selling Spree Triggers Downward Spiral

The price decline began with a surge in selling pressure, most notably from Convex Finance. Over the past 24 hours, the DeFi giant offloaded 901,392 ARB tokens, valued at $1.63 million, at an average price of $1.8 per token.

This move, representing a profit of over $400,000 since acquiring the tokens in an airdrop last year, triggered a domino effect, with other investors following suit.

$ARB price dropped ~9% in the past 24 hours!@ConvexFinance further deteriorates the price by selling 901,392 $ARB ($1.63M) for 559.4 $ETH at ~$1.812 in the past 45 minutes.

They received those $ARB from the DAO airdrop in Apr 2023, which was then worth only $1.2M.

Token flow:… pic.twitter.com/09al0a71Oj

— Spot On Chain (@spotonchain) February 22, 2024

Bearish Indicators Reinforce Downtrend

Technical indicators on the daily timeframe chart further paint a bearish picture. The short-term moving average (SMA), previously acting as support around the $2 mark, has flipped to resistance. The Relative Strength Index (RSI) dipped below the neutral line, suggesting a dominant downward trend, albeit a weak one.

Despite the decline, signs of resilience emerge. The token experienced a slight recovery of 0.2%, currently trading around $1.88. Additionally, the Funding Rate on derivatives platforms like Coinglass remains positive at 0.014%, indicating that buyers still hold some control, albeit with less aggressiveness compared to before.

ARBUSD trading at $1.77 on the 24-hour chart: TradingView.com

Low Derivative Interest: A Point Of Caution

However, the derivative market paints a less optimistic picture. Open Interest, a metric reflecting the total amount of capital locked in futures contracts, stands at around $254 million, indicating relatively low interest in ARB compared to other tokens. This lack of engagement could potentially limit upward momentum and price stability.

Long-Term Prospects Remain Promising

Despite the recent price dip, Arbitrum boasts strong…

Click Here to Read the Full Original Article at NewsBTC…