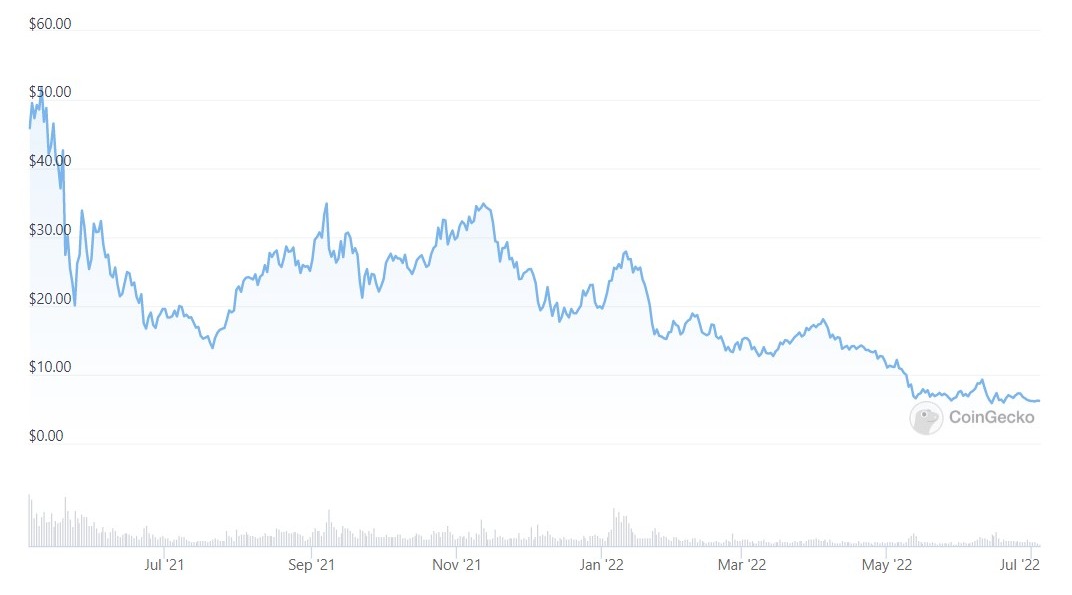

In May 2021, Chainlink (LINK) entered the list of the world’s top 10 cryptocurrencies after topping the market cap of $50 billion for the first time in its history. Once ranked as the 5th most valuable cryptocurrency in the world, LINK is now trading at around $6, down by almost 88% in 12 months. The scenario is not different across other DeFi assets as Uniswap (UNI) and Aave (AAVE) faced a similar situation.

While the overall crypto market witnessed a major correction in the past 7 months, the sell-off across the DeFi market was the worst among altcoins. So, is it safe to say that the DeFi mania is finally over? Or is it another bumpy ride in their journey toward mass adoption? Brian Pasfield, CTO of Fringe Finance, believes that without real use cases, it is extremely difficult for most DeFi tokens to survive in the market.

“Just like you can’t throw all cryptocurrencies in one bag, you can’t do this when it comes to tokens as varied as Chainlink, Compound, Aave, Uniswap, etc. Regardless of how popular the platforms these tokens govern are, the truth is that, without a real use case, a token does not have a reason to hold value in and out of itself,” Pasfield told Finance Magnates.

The issue with DeFi market is that it’s not showing any signs of recovery. While other crypto-assets like XRP, Cardano (ADA), and BNB showed some glimpses of a comeback or at least resisted the market correction in the past few weeks, DeFi tokens are in complete freefall. In the last seven days, Uniswap plunged by nearly 18% while Aave lost approximately 15% of its value.

‘Not the End for DeFi’

Vadim Keff, the co-founder of NUBI and the T7T Blockchain Lab, said that the recent plunge in prices is not the end for the DeFi market as the adoption of DeFi assets will increase after regulatory clarity.

“The correction we are seeing in defi prices is partially explained by the correction in public markets. Over the last six months, public markets have seen the risk-off approach of investors and the departure of capital from risky assets. Both equity and defi markets had a moment of euphoria in 2020-2021 and now we are seeing significant corrections,” Keff said.

…