One Ethereum (ETH) rival that is up more than 150% in 2023 is losing momentum, according to crypto analytics firm Santiment.

Santiment says that the recent Solana (SOL) rally was propelled by the liquidation of shorts and may now start to run out of steam.

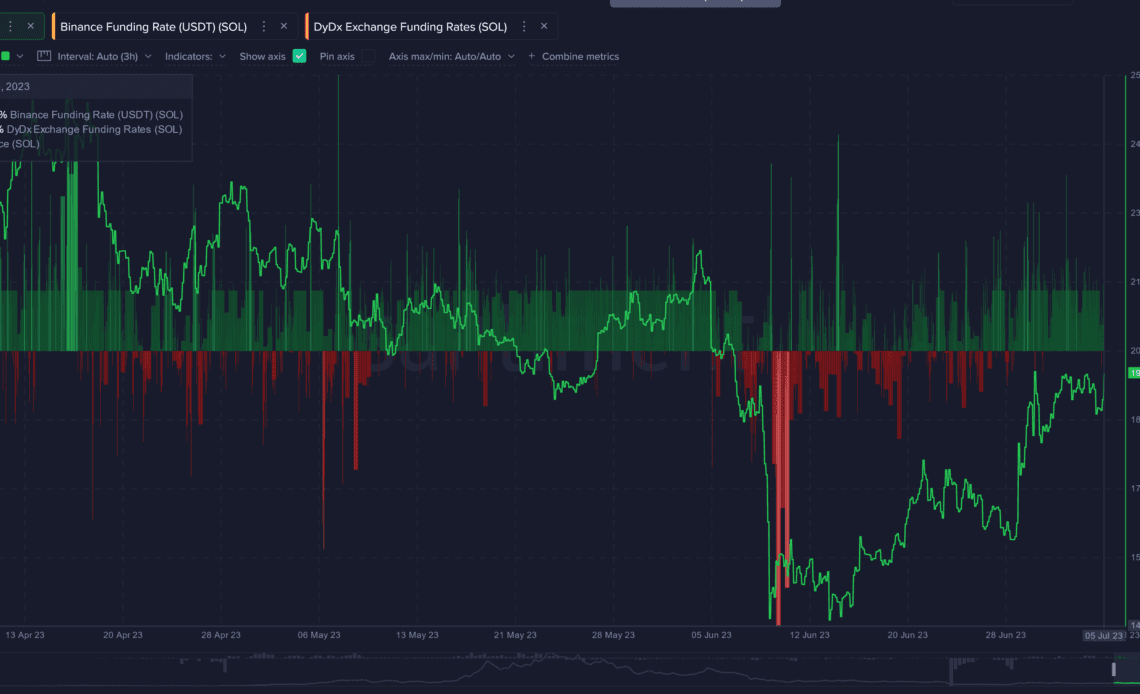

According to the analytics firm, the best time to have bought into Solana was during the second week of June when funding rates had bearish spikes.

“As we can see from Solana’s funding rate on Binance and DyDx, the ideal time to buy in would have been when we saw these ultra short funding rate spikes happening in the second week of June. Prices can still keep climbing without the aid of shorts being liquidated, but the probabilities are certainly lowered.”

A funding rate of above zero indicates that market bullish sentiment is more dominant, while a rate in the negative levels indicates that bearish market sentiment is more dominant.

An increasing funding rate also indicates bullishness while a falling funding rate indicates bearishness.

At time of writing, the Solana funding rate on Binance is now positive at 0.010%. In early June, the funding rate on Binance dropped to a negative of 0.045%.

Santiment also highlights how Solana’s declining social dominance since the start of the year may indicate a lack of support for the current price level.

“We can also tell by the decline in social dominance that Solana’s social dominance has just continued to decline since the beginning of the year.”

Solana hit a low of $8 in December 2022 and is trading for $20.15 at time of writing, a 152% increase.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DreamStudio

Click Here to Read the Full Original Article at The Daily Hodl…