Litecoin (LTC), the silver to Bitcoin’s gold, has enjoyed a recent price surge, leaving investors cautiously optimistic about its future trajectory.

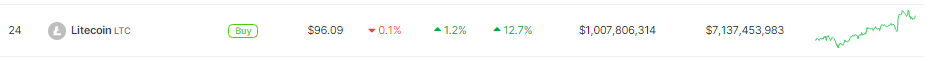

Over the past week, LTC has seen a 13% increase, with its value hovering nearly $96 at the time of writing.

This bullish run has been accompanied by technical indicators suggesting a potential continuation of the uptrend, but some analysts warn of lurking risks.

LTC maintains a strong weekly performance. Source: Coingecko

Potential Litecoin Price Bump In The Offing

One key driver of optimism is the apparent breakout from a bullish triangle pattern. This technical indicator, identified by popular analyst World of Charts, suggests a potential price surge in the coming months, with some analysts even predicting a climb to $400.

$Ltc #Ltc Breakout & Retest Has Already Confirmed Send It Towards 400$ Now https://t.co/6ZJxAgZjVJ pic.twitter.com/xW3xDrgHAZ

— World Of Charts (@WorldOfCharts1) March 26, 2024

Further fueling the bullish sentiment are on-chain metrics like the MVRV ratio, which suggests the coin might not be overvalued yet.

Additionally, a rise in Daily Active Addresses and transaction volume indicates increased investor activity and trading.

This is further corroborated by a bullish crossover on the MACD indicator and a rising Money Flow Index (MFI), both suggesting potential for further price hikes.

Bitcoin is now trading at $70.714. Chart: TradingView

However, not all signals are green. The Network-to-Value (NVT) ratio, which indicates potential overvaluation, has also spiked alongside the price increase. This raises concerns about a possible price correction if the market deems LTC to be overvalued.

While the recent price action for Litecoin is encouraging, it’s crucial to maintain a balanced perspective, analysts caution. Technical indicators can be helpful, but they shouldn’t be the sole decision-making factors, they said.

LTC Hashrate Remains Stable

Meanwhile, the hashrate, a measure of computing power dedicated to mining LTC, has remained stable, suggesting no significant changes in miner activity. However, some analysts worry that a potential drop in hashrate could hinder future growth.

The overall picture for Litecoin presents both opportunities and challenges. The recent price surge and positive on-chain metrics are encouraging signs.

However, potential overvaluation concerns and conflicting technical signals urge caution. Investors should closely…

Click Here to Read the Full Original Article at NewsBTC…