Bitcoin has once again been the center of attention following its recent surge to a new all-time high, only to face a subsequent downturn that tested the resilience of its market value.

A few days ago, Bitcoin traded at $69,328 for the first time ever, but It experienced a pullback, dipping to the $59,000 region before regaining its footing and stabilizing above the $66,000 mark.

Bitcoin Crucial Support Level

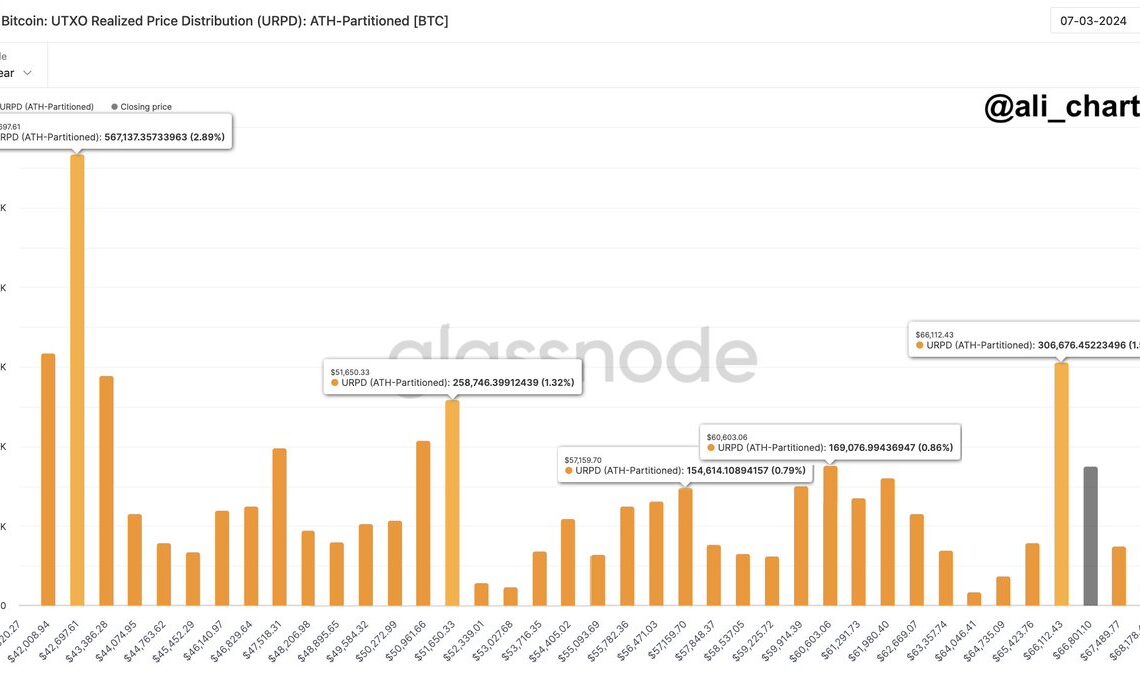

Ali, a recognized figure in the crypto analysis sphere, has pinpointed a critical support level that could play a pivotal role in Bitcoin’s short-term price trajectory. He highlights $66,112 as a key support threshold, supported by a significant transaction volume of 306,676 BTC.

Should Bitcoin’s price venture below this crucial level, it may encounter increased selling pressure, potentially leading it toward the $60,600 mark.

Notably, a substantial transaction volume at the $66,112 support level is a bullish signal, indicating strong market support for Bitcoin.

The key support level for #Bitcoin stands at $66,112, marked by a substantial volume of over 306,676 $BTC transactions. Should #BTC break below this pivotal threshold, eyes will turn to $60,600 as the next crucial support zone. pic.twitter.com/etuBRlvIOR

— Ali (@ali_charts) March 7, 2024

Analyst Insights On Corrections And Market Maturity

As Bitcoin navigates through its current market cycle, the conversation around potential corrections and their implications has intensified. Analysts like CryptoJelleNL have projected a correction in the 20-25% range, hinting at a possible dip to the $46,500 range.

Such predictions are grounded in cycle analysis, which examines market corrections’ historical precedence and impact on Bitcoin’s value. Observations from past cycles reveal a trend toward diminishing severity of corrections, indicating a maturing market that is becoming increasingly resilient to shocks.

For instance, the 2016-2017 cycle witnessed seven significant corrections with an average pullback of 32%, whereas the current cycle has seen fewer and less severe downturns, with an average pullback of 21%.

Corrections are an essential part of a #Bitcoin bull market — but with each passing cycle, the dips become shallower.

This cycle, it looks like ±20-25% will be the sweet spot for dip-buying.

Your job is to be ready to take advantage when it comes. pic.twitter.com/xrI7iKfiPR

— Jelle…

Click Here to Read the Full Original Article at NewsBTC…