Render (RNDR), the cloud-based rendering network, is stirring excitement in the crypto market with technical indicators and analyst predictions hinting at a substantial price surge in the coming weeks or months.

Render Breaks Free From Technical Chains

Technical analysis paints a bullish picture for RNDR. The token has recently broken out of a bullish technical pattern known as the Dragon Pattern, also referred to as the supply line. This breakout historically signifies a potential shift in momentum, with prices likely to trend upwards.

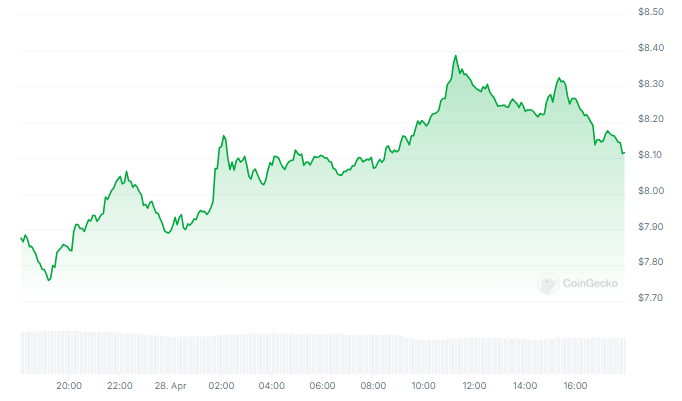

RNDR 24-hour price action. Source: Coingecko

Adding fuel to the fire, analysts are observing the formation of Three Rising Valleys on RNDR’s chart. This pattern suggests a potential market bottom has been established, indicating a reversal from previous downward trends.

Furthermore, a bullish divergence on the four-hour chart hints at weakening selling pressure. In simpler terms, sellers are struggling to push prices down, failing to break below previous lows.

$RENDER – It’s looking bullish in my opinion.

Here is why 👇

• Dragon pattern aka the supply line which broke out already.

• Potential 3 rising valleys in the making while we established a potential bottom.

• 4 hour bullish divergence which means that sellers had a hard… pic.twitter.com/jMBzXWyG81

— Doji 🥷 (@SatsDoji) April 25, 2024

DoJi, a prominent crypto analyst, sees these technical indicators as a recipe for a price surge. Based on his analysis of the Three Rising Valleys, DoJi has set a price target of around $13 for RNDR. He even goes as far as suggesting a price explosion beyond $20 if historical price movements repeat themselves.

According to DoJi, surpassing a key resistance level of $9.20 could be the catalyst that ignites this bullish momentum.

RNDR Up 250% In 6 Months – But Can It Break Resistance?

In the previous half-year, RNDR’s value rose by an astounding 250%. The pattern of impulsive and corrective moves in the price fluctuation points to a turbulent market.

Forecasting the price trajectory of RNDR in the future offers both cautious and optimistic options. There is expected to be resistance at $10.90 and a larger barrier at $13.30.

If the price drops, $6.18 or even lower, $3.79, may provide support. RNDR network adoption rate and general market trends could drive price fluctuations, but long-term indications like the 100-day average point to a possible stabilization around $8.92.

RNDR...

Click Here to Read the Full Original Article at NewsBTC…