A closely followed analyst thinks Ethereum (ETH) is on the verge of a rally after the second-largest crypto asset flashed a bullish signal on the high time frame chart.

Ali Martinez tells his 40,700 followers on the social media platform X that ETH broke out from an ascending triangle on its weekly chart and continues to target $3,400 despite its short-term volatility.

An ascending triangle is a technical analysis pattern that typically involves two or more equal highs and a series of higher lows. It’s usually interpreted as a bullish pattern.

Ethereum is trading at $2,517 at time of writing.

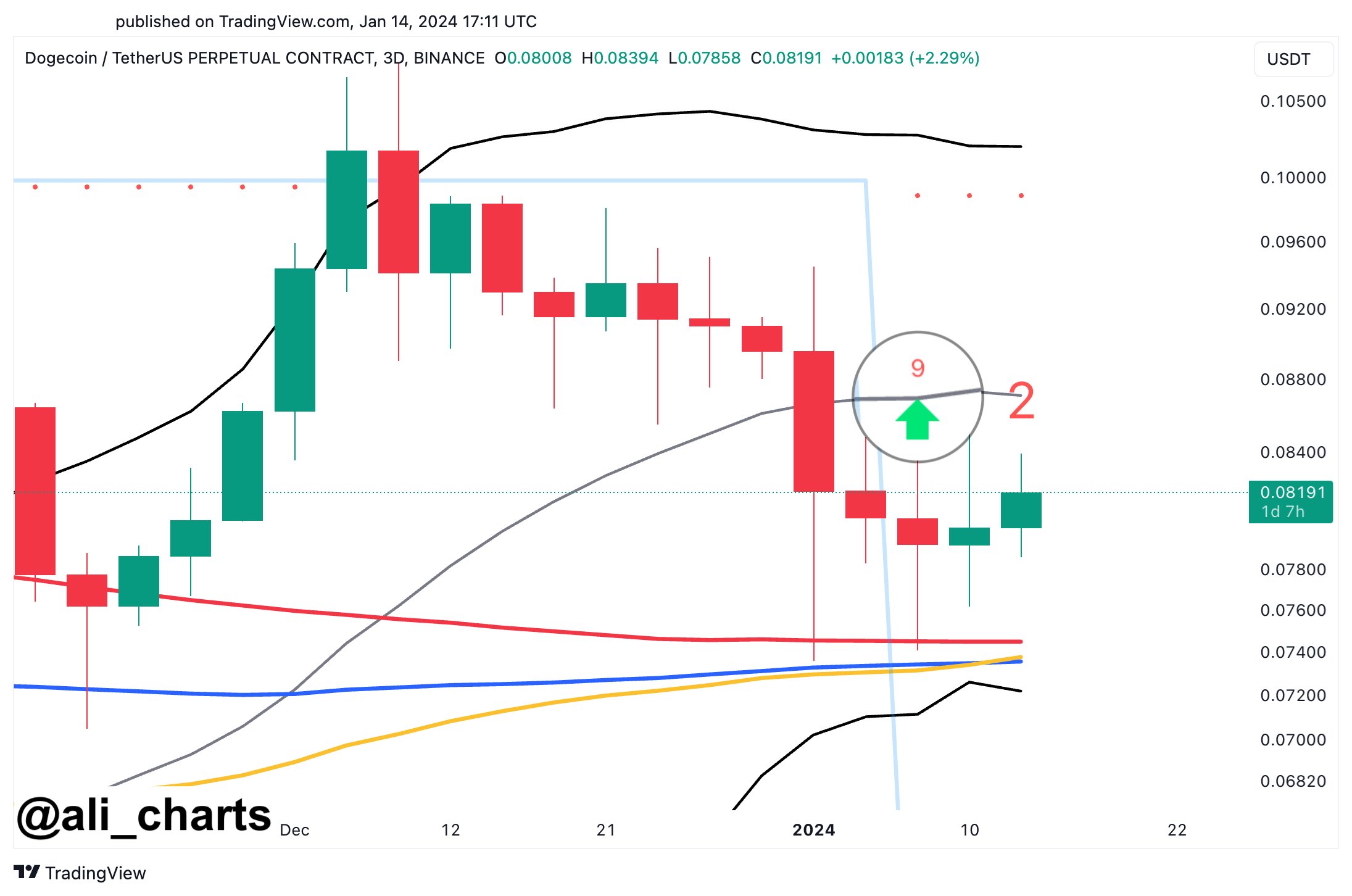

Martinez also notes that the Tom DeMark (TD) Sequential indicator recently presented a buy signal for top meme asset Dogecoin (DOGE). The TD Sequential indicator is used by traders to predict potential trend reversals based on the closing prices of the 13 previous bars or candles.

Says Martinez,

“As long as the $0.074 support cluster continues to hold, DOGE has a great chance of rebounding to $0.100 or higher!”

DOGE is trading at $0.080 at time of writing.

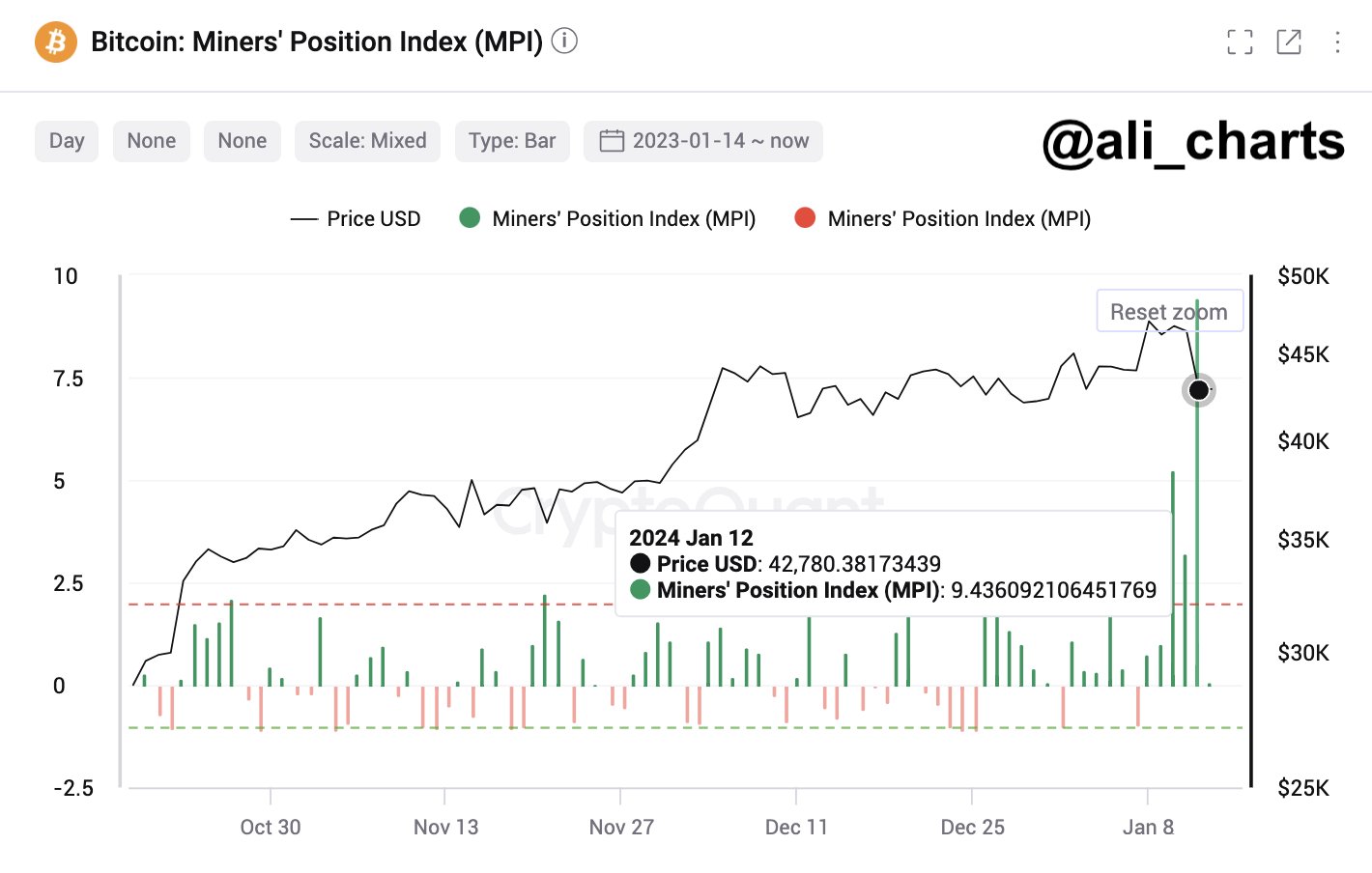

In terms of Bitcoin (BTC), Martinez notes that the BTC Miners’ Position Index (MPI) hit a high of 9.43 on January 12th.

“This indicates miners moved more BTC than usual, hinting at potential sales. Despite a recent BTC price correction, stay vigilant – further miner selling could drive prices further down!”

The MPI is a metric that offers insight into whether BTC miners are selling or holding onto their coins. It is calculated by determining the ratio of the number of all miners’ outflows in US dollars divided by the 365-day moving average, according to the digital asset analytics firm CryptoQuant.

BTC is trading at $42,821 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…