In a video update on YouTube, crypto analyst Rekt Capital delved into the dynamics of Bitcoin’s price movements through the lens of the PI Cycle Top Indicator, a predictive tool that has garnered attention for its historical accuracy in pinpointing the peaks of Bitcoin bull runs.

Here’s How High Bitcoin Price Could Go This Cycle

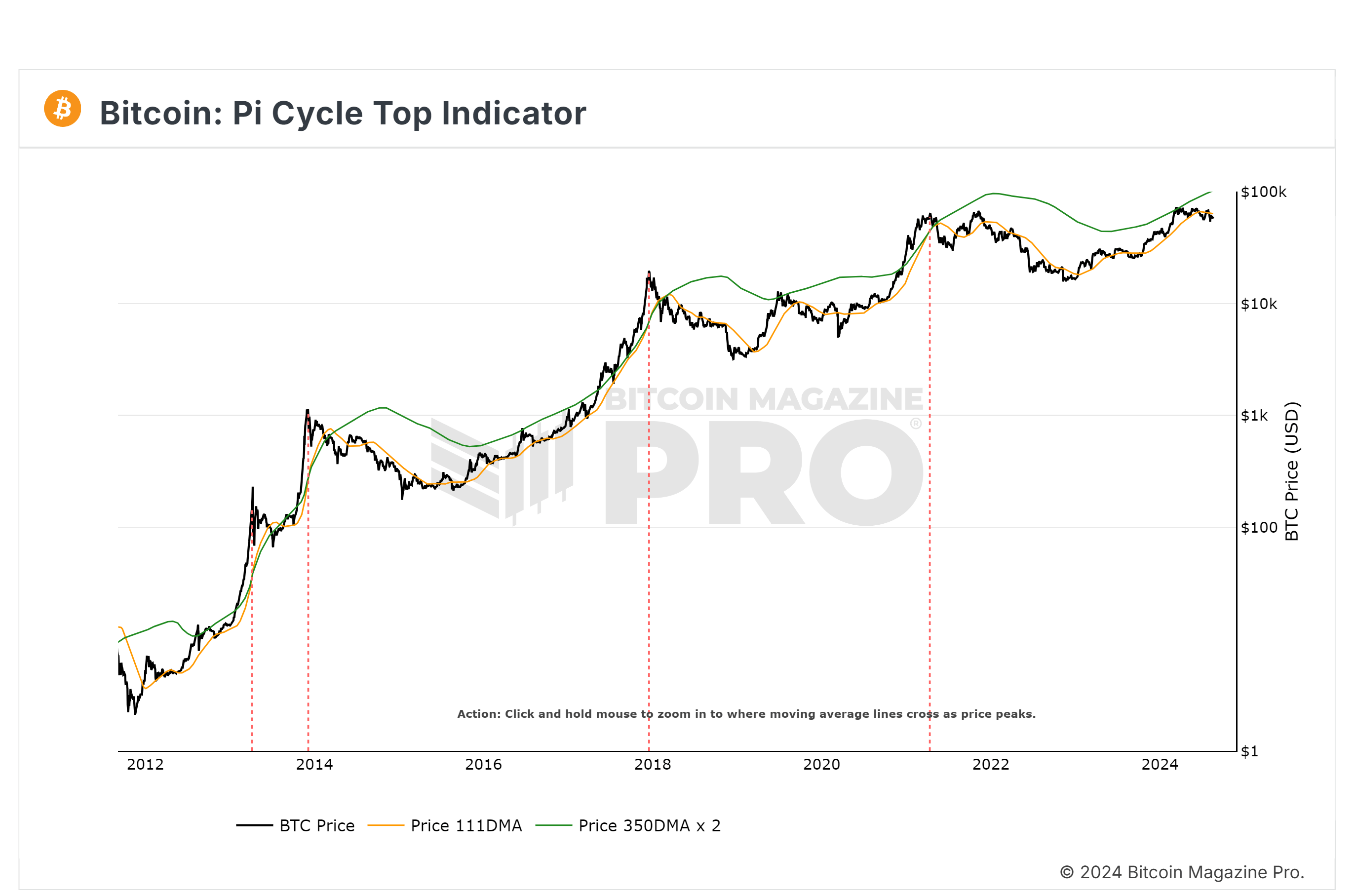

The PI Cycle Top Indicator operates by tracking two key moving averages: a short-term 111-day moving average (colored orange in Rekt Capital’s visual analysis) and the 350 day moving average (depicted in green) to gauge extended market trends. A crucial aspect of this tool is the “crossover” event where the short-term moving average rises above the long-term average, historically signaling a peak in Bitcoin’s bull market within a few days.

However, the current market data shows that these two moving averages are diverging rather than converging, suggesting that the conditions for a bull market peak are not yet in place. “As these two PI Cycle moving averages are currently diverging from one another, the bull market peak is nowhere close,” Rekt Capital explained in his video.

Related Reading

The 111-day moving average serves as a critical metric in Rekt Capital’s analysis. During bear market phases or pre-halving years, this moving average acts as a barometer for bargain buying opportunities, oscillating around it in downtrends. Conversely, in halving years, such as 2020, it tends to act as a support level, underpinning uptrends that lead to new all-time highs.

“Any dip below this moving average is a bargain buying territory,” Rekt Capital noted, emphasizing the strategic importance of this level during different market phases. Currently, Bitcoin is trading below this moving average, approximately at $59,000, which has not happened for a significant period since the pre-halving year, marking a potentially undervalued state relative to historical patterns.

The analysis suggests that if Bitcoin reclaims the $63,900 level—just above the current position of the 111-day moving average—it could end the current bargain buying opportunity, setting the stage for further upward movement. “We are approximately $5,000 away from reclaiming this region. Not much needs to happen for Bitcoin to bounce back and reclaim this region to end this bargain buying opportunity,” remarked Rekt Capital.

Related Reading

Another element of the PI…

Click Here to Read the Full Original Article at NewsBTC…