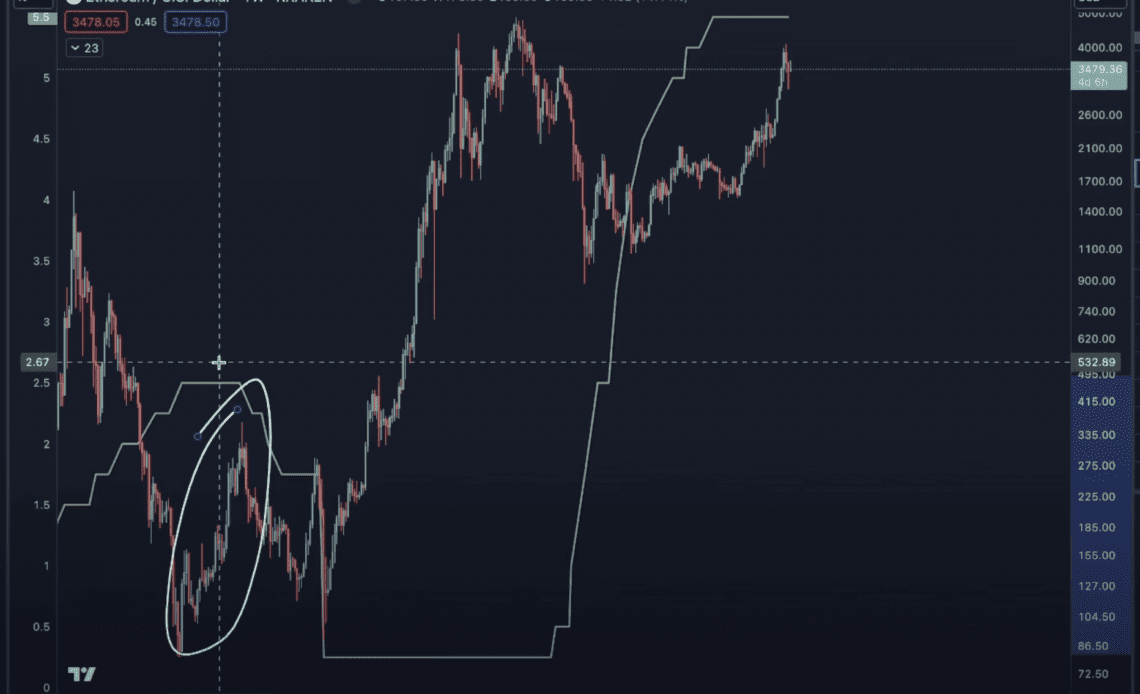

A widely followed crypto analyst is issuing a warning on Ethereum, saying that ETH could still witness a 2019-style collapse.

In a new video update, crypto strategist Benjamin Cowen tells his 796,000 YouTube subscribers that the conditions for Ethereum now are similar to that of mid-2019, and that the leading smart contract platform may suffer a similar setback.

Cowen notes that in 2019, a slash in interest rates coincided with a dramatic correction for ETH. With the Fed expected to begin cutting rates again at some point this year, the analyst suggests that a similar scenario could play out.

“We’ll see how [Ethereum] plays out here, if it does just continue to mimic sort of a bigger version of [its pattern in 2019] or if it does something completely different…

A lot of people don’t like the fact that I compare it to 2019 because it’s gone up, because it’s been taking a lot longer, but still, because ETH/BTC continues to drop, and because the Fed has not yet pivoted, why would we assume that it’s not following the same thing?

Nothing has changed, right? It’s still bleeding against Bitcoin, the Fed has not yet cut rates, and that was the turning point for it at the midcycle top last cycle.”

Cowen says that if Ethereum repeats its 2019 correction, then a multi-month consolidation may be in store before the Fed begins a quantitative easing (QE) and crypto markets bounce again near the end of 2024.

“If you have a hard time with that – sort of a six to nine-month lull in the market – what’s fascinating is that if everything’s been shifted by about three quarters, what if you shift this again?

You go three quarters out, you get to the end of the year and then QE (quantitative easing) returns and you get another bull market – I mean maybe, maybe that’s how it plays out.”

Ethereum is trading for $3,530 at time of writing, a 2.28% decrease on the…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…