A quant has explained how a pattern currently forming in the Ethereum Open Interest could imply the altcoin season is coming “sooner than expected.”

Altcoin Season May Be Approaching Soon Based On Ethereum Pattern

In a CryptoQuant Quicktake post, an analyst has discussed about why an altcoin season may be coming soon for the cryptocurrency sector, based on a trend taking place in a couple of Ethereum and Bitcoin indicators.

The first metric of relevance here is the “Open Interest,” which keeps track of the total amount of derivatives positions related to a given asset currently open on all centralized exchanges.

Related Reading

When the value of this metric goes up, it means the speculators are opening up fresh positions for the coin right now. On the other hand, a decline implies the users are either closing up their positions of their own volition or getting forcibly liquidated by their platform.

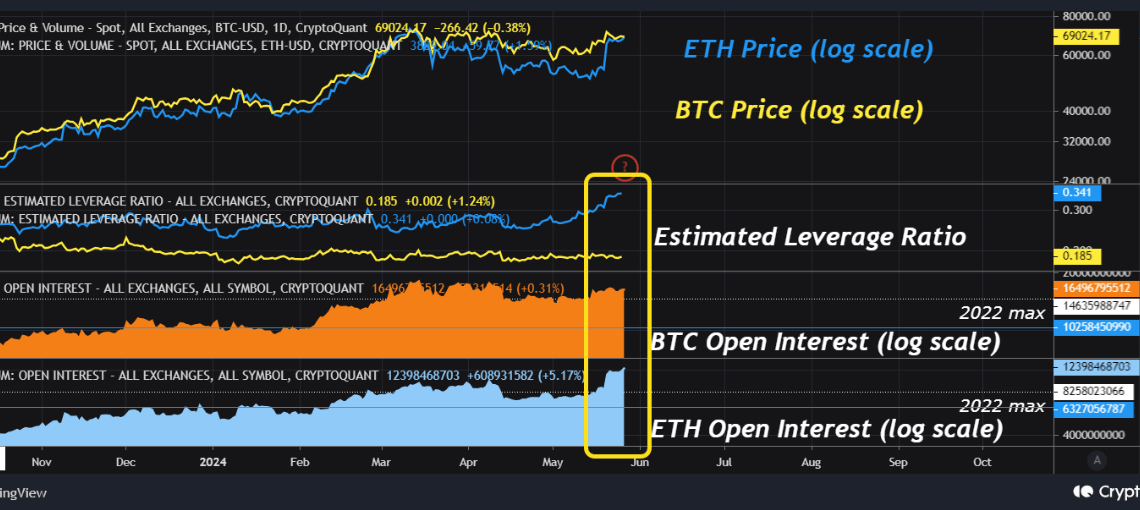

Now, here is a chart that shows how the trend in the Open Interest has compared between Bitcoin and Ethereum over the past year:

As displayed in the above graph, the Bitcoin Open Interest has been moving more or less sideways recently, while at the same time, the metric has registered growth for Ethereum.

This would suggest that ETH has been seeing more appetite for derivatives market contracts than the original cryptocurrency recently. One of the driving factors behind this could be the news cycle related to the approval of the spot exchange-traded funds (ETFs) for the asset.

In the same chart, the quant has also attached the data for another indicator: the Estimated Leverage Ratio (ELR). This metric measures the ratio between the Open Interest and the Exchange Reserve for any asset. The latter is naturally the total amount of the coin that’s currently sitting in the wallets of all centralized exchanges.

The ELR basically provides us with information about the amount of leverage that the average user in the derivatives market is opting for right now. From the graph, it’s visible that this ratio has seen a surge for Ethereum recently but has been showing flat action for Bitcoin.

Thus, it would appear that not only has ETH been seeing more speculative interest than BTC recently, but also these users opening contracts are going for higher risk as they are taking on more leverage.

Related Reading

The analyst believes that the…

Click Here to Read the Full Original Article at NewsBTC…