The venture capital space has lost significant momentum over the last few quarters. Global venture funding is nearly half of what it was last year. Whatever remains of the market is now being directed toward AI funds. AI has become the golden goose for VC firms after the turbulence in crypto in the last year.

Chris Coll–Beswick is the Founder and Managing Partner at Transcend Labs.

Although AI has picked up pace, the VC market is nowhere close to where it was in 2021-22. With higher interest rates and a sustained supply chain shortage, theglobal marketisn’t “ideal.”

In my field of startup incubation, I have experienced the shift firsthand. Back in 2020-21, Investors were much more likely to fund lofty ideas with very little supporting evidence. But today, even the most promising startups have a hard time gaining the attention of top VCs.

According to Crunchbase, “Global venture funding in Q2 2023 fell … 49% compared to the second quarter of 2022 when startup investors spent $127 billion.”

The overall deal volume has also decreased significantly by 37%.

“More than 6,000 startups raised funding this past quarter, compared to more than 9,500 for the same time period a year ago.”

Read more: Blockchain and AI Are Set to Transform Financial Markets: Moody’s

The primary cause of this shakiness is the radical increase in interest rates from near zero to 5.5% – a high number for investors making risky decisions. Investors are also not happy with the IPO drought and the lack of exit opportunities in the market.

Kevin Colleran, co-founder at early-stage firm Slow Ventures, an investor in crypto companies, told VCCircle, “I haven’t written any checks in the past 18 months. I have 30 portfolio companies that I need to help figure out how to survive. There is no point for me to add to the misery.”

For crypto, the situation is worse.

The entire crypto industry made 382 deals in Q2 2023 for a net total of just $2.34 billion. Compared to Q1 2022’s $12.14 billion, these are meager numbers.

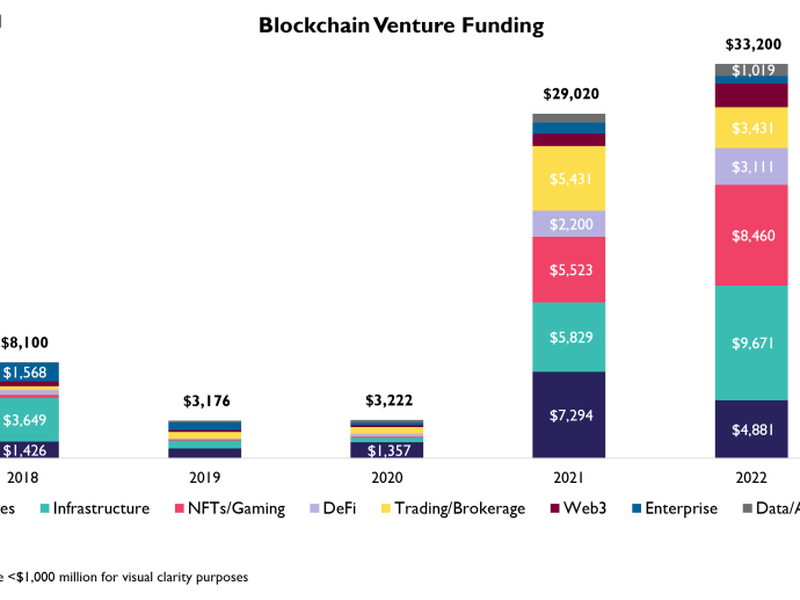

Crypto and Web3 startups specializing in various spaces raised a total of $29B and $33B in two consecutive years ‘21 and ‘22.

However, since Q1 2022, we have seen five consecutive months in the red.

What caused this collapse?

After a hype-fueled bull run starting in 2020, a slew of disastrous…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…