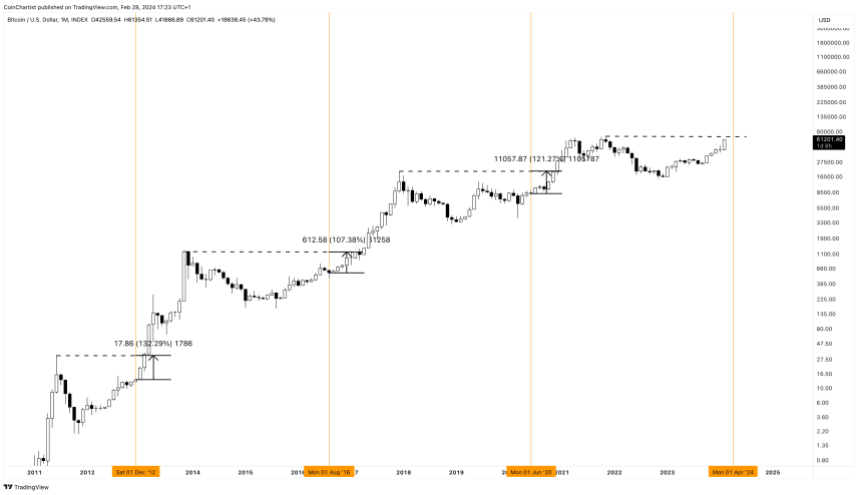

Bitcoin price is trading above $60,000, putting it within striking distance of setting a new all-time high. This would be an unprecedented move for the top Cryptocurrency by market cap, which historically has only made a new price record only after each halving event.

Could BTC set a new record in more ways than one: by reaching a new all-time high before the halving for the first time ever? Let’s take a look at the data.

Why the Bitcoin halving is important

The Bitcoin halving is one of the most anticipated and impactful events for the Cryptocurrency. It reduces the supply of new coins entering circulation. The halving cuts the reward miners receive for processing blocks in half. This means fewer new BTC are created over time, making the supply more scarce.

Reduced supply paired with steady or increasing demand can lead to higher prices according to economic principles. Many investors see halvings as potential catalysts for bull runs. However, this time around, there are unique factors impacting supply and demand.

Unprecedented price action in Crypto

Unlike past Crypto market cycles, which have been suspected to be primarily driven by the supply and demand dynamics created post-halving, Bitcoin price finds itself in an unusual spot: just below all-time high prices.

In all previous market cycles, BTCUSD had over 100% or more to gain at the time of each halving before setting a new all-time high. In fact, it took anywhere between two to seven months after the halving before new all-time highs were set. Yet this time, Bitcoin is around 10% away from making a new all-time high before the halving ever arrives.

What’s behind the change in dynamics?

Since market cycles are driven by global liquidity and supply versus demand, what has changed in 2024 that wasn’t a factor in the past? For one, China has begun injecting liquidity into the global economy in an attempt to save its financial markets.

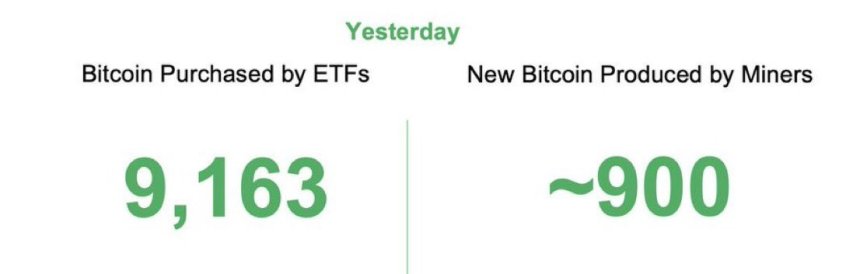

More importantly, is the impact of the new spot BTC ETFs that are beginning to pick up in demand and net flows. Each ETF provider must purchase a corresponding amount of Bitcoin based on the demand for ETF shares. This week, ETFs purchased a grand total of 9,163 BTC in a single day. The same day, BTC miners only produced around 900 BTC. This suggests that ETFs are currently exceeding the new supply of Bitcoin by ten times a day.

Are institutions front-running the halving?

If ETFs are currently absorbing ten times the new supply…

Click Here to Read the Full Original Article at NewsBTC…