Every bull run starts with a spark of capital inflows, something that excites those watching enough to cause FOMO. As a result of that FOMO, traders & paper holders get emotional about holding “this damn coin that just does nothing,”. All while watching others straight line up, then dump their positions at magically the wrong time.

It’s not about capturing the first wave of face melting profits. It’s about using that as an indicator to see how these things have actually worked out. There is one catch, however. You should only attempt this if you understand in order for this process to be successful, it must be observed and executed with little to no emotion. Also don’t listen to social media either or you will almost certainly fail.

Capital flows down just like water. That being the case, let me tell you what we do know. Every bull run that preceded us began with Bitcoin grinding up to the Fibonacci 0.50 mark. It was only when BTC crossed that mark that things got exciting. The 15-17 bull run will be the main focus of this article, due to a word count cap.

Step One – Where Do I Start?

Since the bear market lows, Bitcoin has been the safest bet until the .50 fib. After that we have to monitor our radar for what has technically broken out across medium cap stocks that are doubling (+/-) BTC’s gains in the same time frame. Rotate your allocated trading amount into it without excuses, no “hodling” based on feelings, or “the team”, etc. This is not so much about that, as it is about the current eyes on them. Also just like Solana this cycle, and Ethereum during the 15-17 run, there should be plenty of time to scale out.

Step Two – Rotation Time

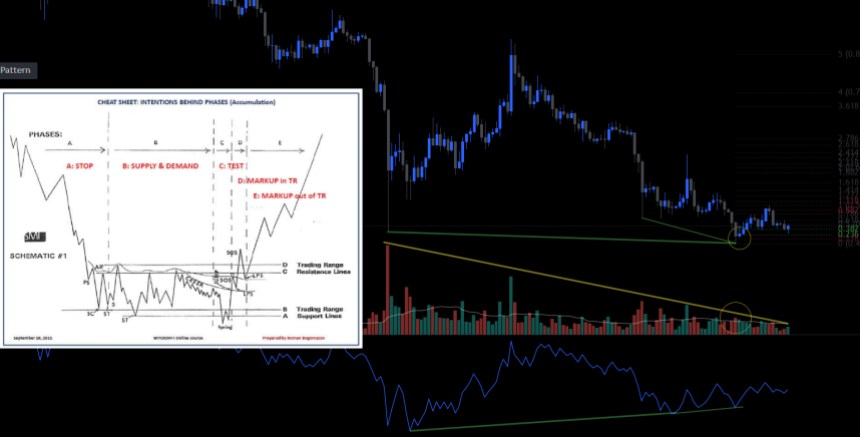

After that, I scale profits into the fundamentally strongest large and medium caps. Currently the ETH/BTC reversal (since writing price has broken out up) indicates that, and its strongest within the family the ones to watch at the moment (as seen in the chart below).

Fortunately, with some trading education & experience, the timing of these things becomes much less of a guessing game. If you study Elliott’s Wave analysis, Wyckoff Schematics, chart patterns, volume, etc. When done correctly (as seen in the chart below) you can be on the bleeding edge of these runs. Which leads to a very happy Trading account.

Click Here to Read the Full Original Article at NewsBTC…