As decentralized finance, or DeFi, continues to evolve and mature, the concept of total value locked – a measure of how much money users have stashed in a given protocol – has also gained significant attention. Originally focused on digital assets such as cryptocurrencies, TVL has expanded to include tokenized real-world assets (RWA), providing a more comprehensive understanding of the assets represented on-chain. These tokenized assets are typically held in smart contracts on a blockchain network.

Since RWA, such as mortgages, private equity investments and illiquid funds, have not been historically represented on-chain, TVL primarily focused on the value of digital assets deposited within DeFi protocols. However, as blockchain technology adoption by traditional financial institutions progresses, the inclusion of RWA, measured within the TVL framework, becomes increasingly relevant and necessary. This is a natural progression in line with the continued development of the DeFi ecosystem, which is coming to embrace tokenized RWAs as part of TVL. Moreover, as DeFi platforms attract institutions and large-scale investors (which are vital for scaling), it becomes increasingly attractive to offer the ability to trade tokenized bonds, equity, debt and other assets such as gold, real estate and art.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

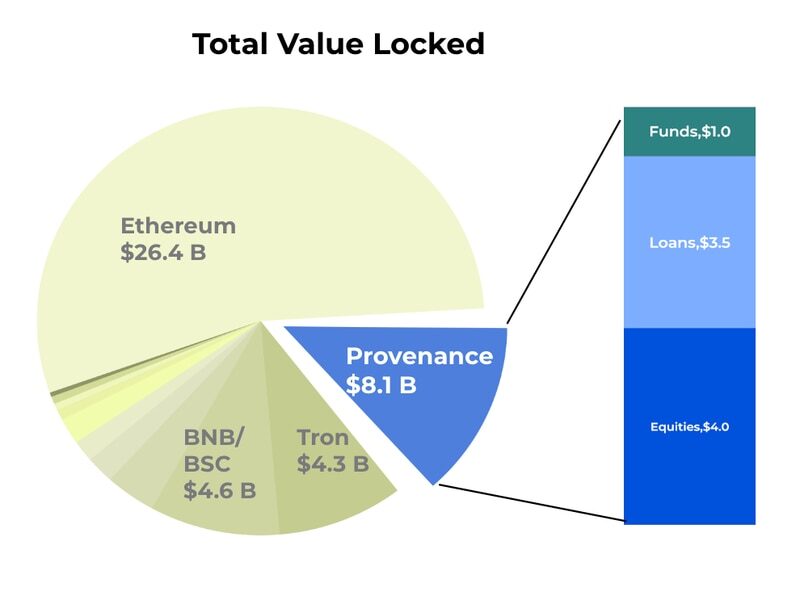

While integrating RWAs into the TVL metric is still in its early stages, with only about $300 billion locked on-chain, the current state of the blockchain layer-1 and layer-2 landscape shows the following figures representing TVL as of July 2023.

Most blockchains’ TVL is largely representative of digital assets, such as cryptocurrency and NFTs, although there are a select few notable blockchains whose TVLs are heavily weighted to RWAs. A great example is Provenance Blockchain, which has an overall TVL of $9.3 billion, of which more than $8.1 billion is from real-world financial assets, such as home equity line of credit (HELOC) loans, private equity and alternative asset funds. RWAs are gradually making their way onto the blockchain, further expanding the TVL metric and its significance.

Importance of TVL to…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…