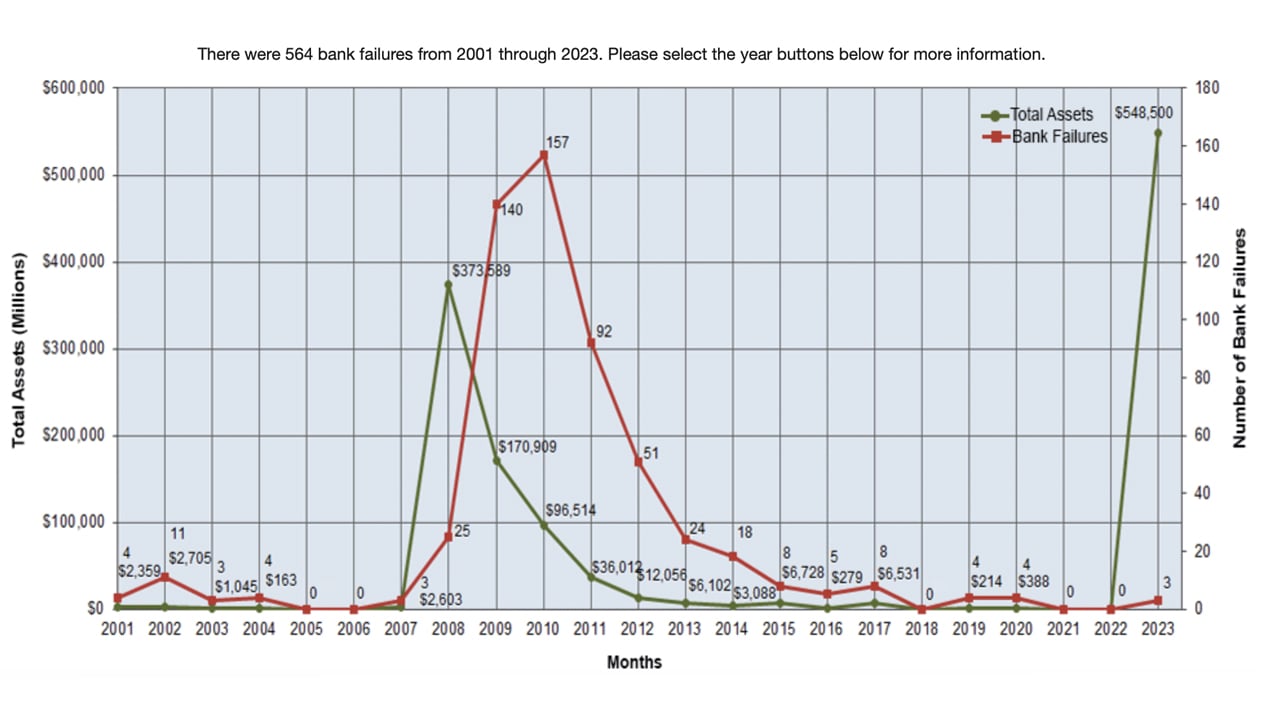

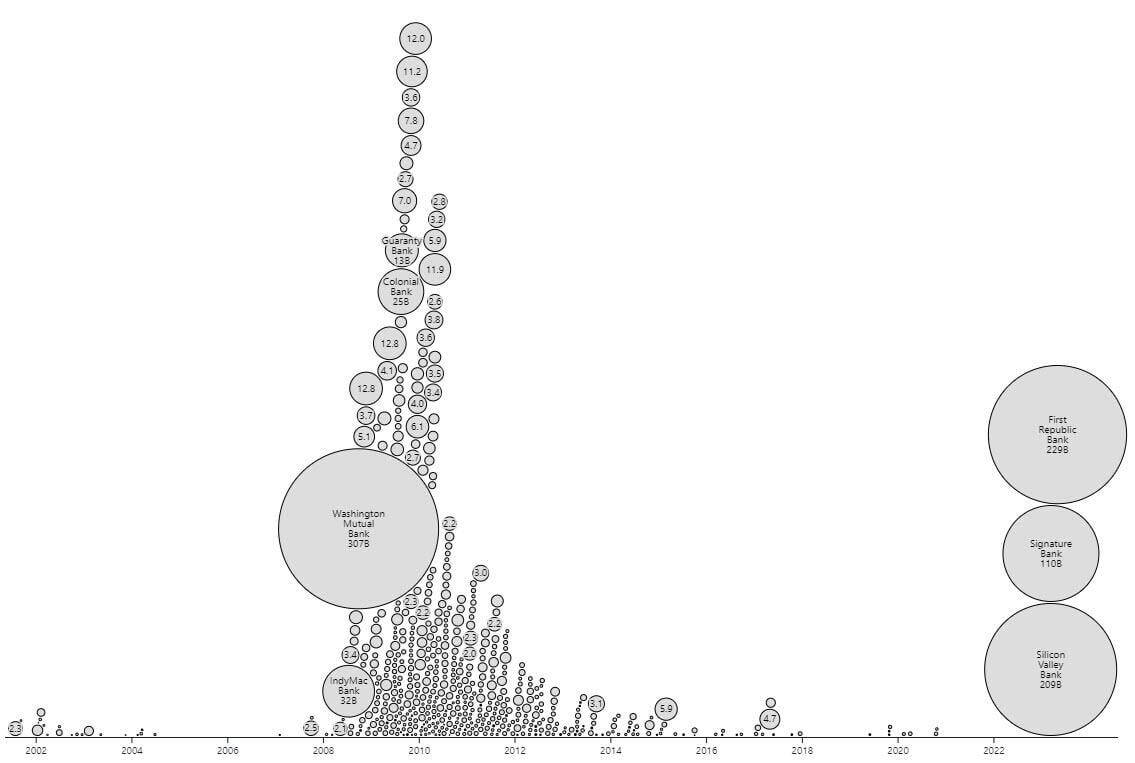

2023 has been a rollercoaster ride for the U.S. banking industry. The collapse of three major banks has sent shockwaves through the financial world, with their combined assets surpassing the top 25 banks that crumbled in 2008. The following is a closer look at what has triggered a ‘great consolidation’ in the banking sector, a recurring theme in the industry’s history over the past century.

A Listicle of Bank Consolidation, Failures, and Issues Facing the U.S. Banking Sector

The U.S. banking industry has taken a beating in 2023, with the market capitalizations of dozens of banks across the country dropping considerably in recent months. The reasons for this struggle are varied, with some blaming poor choices by financial institutions and others pointing fingers at the U.S. central bank. While it’s important to consider different opinions, a comprehensive listicle of information can shed light on the country’s ‘great consolidation’ in the banking sector and the largest bank failures in the United States. So, let’s take a closer look at these developments and what they mean for the country’s banking industry.

- In the year 1920, historical data reveals that the United States boasted a grand total of approximately 31,000 banks. However, by the year 1929, this number had dwindled down to less than 26,000. Since that time, the number of banks has experienced a precipitous decline, plummeting by a staggering 84%. As a result, fewer than 4,160 banks remain in operation today.

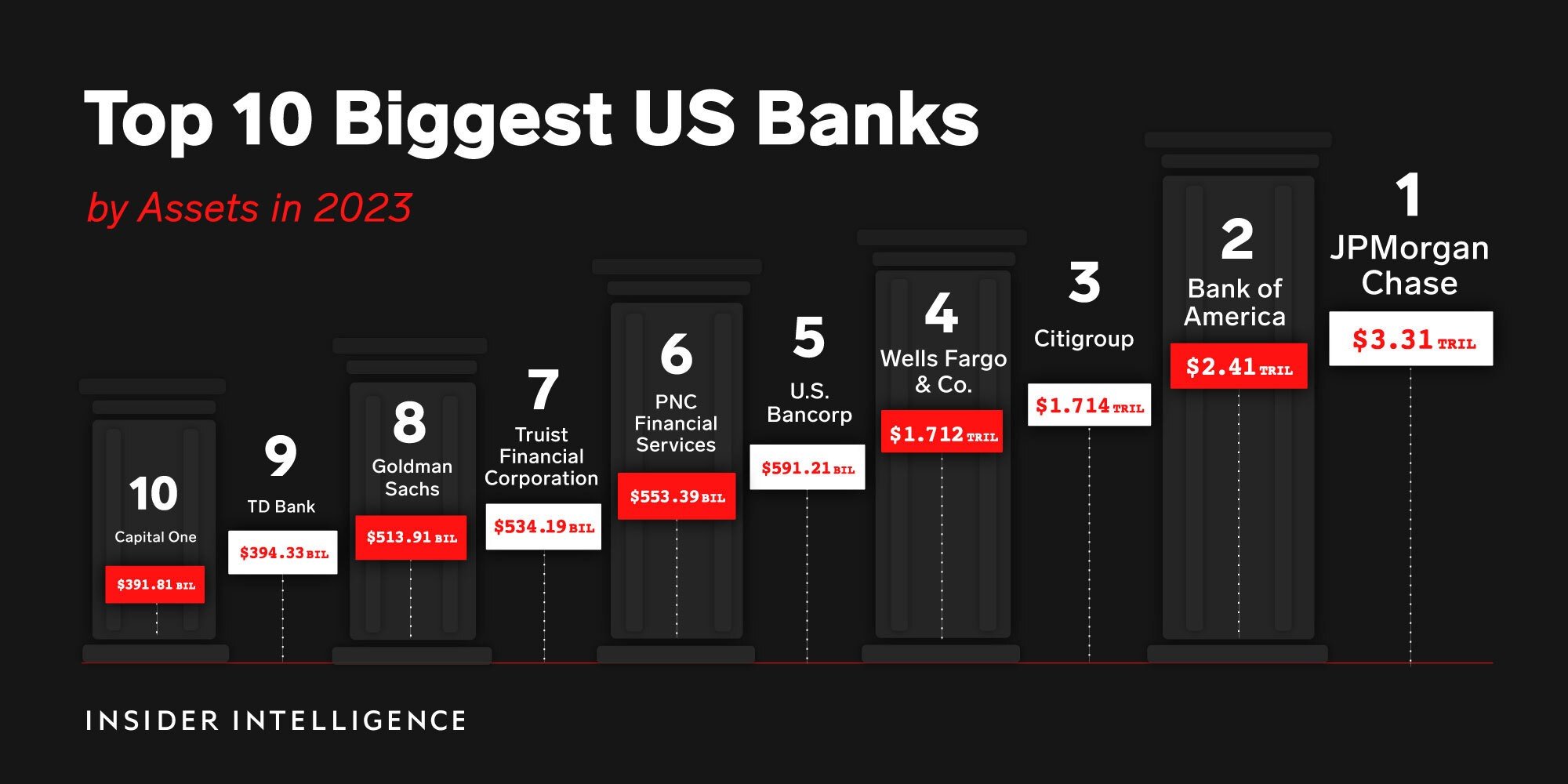

- Out of the 4,150 U.S. banks, the top ten hold more than 54% of FDIC-insured deposits. The four largest banks in the country have amassed a whopping $211.5 billion in unrealized losses, with Bank of America bearing the brunt of a third of that amount.

- The Federal Deposit Insurance Corporation (FDIC) provided JPMorgan Chase a $50 billion credit line and noted it lost $13 billion from the First Republic Bank fallout. The FDIC estimated the cost of Signature Bank’s failure to its Deposit Insurance Fund to be around $2.5 billion and the Silicon Valley Bank collapse cost the FDIC $20 billion, bringing the total to $35.5 billion.

- In addition to the recent First Republic Bank collapse,…

Click Here to Read the Full Original Article at Bitcoin News…