It was hard not to take notice of the “uptober” crypto rally. Bellwether BTC was up over 35% since October, and assets such as LINK and SOL are up two or three times that much.

Less explored, though, are the liquidity trends underpinning this price action. Observing these can help us gauge where we are in the cycle and thus navigate what the future market might hold.

This post is part of Consensus Magazine’s Trading Week, presented by CME.

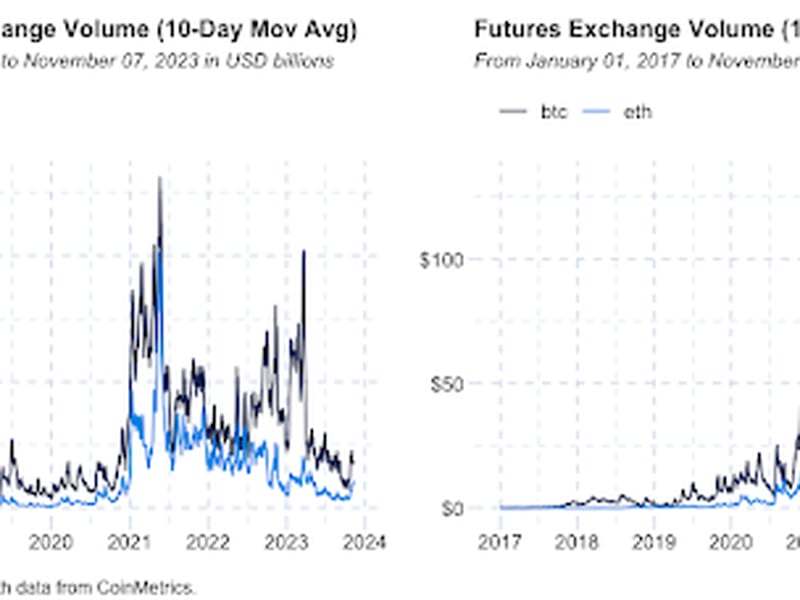

As we highlighted for CoinDesk earlier in the year, price changes with low trading volumes are less reliable indicators than those with higher volumes. Low volumes suggest limited market participation at a particular price level, potentially leading to greater price volatility and reduced market depth.

Conversely, higher trading volumes signify broader market participation, indicating a stronger consensus and offering a more dependable basis for price movements, thereby bolstering the credibility of the signal.

Trade volume recovery in BTC and ETH, the most watched liquidity metric, is eye-catching. Two of the top-15 trading volume days since the market top two years ago were recorded during this recent rally. And most of the other high-volume days happened as dramatic company failures were taking place in 2022, or as several mid-sized U.S. banks got into difficulty in March 2023. BTC Spot volumes, which until September were breaking three-year lows, have steeply recovered and are now approaching six-month highs.

But this is not the whole story. Digging deeper into liquidity trends can provide us further insight.

Strong action in derivatives, especially CME

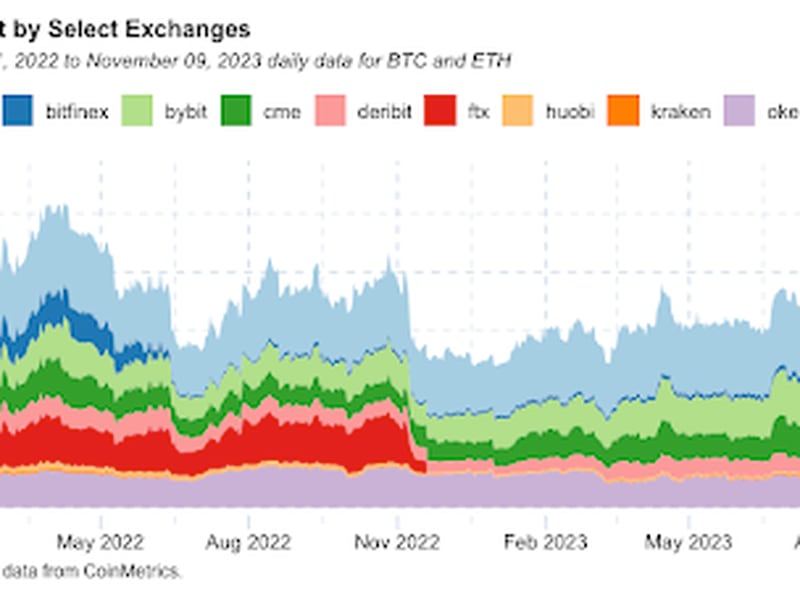

Futures open interest (OI) in BTC and ETH just crossed the $20 billion mark for the first time since the FTX meltdown in November 2022, led by BTC on the back of excitement around the highly anticipated U.S. spot ETF launch.

Notably, but perhaps not surprisingly, this increase is led by institutional capital. The CME, a favorite venue for large traditional finance companies to get crypto exposure, gained the most market share across all venues and is close to overtaking Binance as the leading BTC futures exchange by OI.

A similar trend can also be seen on options.

Open interest in BTC options just crossed $16 billion, and volumes are now at all-time highs. Much of this action is translated to spot…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…