One year after its historic transition to proof of stake, Ethereum has seen a massive reduction in energy use and a marked improvement in access to the network, however, a number of technical issues still mark the road ahead.

The Merge was executed on Sept. 15, 2022 — an event that saw the Ethereum mainnet merging with a separate proof-of-stake blockchain called the Beacon Chain.

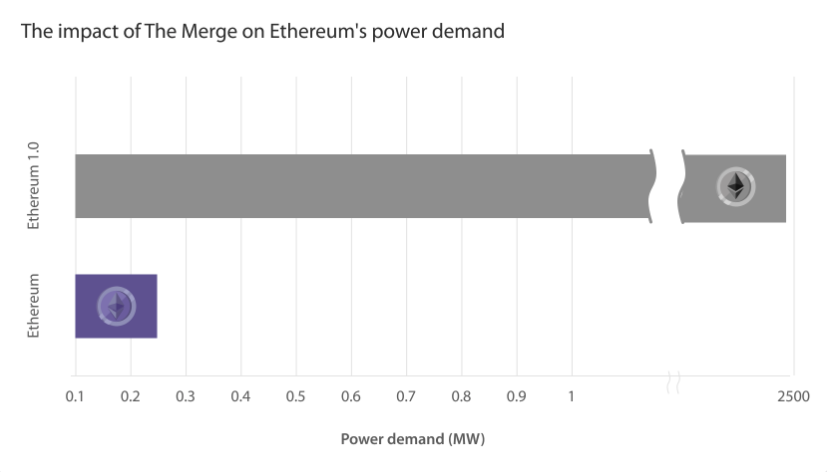

The most noticeable improvement to Ethereum post-merge was the seismic shift from an energy-guzzling proof-of-work (PoW) consensus mechanism to PoS, which saw the Ethereum network drastically reduce its total power consumption.

According to data from The Cambridge Centre for Alternative Finance, the Ethereum network has seen its energy use drop more than 99.9% from the approximately 21 terawatt hours of electricity it used while running under PoW.

Ethereum turns deflationary

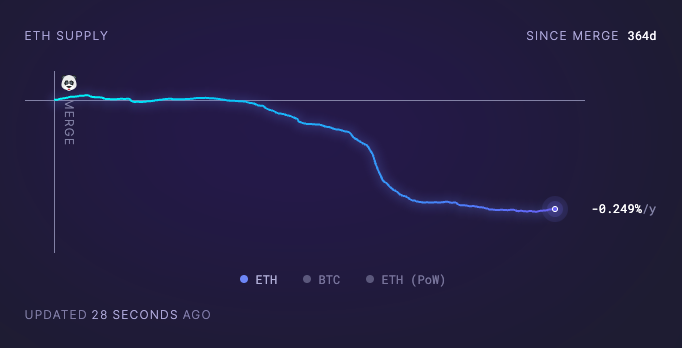

Outside of using less power, The Merge also saw the Ethereum network become economically deflationary, meaning that the number of new Ether (ETH) issued to secure the network has been outpaced by the amount of ETH removed from supply forever.

According to data from the Ethereum data provider ultrasound.money, a little more than 300,000 ETH (worth $488 million at current prices) has been burned since The Merge. At current burn rates, the total supply of ETH is being reduced at a rate of 0.25% per year.

While many proponents believed that the price of Ethereum would surge in response to this new deflationary pressure, the hopes of a dramatic increase in the price of ETH were buffeted by a series of macroeconomics headwinds such as the banking crisis and spiking inflation.

Notably, the growth of ETH paled in comparison to the growth in the price of Bitcoin (BTC) in the first quarter of this year, with the flagship crypto asset seeming to benefit from much of the traditional financial instability brought about by the banking crisis.

Price action aside, the central theme of the proof-of-stake upgrade was the introduction of stakers in place of miners to secure the network.

The subsequent Shapella upgrade in April 2023 drove ETH in huge droves towards staking. The top beneficiaries of this shift were the liquid staking providers such as Lido and Rocket Pool.

Liquid staking takes over

Since the Merge, liquid staking providers have come to dominate the Ethereum landscape, with…

Click Here to Read the Full Original Article at Cointelegraph.com News…