The total value of assets locked (TVL) in liquid staking projects has continued to climb despite the overwhelming bearish sentiments present in the market.

DeFillama’s data reveals an impressive surge in the category’s TVL, which has reached almost $20 billion in the past year. Notably, this growth has outpaced other sectors in decentralized finance, including lending and decentralized exchanges, during the same timeframe.

Liquid staking protocols, such as Lido (LDO), Frax Ether (FXS), and Rocket Pool (RPL), offer users the unique opportunity to earn staking rewards while retaining liquidity for other crypto activities. The sector’s growth is largely due to the Ethereum (ETH) Shanghai upgrade, which allowed stakers to withdraw their staked ETH easily.

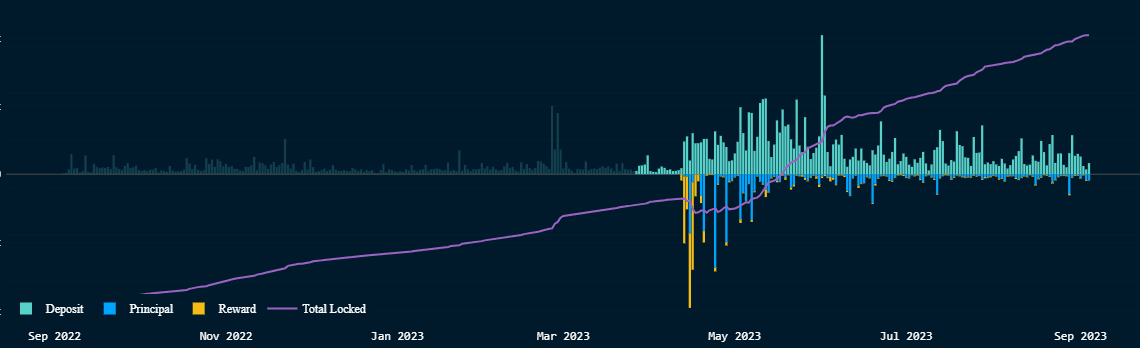

This upgrade reignited enthusiasm within the crypto community for these protocols. For context, Nansen’s Ethereum Shanghai dashboard shows a trend of ETH staking deposits outpacing withdrawals since the process began. These deposits are concentrated on liquid staking platforms, with Lido dominating.

Furthermore, the recent regulatory actions in the United States targeting centralized staking service providers like Kraken have provided liquid staking protocols with a distinct advantage over their centralized counterparts.

Lido remains dominant

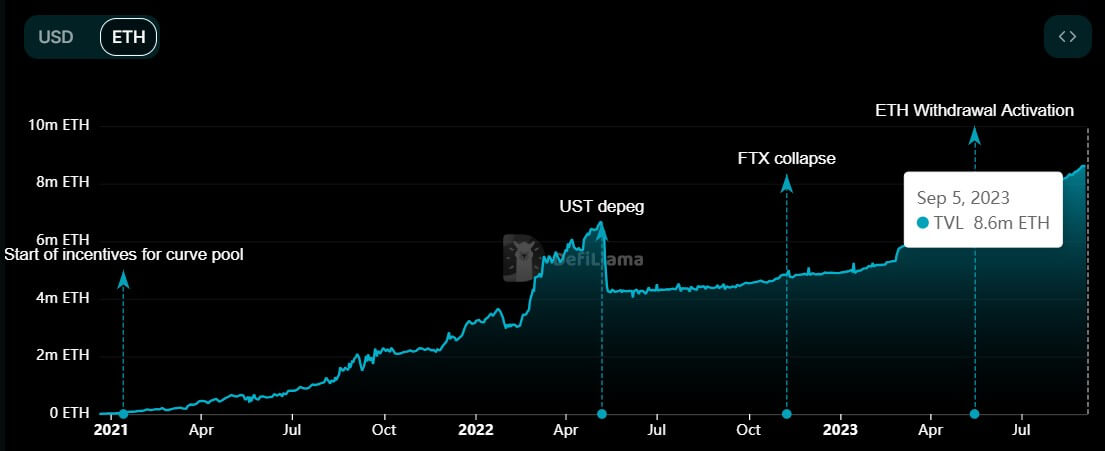

Lido stands out as a prime example of the dynamic growth in liquid staking. In April 2022, the protocol’s TVL peaked at $20.32 billion, according to DeFillama data. However, it faced a setback following Terra’s UST depeg, plummeting to $4.51 billion.

This decline was largely influenced by the sharp drop in ETH prices during that period. Concurrently, Lido’s Ether TVL declined from 6.59 million to 4.27 million.

Subsequently, Lido has experienced a resurgence in its Ether TVL, soaring to an all-time high of 8.63 million.

Nevertheless, this remarkable growth in ETH TVL has yet to translate into an…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…