On August 16, Bitcoin (BTC) closed below $29,000 for the first time in 56 days. Analysts quickly pointed to this week’s FOMC minutes, which expressed concerns about inflation and the need to increase interest rates, as the likely cause.

Despite the immediate reasons for the drop, the upcoming $580 million Bitcoin options expiry on Friday has favored the bears. They could potentially make a $140 million profit on August 18, adding to the downward pressure on Bitcoin and complicating BTC’s search for a bottom.

Federal Reserve minutes did not impact traditional markets

On Aug. 16, Federal Reserve Chair Jerome Powell emphasized the 2% inflation target. This pushed the U.S. 10-year Treasury yields to their highest level since October 2007, prompting investors to shift away from riskier assets like cryptocurrencies to favor cash positions and companies that are well prepared for such a scenario.

Notably, Bitcoin had already fallen to $29,000, its lowest point in 9 days, prior to the release of the Fed minutes. The impact of the minutes was limited, especially considering the 10-year yield had been rising, indicating skepticism about the Fed’s ability to control inflation.

Additionally, on August 17, S&P 500 index futures only dropped by 0.6% compared to their pre-event level on August 16. During the same time, WTI crude oil gained 1.7%, while gold traded down 0.3%.

Concerns about China’s economy might have also contributed to the decline. The country reported lower-than-expected retail sales growth and fixed asset investment, potentially affecting the demand for cryptocurrencies.

Although the exact causes of the price drop remain uncertain, there’s a possibility that Bitcoin could reverse its trend after the weekly options expiry on August 18.

Bitcoin bulls cast the wrong bet

Between August 8 and August 9, the price of Bitcoin briefly crossed the $29,700 mark, sparking optimism among traders using options contracts.

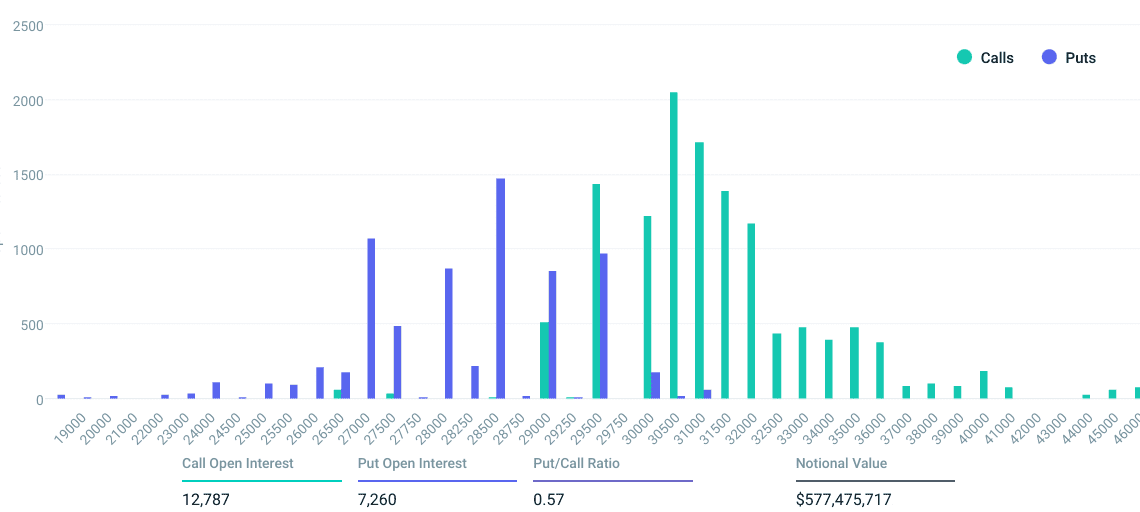

Deribit Bitcoin options aggregate open interest for Aug. 18. Source: Deribit

The 0.57 put-to-call ratio reflects the difference in open interest between the $365 million call (buy) options and the $205 million put (sell) options. However, the outcome will be lower than the $570 million total open interest since the bulls were caught by surprise with the latest price drop below $29,000.

For example, if Bitcoin’s price trades at $28,400 at 8:00 am UTC on Aug. 18, only $3 million worth of call options will be accounted for. This distinction arises from…

Click Here to Read the Full Original Article at Cointelegraph.com News…