The connection between Bitcoin and gold goes back to Bitcoin’s origin. While it is not mentioned in the Bitcoin white paper, Satoshi Nakamoto actually referred to gold’s rarity in a Bitcointalk forum post when introducing the first version of Bitcoin (BTC) in 2009. This was to emphasize the importance of a limited supply of 21 million coins.

Bitcoin’s market value is frequently matched up against gold, which boasts a total worth of $12.8 trillion, and many crypto pundits often point to the approval of a gold exchange-traded fund (ETF) in 2004 as the catalyst for the asset’s price appreciation.

Currently, Bitcoin encounters resistance at the $30,000 mark, and its inability to surpass this level could lie in how institutional investors perceive the comparison of BTC and gold as stores of value.

Bitcoin’s present market cap of $570 billion outshines traditional giants like Visa, Taiwan Semiconductor and JPMorgan Chase. However, it’s still 55% behind silver and significantly trails the world’s foremost tradable asset, gold.

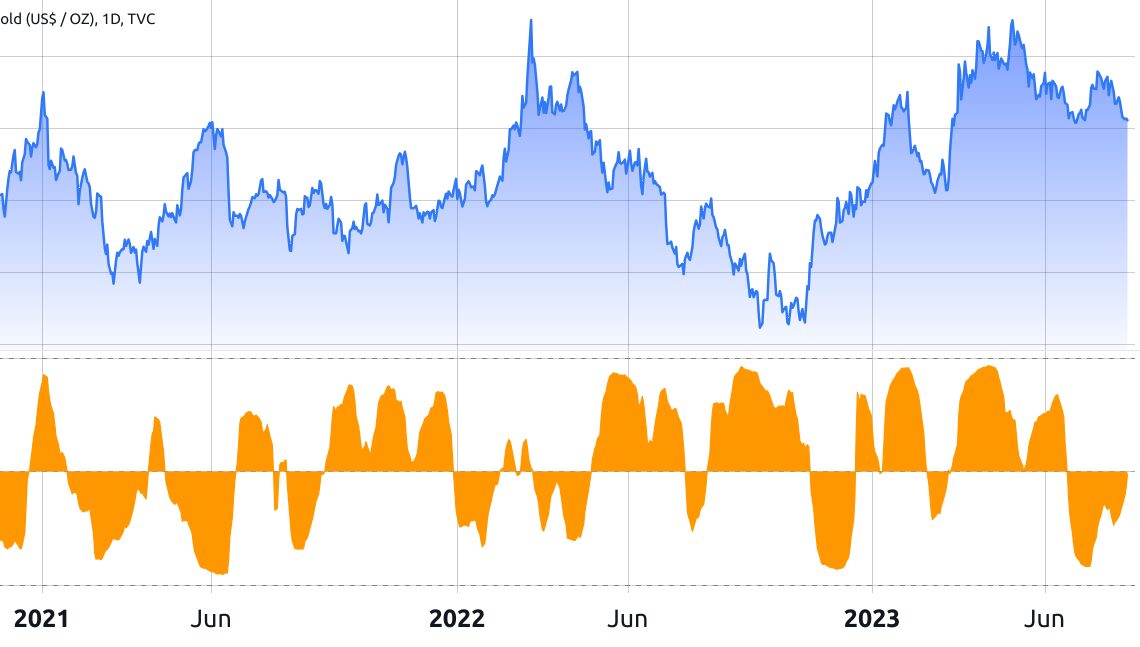

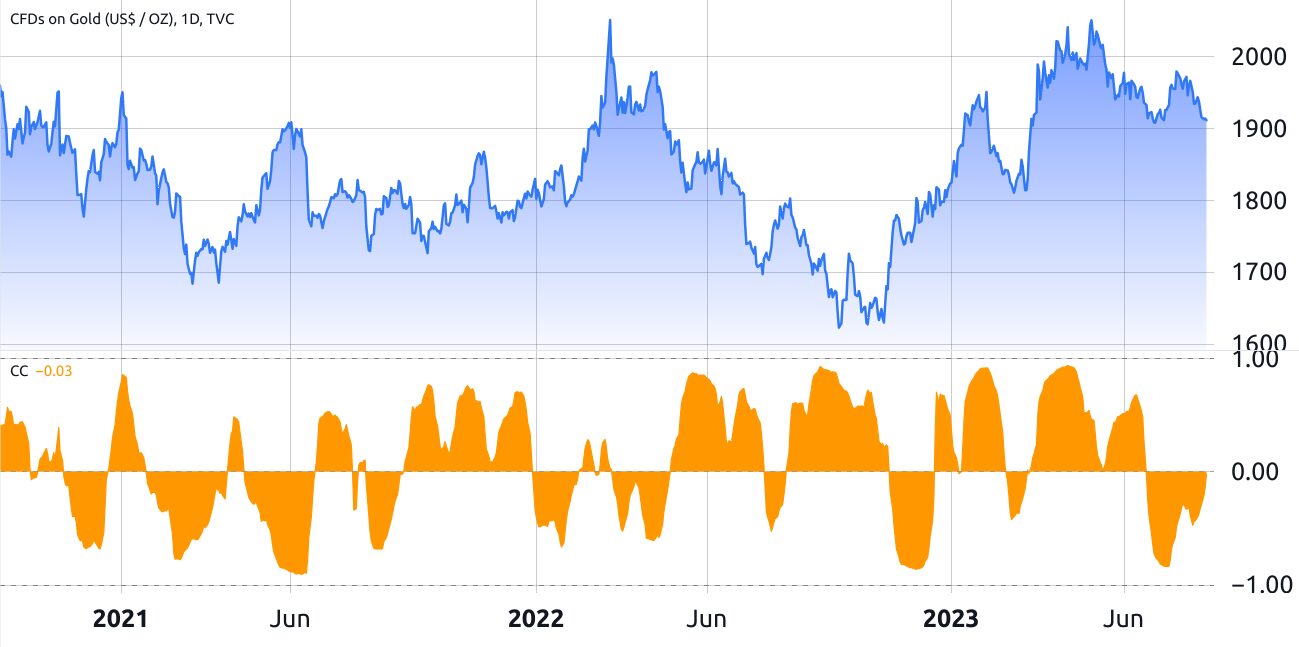

This raises a crucial question: How closely are the prices of these two assets linked? In simpler terms, do their prices actually have a noticeable connection?

The explanation becomes clear when considering Bitcoin’s heightened volatility. For example, the 30-day correlation indicator can shift from positive to negative within a matter of weeks. This lack of consistent price connection can be attributed to Bitcoin’s relatively modest adoption and the uncertainty that investors still grapple with concerning its potential and practical applications.

Investors and analysts continue to debate whether Bitcoin’s decentralized nature and limited supply validate its role as a financial reserve, while others counter that its price instability hinders its viability as a medium of exchange. Nonetheless, there’s no barrier to evaluating Bitcoin’s market cap alongside major global stocks and other commodities.

Examining Bitcoin’s market cap in comparison to gold unveils an interesting trend, highlighting resistance levels at 10% and 4.5%, which could potentially explain the $30,000 resistance.

Bitcoin investment products vs. gold ETF

According to CryptoCompare, investment vehicles linked to Bitcoin amassed a total of $24 billion in July. This encompasses products like…

Click Here to Read the Full Original Article at Cointelegraph.com News…