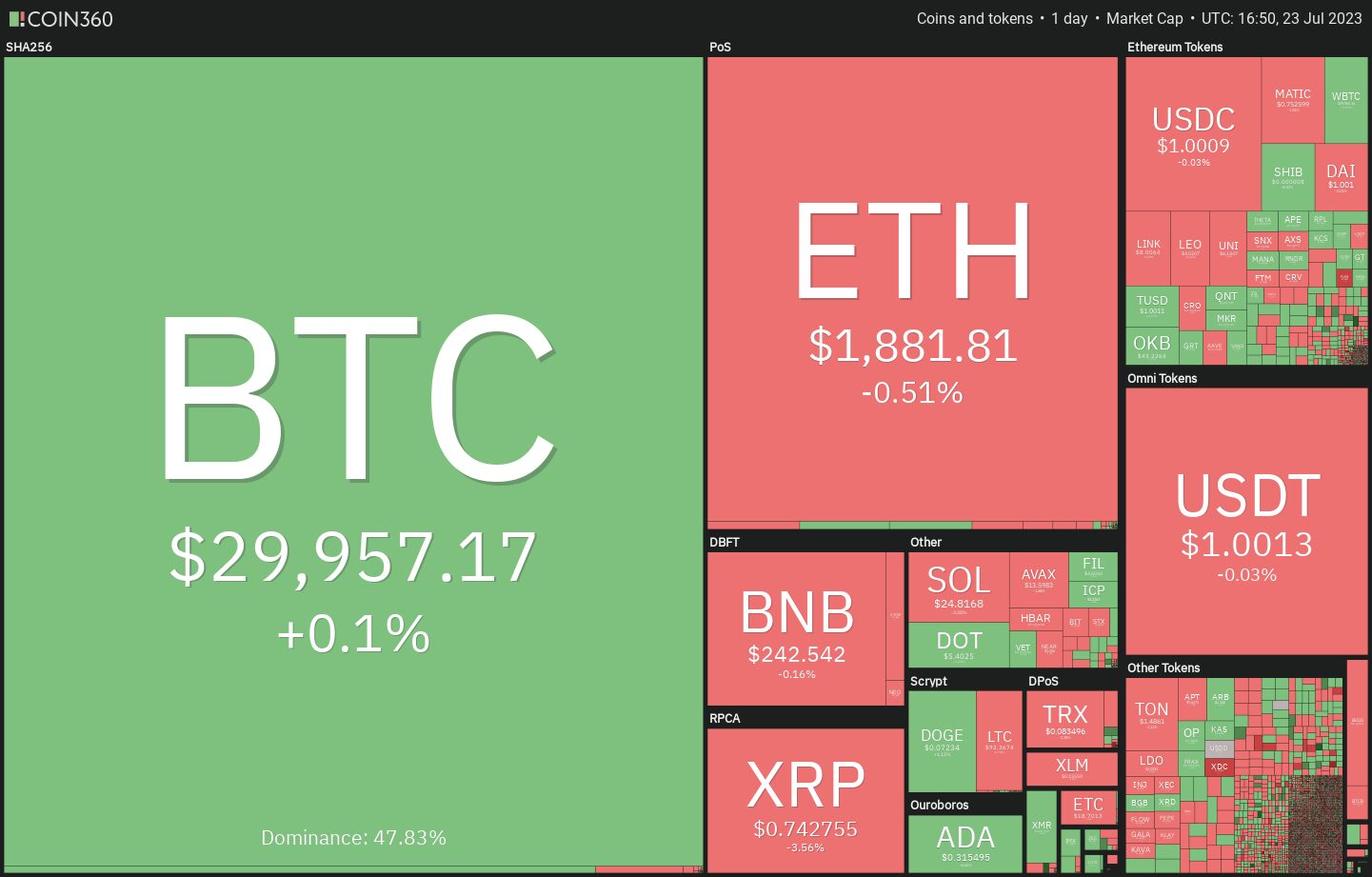

Bitcoin (BTC) is struggling to rise above the overhead resistance at $31,000 but a minor positive is that the bulls have not allowed the price to dive below the $29,500 support. This suggests that a catalyst may be needed for the price to break out from its range.

On the macroeconomic front, the Federal Reserve’s meeting on July 25 and 26 is an important event to keep an eye on. The FedWatch Tool shows a 99.2% probability of a 25 basis point rate hike in the meeting. If that happens, the markets may not witness a knee-jerk reaction as the hike seems to have been priced in. However, any surprise move by the Fed could thrust the price out of the range.

Several analysts expect the range to break soon but there is no consensus on the direction of the breakout. If the price breaks below the range, analysts expect a significant downside. Some are even projecting a fall closer to $20,000.

If Bitcoin moves higher, select altcoins could attract buyers. Let’s study the charts of top-5 cryptocurrencies that could turn positive over the next few days.

Bitcoin price analysis

Bitcoin remains pinned below the 20-day exponential moving average ($30,036) for the past few days but a positive sign is that the bears have not been able to sink the price to the 50-day simple moving average ($28,979).

This suggests that the bulls have not given up and they are buying on every minor dip. The repeated failure of the bears to pull the BTC/USDT pair lower may attract buyers.

If the price breaks above the 20-day EMA, the pair could rally toward the overhead resistance of $31,000. A charge above the $31,000 to $32,400 zone could clear the path for a possible rally to $40,000.

On the other hand, if the price turns down and dives below the 50-day SMA, it will suggest that bears are making a comeback. The pair may then slump toward the support at $24,800.

The moving averages on the 4-hour chart are flattening out and the relative strength index (RSI) has risen to the midpoint, indicating that the range-bound action may continue for some more time.

If bulls push the price above the 50-SMA, the pair could attempt a rally to $30,500 and then to $31,000. The important support to watch on the downside is $29,500. If this level crumbles, the pair may decline to $27,500.

Chainlink price analysis

Chainlink (LINK) has been trading inside a large range between $5.50 and…

Click Here to Read the Full Original Article at Cointelegraph.com News…