What is peer-to-peer (P2P) lending?

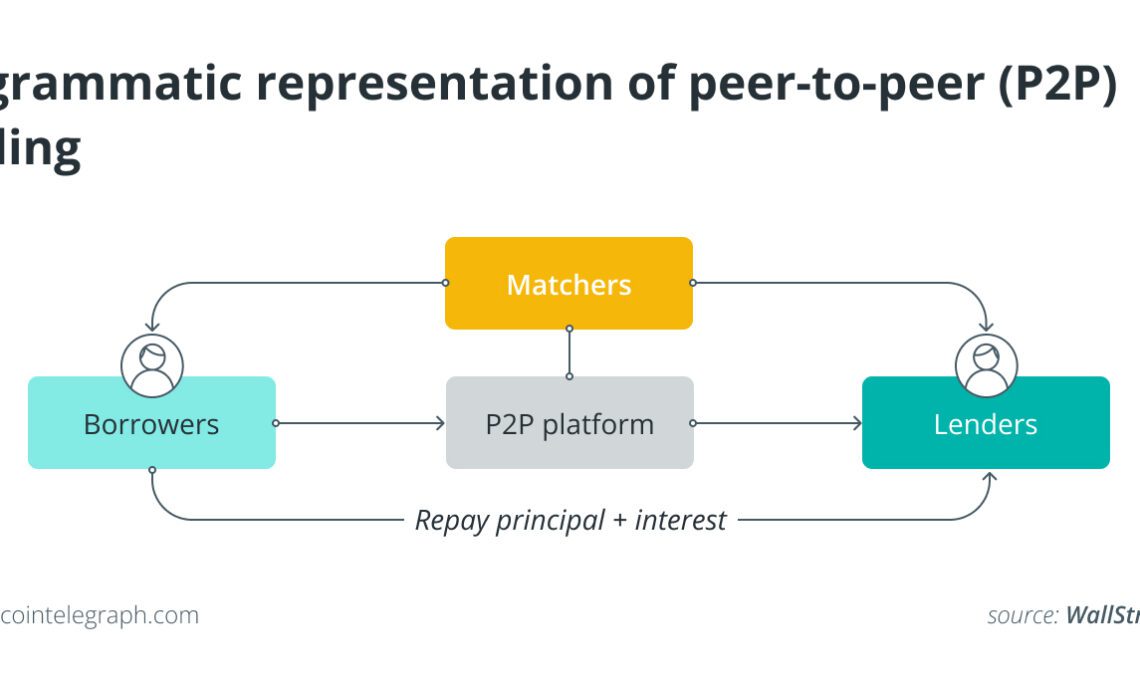

Peer-to-peer (P2P) lending, also referred to as marketplace lending, is a type of lending that uses online platforms to link lenders and borrowers directly, eliminating the use of conventional financial intermediaries, such as banks.

In P2P lending, individuals or businesses seeking loans can request funding by creating loan listings on a P2P platform. Individual investors or institutional lenders, on the other hand, can analyze these listings and decide to fund them based on their level of risk tolerance and expected rate of return.

P2P lending platforms serve as intermediaries, enabling the loan application, credit evaluation and loan servicing processes. They leverage technology to improve the user experience and pair lenders and borrowers. The loans may be used for a variety of things, including debt consolidation, small company loans, school loans and personal loans.

P2P lending platforms function within the legal restrictions imposed by the country in which they are based. Platforms must abide by all applicable laws, particularly those relating to borrower and investor protection, which differ depending on the country’s regulations.

Examples of P2P lending platforms

LendingClub is one of the largest P2P lending platforms in the United States. It offers personal loans, business loans and auto refinancing options. Zopa is another prominent P2P lending platform in the United Kingdom. It offers personal loans and investments, connecting borrowers and investors directly.

Aave is a decentralized P2P lending platform on the Ethereum blockchain that enables users to lend and borrow cryptocurrencies at interest rates that are based on supply and demand dynamics. It provides a wide range of features, including incentives for liquidity mining, flash loans and collateralized borrowing.

How does P2P lending work?

Let’s understand the P2P lending process using an example. Say Bob wants to borrow $10,000 to consolidate his debt. On a P2P lending platform, he submits a loan application and includes his financial details and loan justification. After evaluating John’s creditworthiness, the platform lists his loan.

A platform user named Alice reads John’s loan listing and decides to fund $1,000 of the loan because she thinks it fits with her investment philosophy. As additional lenders follow suit, Bob receives the $10,000 when the loan has been fully funded. The P2P lending network disperses Bob’s monthly repayments, which…

Click Here to Read the Full Original Article at Cointelegraph.com News…