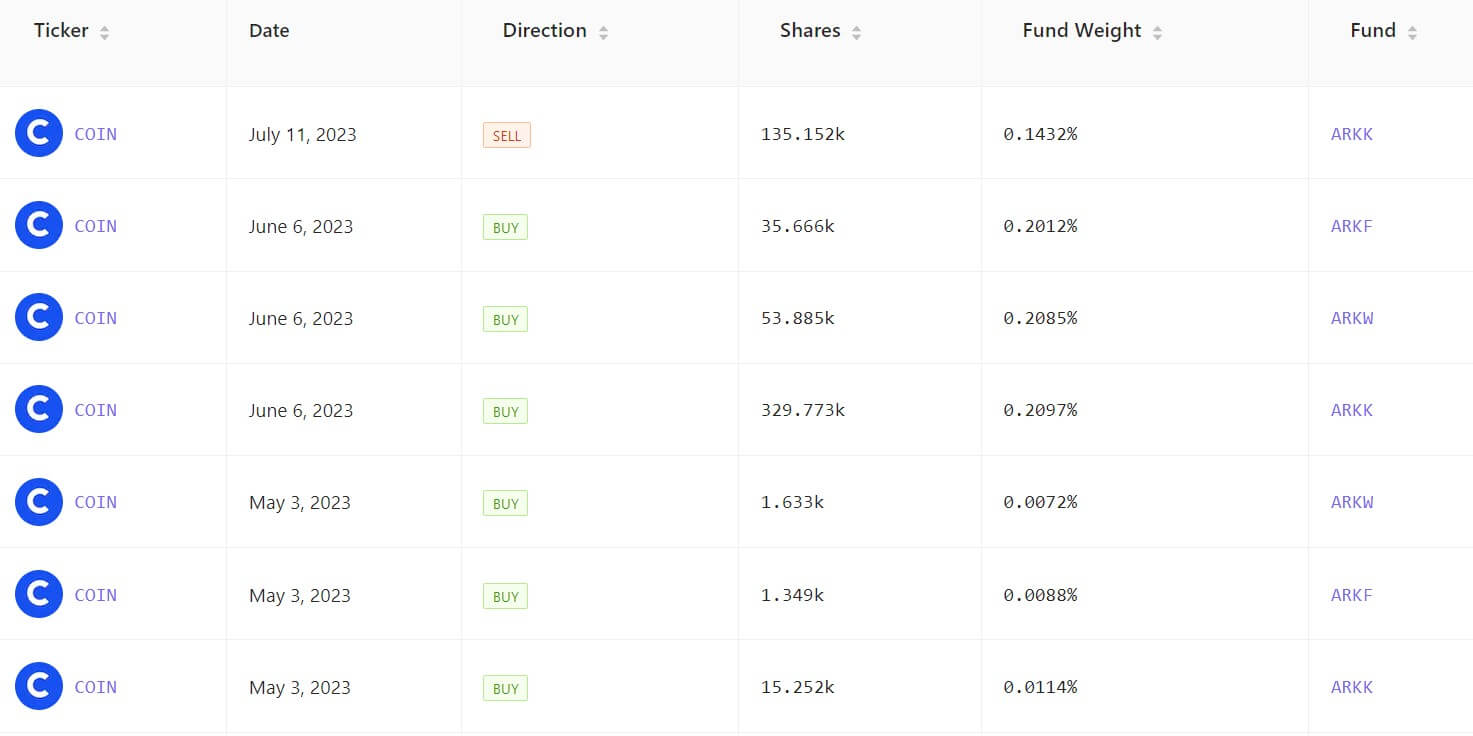

Ark Invest Management sold 135,152 Coinbase shares for $12 million on July 11, according to data from Cathiesark.

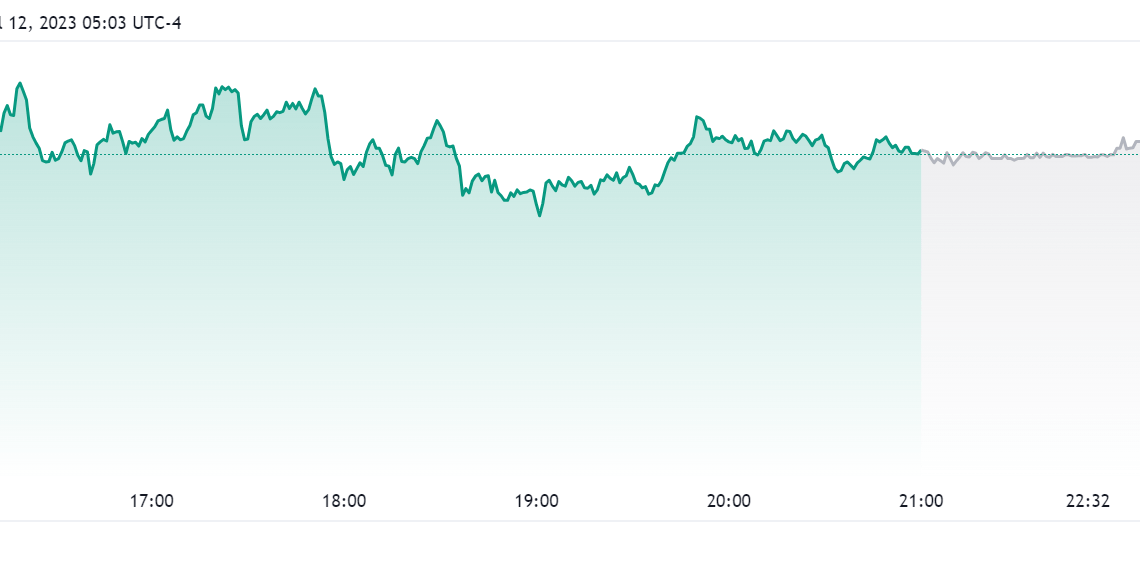

On July 11, COIN rallied to a one-year high of $90, continuing its mostly positive price performance of a recent while. During the last 30 days, Coinbase stock has outperformed Bitcoin’s (BTC) price, increasing by over 60%, while BTC gained less than 20% during the same period.

Coinbase role in Bitcoin ETF applications

With several traditional financial institutions applying for a Bitcoin exchange-traded fund (ETF), most have chosen the exchange as a partner for their surveillance-sharing agreement.

The U.S. Securities and Exchange Commission (SEC) returned the applications filed in June over a lack of clarity and comprehensiveness. The regulator stated that the proposals did not identify or detail the spot Bitcoin exchange that would provide a surveillance-sharing agreement, forcing most applicants to refile and name Coinbase as their partner.

Despite the SEC lawsuit, market observers have argued that these partnerships underscore Coinbase’s legitimacy as a U.S. financial institution.

Cathie Wood bullish on Coinbase

Since the beginning of the year, Cathie Wood has maintained a bullish stance on Coinbase stocks despite the regulatory uncertainty surrounding the exchange.

Wood stated that the SEC action against Binance could indirectly benefit Coinbase, as, unlike Binance, Coinbase is not accused of any criminal activity.

In a sign of her conviction, Wood’s investment fund acquired over 400,000 Coinbase shares following the regulatory scrutiny. According to Cathiesark data, Ark Invest is one of the largest shareholders of the exchange, holding over 11 million COIN stocks across all funds.

The post Cathie Wood’s Ark Invest unloads $12M Coinbase shares as COIN rallies to one-year high appeared first on CryptoSlate.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…