The price of Bitcoin (BTC) has been trading between $29,900 and $31,160 for the past 18 days, causing concern among investors who are looking for explanations for the lack of a clear trend.

After a 25.5% rally between June 15 and June 23 leading to Bitcoin’s highest level in 13 months one would expect investors to become more active and optimistic, but the lack of BTC’s ability to sustain prices above $31,000 and neutral on-chain and derivatives data do not corroborate this thesis.

Bitcoin ETF expectations faced a harsh regulatory environment

The current price situation is particularly worrisome because of the expectations that arose after BlackRock, the world’s largest fund manager, applied for a spot Bitcoin ETF on June 16. Some analysts have predicted a Bitcoin price of $100,000 by the end of the year, adding to the frustration of traders who are betting on further gains.

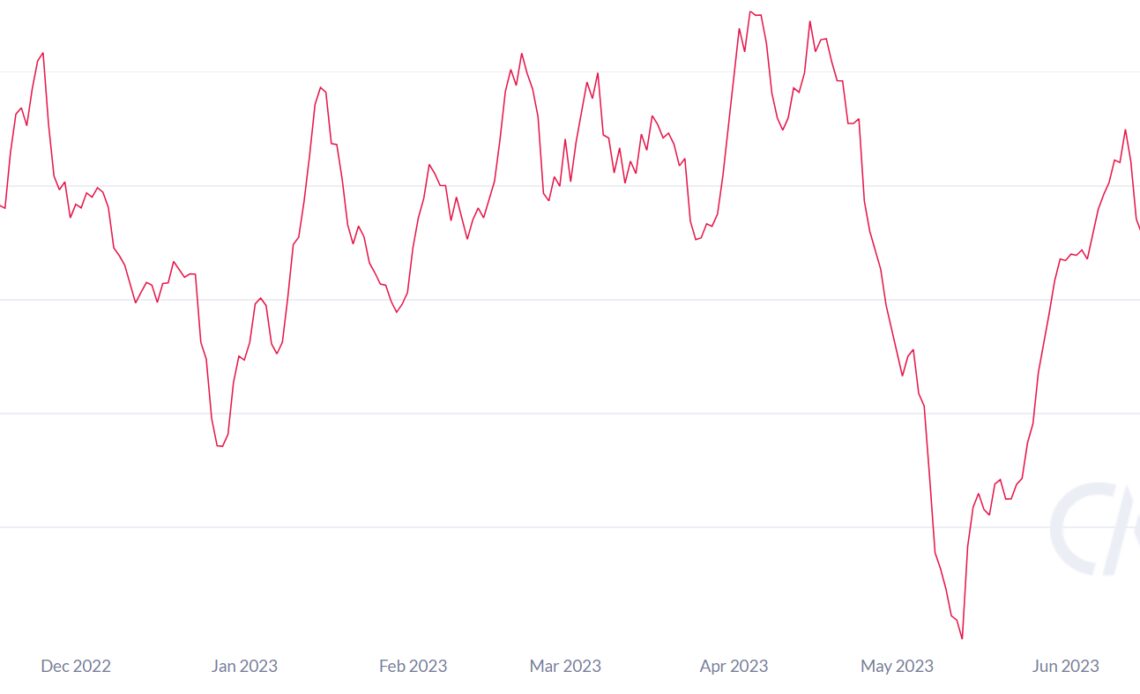

It’s worth noting that in mid-April, investors experienced a consolidation of prices around $30,000, but it didn’t last longer than a week, and the price eventually dropped to $28,000. This movement explains why investors are hesitant to build positions at the current price levels and prefer range trading.

Despite the initial excitement about the possibility of the U.S. Securities and Exchange Commission (SEC) approving a Bitcoin instrument for traditional finance markets, there’s negative price pressure due to the regulatory actions against leading exchanges like Coinbase and Binance.

This combination of positive triggers and a stricter regulatory environment is likely the main cause of Bitcoin’s recent price movement, and analyzing blockchain data could provide insights into the network’s use.

Bitcoin on-chain activity does not show a significant improvement in activity

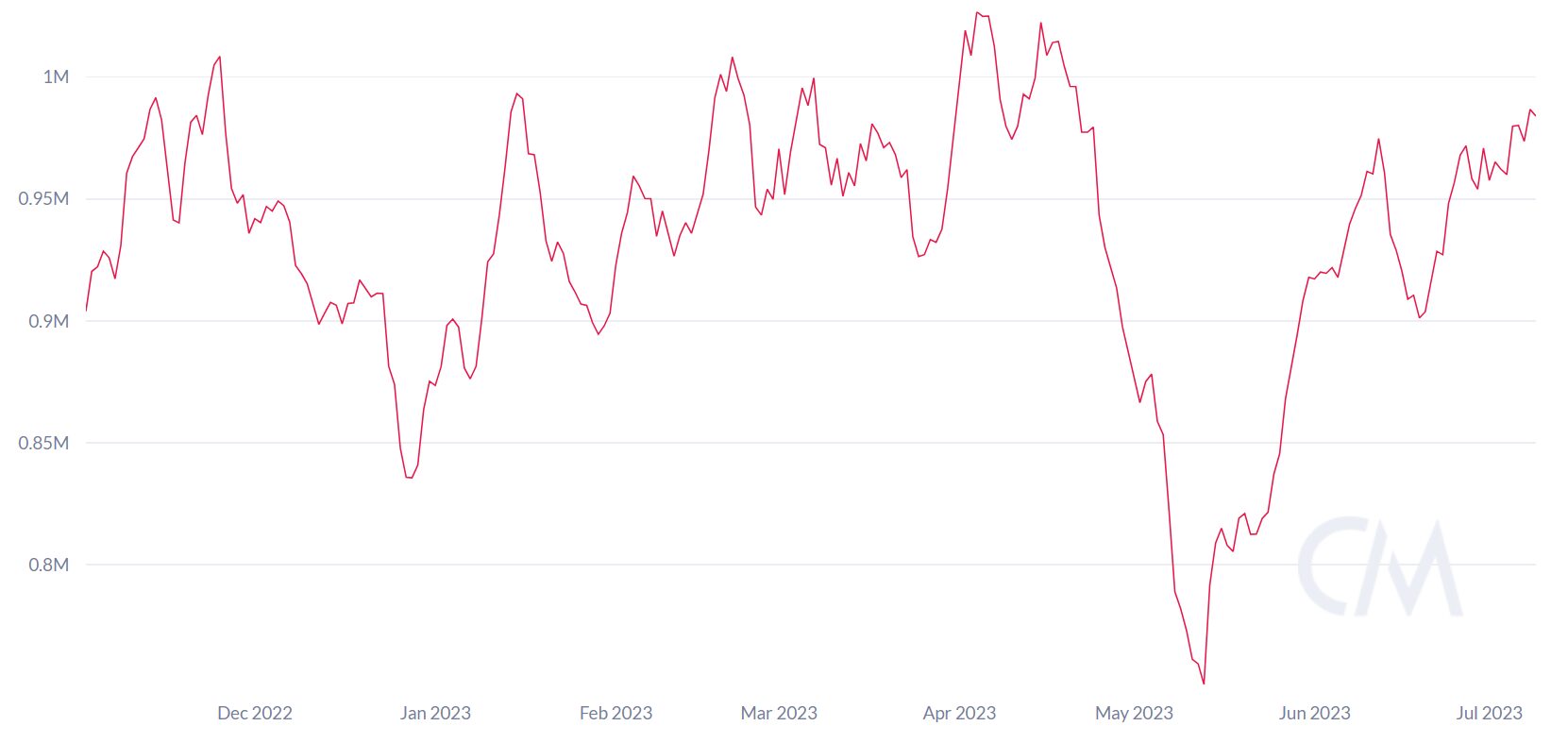

When it comes to blockchain-based analysis, network activity should be the starting point. This analysis should entail looking beyond just trading and exchange flows. Cryptocurrencies were designed to facilitate free transactions and the registration of digital assets, so the number of active users is crucial.

Bitcoin’s 7-day active addresses have failed to exceed 1 million, only reaching the same levels as three months ago. Moreover, the peak of 1.02 million addresses in April 2023 was 16% lower than the all-time high in January 2021. Therefore, on-chain data indicates a stagnation in the number of active users on the Bitcoin network, using addresses as a…

Click Here to Read the Full Original Article at Cointelegraph.com News…