While the cryptocurrency community is actively discussing the upcoming Bitcoin (BTC) halving in 2024, there is potentially another big market event happening this year.

The trustee of the hacked Bitcoin exchange Mt. Gox is set to finally repay the exchange’s creditors by the end of October 2023. If that happens, the cryptocurrency market could be significantly affected in several ways, some industry observers agree.

Founded in 2010, Mt. Gox was once the biggest Bitcoin exchange in the world, estimated to facilitate around 70% of all BTC transactions before its implosion.

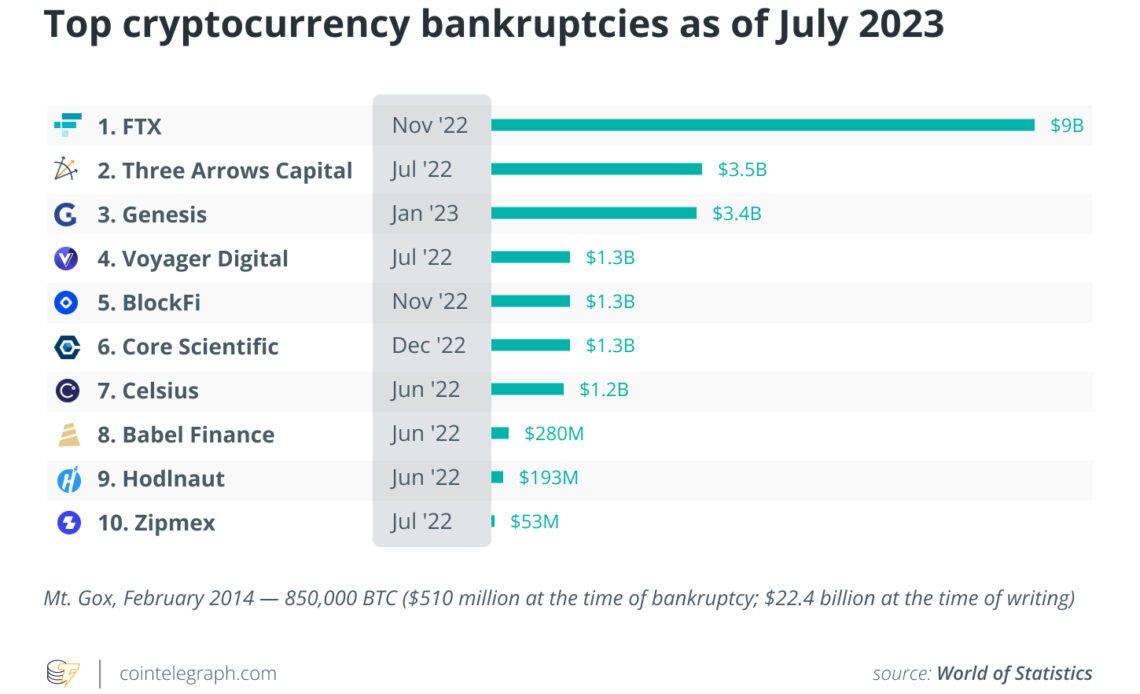

The now-defunct exchange lost 850,000 BTC — or 4% of all Bitcoin to ever be issued — in a security breach in 2014. The event made Mt. Gox one of the biggest cryptocurrency bankruptcies of all time, with creditors yet to be repaid, nine years later.

As the current Mt. Gox repayment deadline is scheduled to occur in roughly three months, Cointelegraph has reached out to some crypto executives to find out what to expect from the anticipated Mt. Gox repayment.

What will the investors do once they get their Bitcoin back?

The repayment of Mt. Gox will be a unique event, which is certain to have a significant impact on the market, WhaleWire founder and CEO Jacob King believes.

After losing all their Bitcoin almost 10 years ago, the majority of creditors are likely to sell at least a part of their BTC once they finally get it back, King told Cointelegraph.

“This influx of sell orders could create a downward pressure on prices and potentially lead to a market downturn,” he said. King also mentioned multiple prolonged delays in the Mt. Gox repayment process, which has already caused a sense of “disillusionment among investors, eroding their confidence in the market.”

The WhaleWire CEO continued:

“It’s a simple question of, what will the investors do? Over the last year, we’ve seen more sells than buys, and many of those who lost on Mt. Gox have moved on past crypto. The chances they hold for more years, after everything that happened, is highly unlikely.”

“We are sure some will be glad to be able to finally cash out, but we doubt it will cause a massive sell off,” he stated. When asked whether the crypto industry has ever seen a similar event, Weert said that there hasn’t ever been an event on such a scale so far.

Some of the Mt. Gox creditors themselves admit that the Bitcoin market may face some selling pressure once the repayment is done. However, many claimants are likely to…

Click Here to Read the Full Original Article at Cointelegraph.com News…