A combination of escalating interest rates and a tight regulatory environment in the United States has driven a $417 million outflow from the crypto industry in the past eight weeks, with halts in trading for many altcoins draining liquidity and prolonging the ongoing crypto winter.

This environment is forcing crypto companies to rethink and adapt their business strategies.

Crypto exchange Binance, for instance, is moving forward with efforts to diversify its sources of revenue amid legal challenges with regulators. The company is launching a new subscription-based cloud mining product dedicated to Bitcoin (BTC), allowing users without equipment to purchase Bitcoin hash rates via Binance’s cloud mining service.

Also taking a new direction is venture capital firm Andreessen Horowitz (a16z), opening its first office outside the U.S. in London, United Kingdom. Chris Dixon, a16z’s managing partner, cited a “predictable business environment” as one of the main factors behind the decision. U.K. Prime Minister Rishi Sunak attributed the expansion to having the “right regulation and guardrails” to “foster innovation” while protecting consumers.

According to the Sovereign Wealth Fund Institute, a16z is the largest venture capital firm in the world, with $35.8 billion in assets under management. With this move, the company joins many other crypto businesses setting up operations in more friendly regulatory environments outside the United States.

This week’s Crypto Biz looks at crypto markets outflows, a16z’s first branch outside the U.S., the ongoing silent ban on altcoins, and the AI models to be first deployed in the United Kingdom.

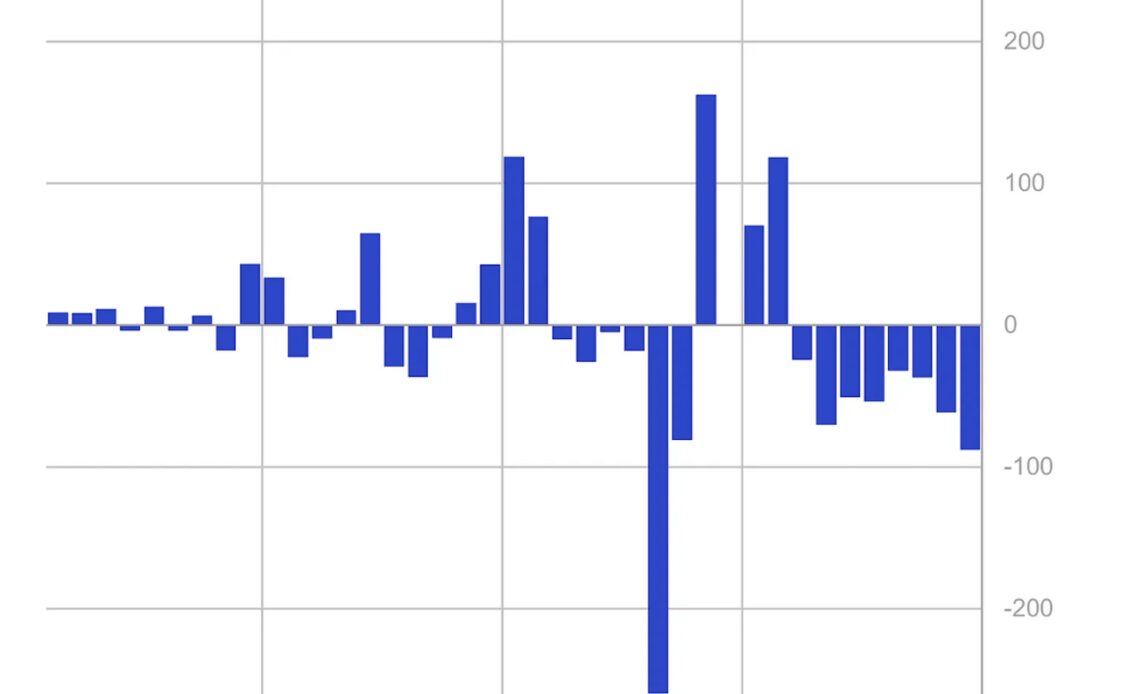

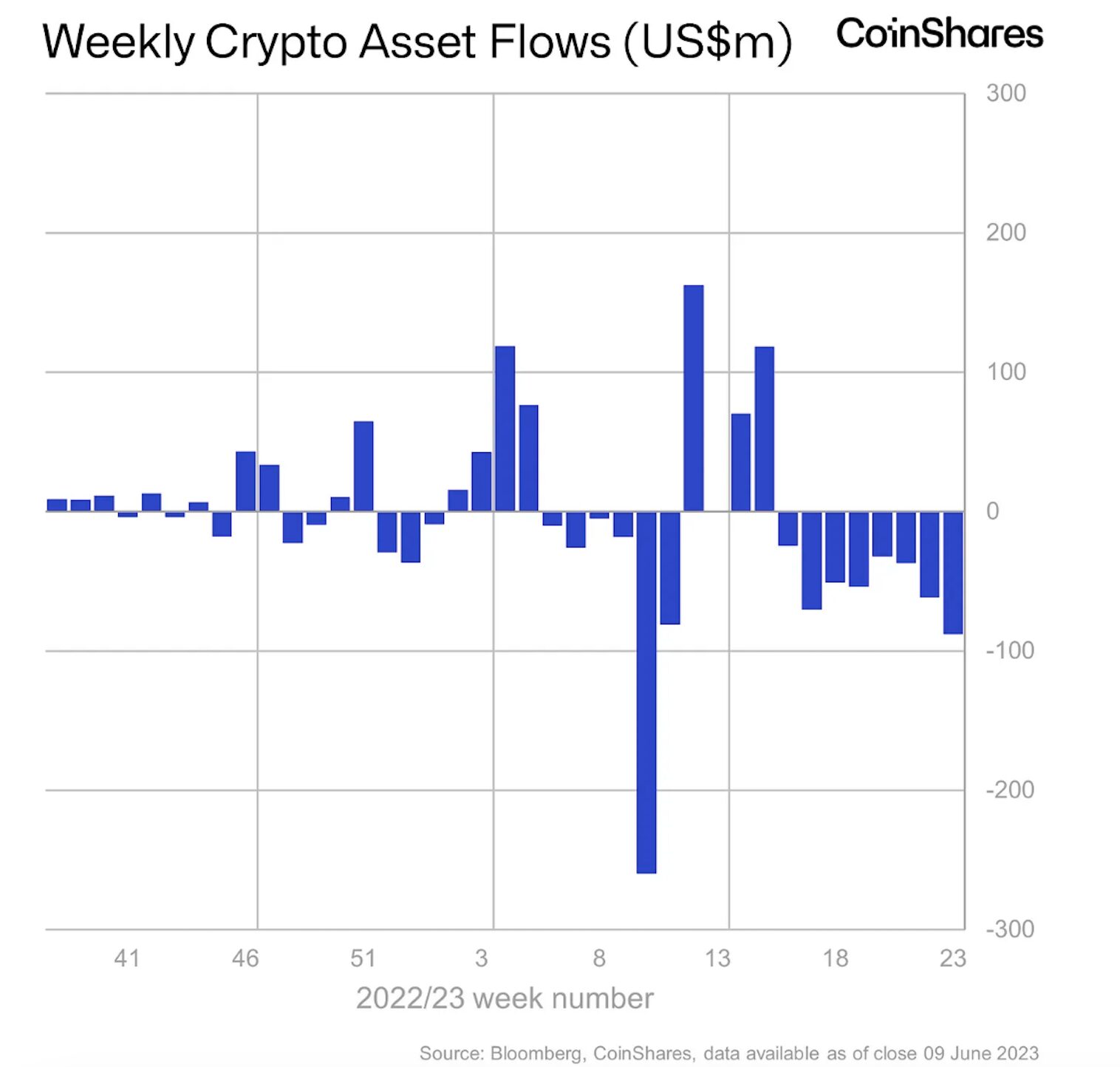

Crypto fund outflows reach $417 million over eight weeks as investor caution persists

CoinShares’ latest weekly report revealed that cryptocurrency investment products experienced outflows of $88 million last week. With the substantial drawdown, the outflow streak has reached eight weeks, totaling $417 million. CoinShares analysts attribute this ongoing trend to monetary policy considerations, prompting investors to remain cautious about digital assets. In the past week, Ether products witnessed $36 million of outflows, marking the largest weekly outflows for the asset since the Ethereum Merge in September 2022. Meanwhile, Bitcoin investment products saw outflows totaling $52 million.

A16z opening…

Click Here to Read the Full Original Article at Cointelegraph.com News…