Bitcoin (BTC) price has been unable to close above $32,000 for the past fifteen days and is currently down 37% year-to-date. Although that might seem excessive, it does not stand out among some of the largest U.S.-listed tech companies which have also sustained notable losses recently.

In this same 15-day period, Shopify Inc. (SHOP) stock dropped 76%, Snap Inc. (SNAP) crashed 73%, Netflix (NFLX) is down 70% and Cloudflare (NET) presented a negative 62% performance.

Cryptocurrency investors should be less concerned about the current “bear market” considering Bitcoin’s 79% annualized volatility. However, that is clearly not the case, because Bitcoin’s “Fear and Greed Index” reached an 8 out of 100 on May 17, the lowest level since March 2020.

Traders fear that worsening macroeconomic conditions could cause investors to seek shelter in the U.S. dollar and Treasuries. Japan’s industrial production data released on May 18 showed a 1.7% contraction year over year. Moreover, May 20 retail sales data from the United Kingdom showed a 4.9% decline versus 2021.

Financial analysts across the globe blame the weakened market conditions on the U.S. Federal Reserve’s slow reaction to the inflation surge. Thus, traders increasingly seek shelter outside of riskier assets, which negatively impacts Bitcoin price.

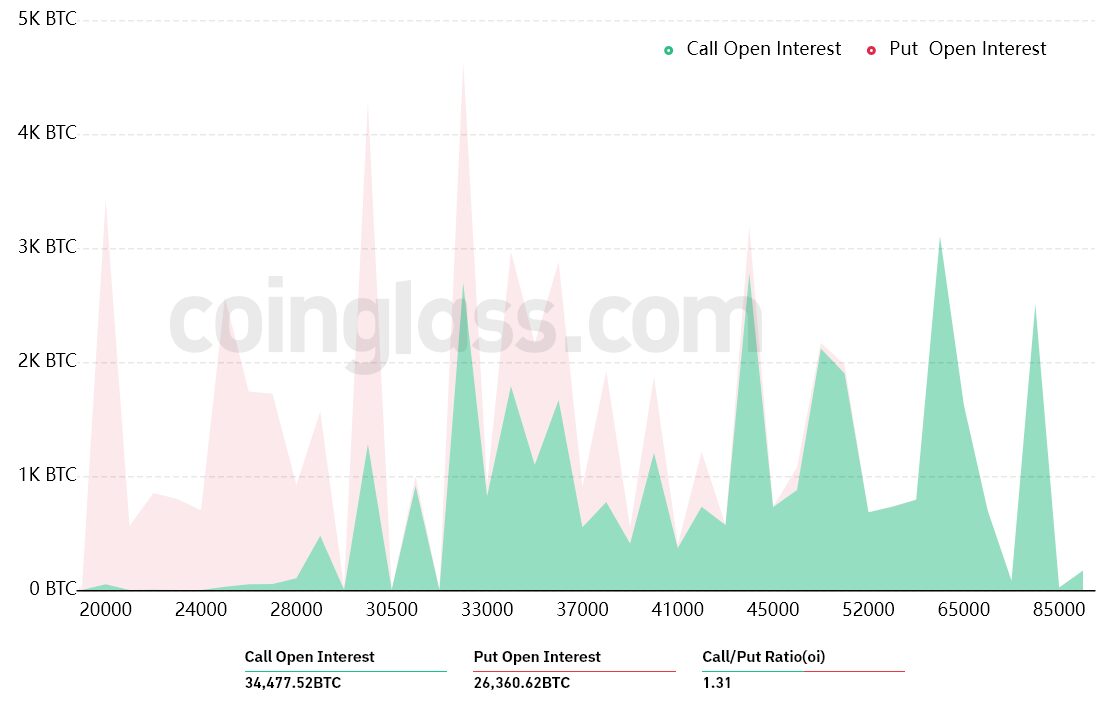

Bulls placed most bets above $40,000

The open interest for the monthly May 27 options expiry in Bitcoin is $1.81 billion, but the actual figure will be lower since bulls were caught by surprise as the BTC price has fallen 26% in the last 30 days.

The 1.31 call-to-put ratio reflects the $1.03 billion call (buy) open interest against the $785 million put (sell) options. Nevertheless, 94% of the bullish bets will likely become worthless as Bitcoin currently trades near $30,000.

If Bitcoin’s price remains below $31,000 on May 27, bulls will only have $60 million worth of these call (buy) options available….

Click Here to Read the Full Original Article at Cointelegraph.com News…