Billionaire Chamath Palihapitiya remains firm in his belief that the US dollar will continue to reign as the world’s reserve currency despite the push by BRICS countries to move away from the USD.

In a new episode of the All-In Podcast, Palihapitiya says that while global demand for US government debt is in a downtrend, he highlights that central banks around the world are still gobbling up US dollars.

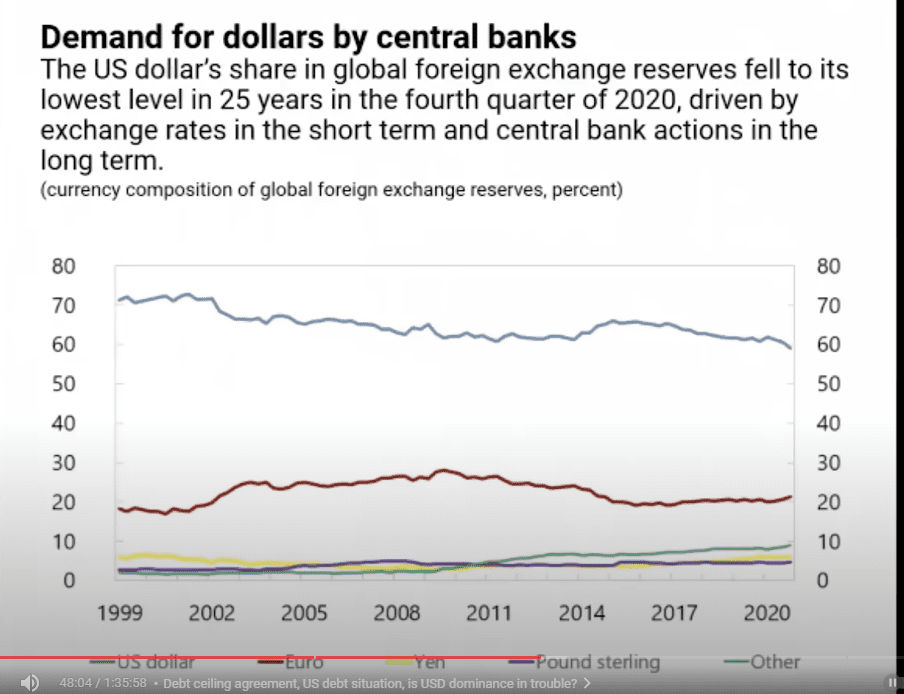

The billionaire shares a chart from the International Monetary Fund (IMF) showing that the US dollar accounts for 60% to 70% of central banks’ foreign exchange reserves since 1999.

“If you look at the IMF data… you can’t just look at US treasury securities. You have to look at actual absolute dollar reserves.

When you look at that over time, it hasn’t fluctuated that much. So for all the dopes that don’t understand how this sh** works, it’s not just securities. It’s actually also money and the actual amount of US dollar money hasn’t changed that much.”

According to Palihapitiya, foreign central banks and governments will likely continue to accumulate US dollars in the future even though BRICS nations are actively finding ways to settle trades using an alternative currency.

“Foreign reserves are up. These guys are banking US dollars like nobody’s business… What I’m saying is that in general, the anchor currency for governments and central banks has been, will be and will likely be in the future the United States dollar.”

The billionaire also highlights that he sees the dollar reigning supreme even though BRICS and other nations are attempting to settle trades in yuan.

“I think you guys keep forgetting this key thing, which is the yuan is pegged to the US dollar, so it is a proxy dollar.

If you really want to decouple, you have to first let this currency free float. They have no desire to let them do that, especially in a moment where they’re economically imploding internally. So again, you back to this circular argument where everything goes back to the dollar.”

BRICS, which was set up by emerging economies to create an alternative to US dollar hegemony, is currently made up of Brazil, Russia, India, China and South Africa.

I

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Click Here to Read the Full Original Article at The Daily Hodl…